The California Industrial General Permit: Understanding Your Level Status

While obtaining and maintaining a baseline Industrial General Permit (IGP) for a facility can already be complicated with requirements for stormwater sampling, the creation of a Storm Water Pollution Prevention Plan (SWPPP) and the implementation of Best Management Practices (BMPs), a facility may find themselves assigned a Level 1 or even Level 2 status. What does that mean?

For each reporting year, from July 1st to June 30th, facilities covered by a Notice of Intent (NOI) under the IGP must collect samples of their stormwater runoff from Qualifying Storm Events (QSEs) four times per year. Two of the sampled QSEs must occur in the first half of the reporting year, July 1 to December 31, and the other two QSEs must occur in the second half, January 1 to June 30.

The resulting analytical reports, sometimes called Ad Hoc reports, must be submitted to California’s Stormwater Application and Report Tracking System (SMARTS) within 30 days of receipt. On July 1st, the first day of the following reporting year, facilities are assigned one of three statuses based on their history of Numeric Action Level (NAL) exceedances—Baseline, Level 1, and Level 2.

Baseline

Facilities with no NAL exceedances in the previous reporting year are in compliance with the IGP. Generally, this means the facility can continue to conduct business as usual. All facilities start at Baseline status when beginning their NOI coverage.

Level 1

Facilities with Baseline status that have any NAL exceedances in the previous reporting year are assigned a Level 1 status at the beginning of the following reporting year.

This means the facility must file a Level 1 Exceedance Response Action (ERA) Evaluation by October 1st of the reporting year in which they were assessed at Level 1. The facility must work with a Qualified Industrial Storm Water Practitioner (QISP) to inspect their site and assist with the development of the Level 1 ERA Evaluation, which should include information on what the possible pollutions sources are and what BMPs could be implemented to prevent future NAL exceedances.

Level 1 facilities must also submit a Level 1 ERA Report, which is a comprehensive facility analysis conducted by a QISP, by January 1st.

Level 2

Level 2 facilities are at risk of incurring fees and violations for stormwater pollution. These fees can vary depending on the complexity of the facility and discharge and the threat to water quality caused by the discharge.

Facilities with Level 1 status based on an NAL exceedance for a specific parameter that have another NAL exceedance in following years for that same parameter are assigned a Level 2 status at the beginning of the next reporting year.

In addition, facilities are required to work with a QISP in order to develop and submit a Level 2 ERA Action Plan by January 1st of the reporting year following assessment at Level 2 status. After a facility is assigned Level 2 status, any NAL exceedances for any parameter, not just the parameter that triggered the Level 2 status, are considered Level 2 exceedances and must be added to the Level 2 ERA Action Plan.

In addition to the Action Plan, Level 2 facilities must also submit a follow-up Technical Report prepared by a QISP on January 1st of the year after the Action Plan is submitted, though one six-month extension may be requested.

The Technical Report must include a description and evaluation of pollution sources related to the facility’s NAL exceedances and a description and analysis of all BMPs. If the facility does not expect to eliminate NAL exceedances, the Technical Report must also include analysis of possible additional BMPs and their estimated costs, as well as an analysis explaining why the possible additional BMPs were not chosen. The Technical Report must be updated annually by a QISP if the facility continues to have NAL exceedances.

Returning to Baseline

Facilities assessed at Level 1 or Level 2 can return to Baseline status, and the eased compliance measures associated with it, if they have four consecutive samples from QSEs with no NAL exceedances.

Takeaways

With multiple exceedances, your facility can be fined for noncompliance. The best way to avoid fines, additional reporting, and potential construction is to proactively apply non-structural BMPs or consult a QISP on how your facility can prevent stormwater pollution. Once assessed at Level 1 or 2, your facility will be required to consult a QISP and develop additional reports and procedures to ensure compliance with the IGP.

Need Help?

If you want to schedule a stormwater-focused walkthrough and assessment, re-evaluate BMPs, develop a SWPPP, get started on your response to a Level 1 or Level 2 status change, or create new Standard Operating Procedures for your facility, please contact Yatziri Enriquez-Lopez, QISP, E.I.T. (909.477.7135 or yenriquez@all4inc.com) or Victor Chen, QISP (909.477.7128 or vchen@all4inc.com).

If you have questions about the Industrial General Permit or this article, please contact Amaris Bellord (626.663.1105 or abellord@all4inc.com) for more information.

2024 Texas Lookahead

Texas is a very dynamic state with a robust variety of industries that are faced with unique and cumbersome regulatory requirements. ALL4 closely follows the actions of the Texas Commission on Environmental Quality (TCEQ) and U.S. EPA Region VI.

ALL4’s Texas experience spans ALL4’s service areas, from air quality permitting and compliance to air dispersion modeling, environmental program management, multimedia regulatory review and auditing, continuous monitoring, and providing health and safety consulting. Our experience covers many industries from petroleum refining, chemical and power to waste management, oil and gas, cement, glass and miscellaneous manufacturing. If you have any questions or need assistance with evaluating your facility’s specific needs, please reach out to Meghan Skemp at mskemp@all4inc.com.

NAAQS Updates & Impacts in Texas

The U.S. Environmental Protection Agency (U.S. EPA) is expected to lower the annual National Ambient Air Quality Standard (NAAQS) for particulate matter less than 2.5 microns (PM2.5) from 12 micrograms per cubic meter (µg/m3) to 9 or 10 µg/m3. This revision, proposed in early 2023, underwent a public comment period and is currently under review by the White House Office of Management and Budget (OMB). In early January 2024, the U.S. EPA signaled a delay in finalizing the standard, and ALL4 anticipates a final rule by mid-February 2024. ALL4 expects the following impacts:

- The lowered standard may complicate air quality dispersion modeling analyses, as existing background concentrations are close to the proposed limits, leaving limited room for new industrial projects.

- The change could lead to immediate impacts on air permit applications, requiring re-submission of PM2.5 NAAQS air quality modeling demonstrations that are not below the final standard.

- The revision is also expected to lead to more nonattainment areas and stringent new source review (NNSR) permitting requirements by 2026, including considerations for PM2.5 precursors like nitrogen oxides (NOX), sulfur dioxide (SO2), ammonia (NH3), and volatile organic compounds (VOCs). This change aims to improve air quality but poses challenges for compliance and industrial growth.

A lower PM2.5 standard will greatly affect permitting and compliance throughout the state of Texas, but specifically will have a greater impact on the Houston-Galveston-Brazoria (HGB) and Dallas-Fort Worth Nonattainment areas. ALL4 can assist facilities with navigating air permitting, modeling, and monitoring.

For more information check out ALL4’s PM2.5 NAAQS Resource webpage or contact Dan Dix at ddix@all4inc.com.

Texas Chemical Industry Updates

Are you prepared? In 2024, there are significant regulatory updates coming to the Chemicals Industry. Last year, the U.S. EPA proposed revisions to several National Emission Standards for Hazardous Air Pollutants (NESHAP) and New Source Performance Standards (NSPS) applicable to facilities in the Synthetic Organic Chemical Manufacturing Industry (SOCMI) and Group I and II Polymers and Resins (P&R) Industries. The final rules are expected in March of this year with the compliance dates quickly approaching. These revisions will affect a variety of sources (e.g., process vents, storage tanks heat exchange systems, pressure relief devices, and flares) and will require fenceline monitoring for facilities that use, produce, store, or emit the following HAPs: benzene, chloroprene, 1,3-butadiene, ethylene dichloride, ethylene oxide, and vinyl chloride. U.S. EPA is also expected to finalize revisions to risk management program (RMP) requirements and storage tank NSPS in 2024. These revisions will affect many sectors in Texas industry, in various degrees. ALL4 can help you understand the revised regulatory requirements and evaluate how these updates will affect your facility.

If you want additional information or help preparing your facility for these updates, check out our Webinar and reach out to Wes Hill at whill@all4inc.com.

Texas Water Updates

The Texas Commission of Environmental Quality’s (TCEQ) Pretreatment Stakeholders Group (PSG) discussed in their most recent meeting that the U.S. EPA is expected to publish a proposed rule to restrict the per-and polyfluoroalkyl substances (PFAS) discharges from industrial dischargers and pretreatment programs in Summer 2024 for metal finishing and electroplating. The regulated community can expect regulators to begin identifying industrial users (IUs) who manufacture, use, or otherwise process PFAS substances. The PSG discussed making IUs aware of the PFAS Final Rule and upcoming revisions to categorical standards. The plan also includes the monitoring of industrial categories where the phaseout of PFAS is projected by 2024, including pulp, paper, and paperboard, and airports. Checkout our 2024 PFAS lookahead article for more details around PFAS regulatory changes that are coming and let us know how we can help you prepare.

TPDES Phase II Municipal Separate Storm Sewer System (MS4) General Permit Updates

TCEQ is in the process of renewing the TPDES Phase II MS4 General Permit, TXR040000, which expired on January 24, 2024. However, due to a delay in the Texas NeT-MS4 System setup (the electronic system for permitting/reporting), the renewal of the Phase II MS4 General Permit has been delayed until August 2024. TCEQ published notice of the proposed 2024 MS4 General Permit in the Texas Register, and the Houston Chronicle and the public comment period was closed on September 25, 2023.

What does this mean for the regulated community?

Small MS4 operators with active authorizations:

- Will be granted an administrative continuance of their existing authorization.

- During this administrative continuance period, TCEQ cannot process any notice of change requests. Those will be addressed by TCEQ after August 2024.

- Must continue to implement ongoing items and compliance with their most recently approved stormwater management program until new authorizations are issued in August 2024.

New small MS4 operators will be unable to seek coverage until the Phase II MS4 General Permit is renewed in August 2024.

The proposed 2024 MS4 General Permit includes updates to definitions and rule language, mandates electronic submittal of applications and annual reports (unless obtaining a waiver), and includes increased inspection mandates, as well as many other changes. If you want additional information or help preparing your facility for these updates, please reach out to Cody Fridley at cfridley@all4inc.com.

TCEQ Water Regulatory Reviews

The TCEQ is in the process of reviewing the following regulations to determine if the need for these rules continues to exist.

- TCEQ is reviewing 30 TAC 307, Texas Surface Water Quality Standards, to determine if the need for rules within this chapter continues to exist. Changes to surface water quality standards could have broad implications to all dischargers in Texas, specifically industrial facilities could see more or less stringent discharge permit limits.

- TCEQ is reviewing regulations related to the use of reclaimed water to determine if the rule is still necessary (30 TAC 210). Reclaimed water comes primarily from municipal and industrial sources and is treated wastewater that is suitable for other uses such as irrigation, fire protection, dust control, cooling tower makeup, and many more. Changes to reclaimed water regulations could have impacts on all types of facilities and may change what types of water are eligible for reuse, what reused water may be used for, and reporting or monitoring requirements associated with reuse.

- TCEQ is reviewing 30 TAC 288, Water Conservation Plans, Drought Contingency Plans, Guidelines and Requirements, to determine if the need for the rules within this chapter continues to exist. Changes to the requirements for these plans could change aspects of their scope, which could in turn add to the burden of creating or administering the plans, and has the potential to affect municipalities, industrial facilities, agricultural facilities, wholesale water suppliers, and more.

Texas, Clean Energy, and the Inflation Reduction Act

The Inflation Reduction Act (IRA) of 2022 marks a turning point for Texas’ energy landscape, particularly regarding clean power generation and storage. While framed as an economic stimulus, the IRA contains never before seen clean energy provisions that will bring in 66.5 billion dollars of investment into the state for both clean power generation and storage as well as the jobs needed to support new clean energy infrastructure. A few examples of how these investments can be used include:

Solar

Texas’ open and uncovered land is prime real estate for solar energy generation. Extended and expanded solar investment tax credits (ITCs) significantly reduce installation costs, paving the way for large-scale solar farms, residential rooftop integrations, and addition of solar panels and photovoltaic cells to industrial facilities and plants. On top of that, manufacturers of solar components can be eligible for Advanced Manufacturing Production Credits to incentivize solar technology production within Texas.

Wind

The IRA’s extended renewable energy production tax credit (PTC) revitalizes wind energy by allowing owners and developers of wind energy facilities to claim a federal income tax credit for every KW-h of electricity sold to a third-party. This incentivizes new wind farms, potentially lowering wholesale electricity prices and enabling chemical and energy companies to blend their electricity mix through power purchase agreements (PPA).

Storage Technology

The IRA addresses the challenge of maintaining and storing energy by offering generous tax credits for construction and installation of batteries and more broadly any storage technologies that can receive, store, and deliver energy for electric or thermal use. This will incentivize the development of a more robust energy storage infrastructure in Texas, making clean energy more reliable and attractive for industry adoption.

Opportunities

The IRA presents substantial opportunities for members of the public as well as industrial facilities across Texas to leverage tax credits to invest in renewable generation, storage, and carbon capture and storage (CCS) technologies. This can not only reduce the carbon footprint of Texas but also improve the environmental image of the state by opening up new markets for clean energy generation and storage, as new technologies, technicians, and facilities will need to be built to keep up with the potential changes. If Texas is incentivized to rely on more clean energy sources, we could see a decrease in greenhouse gas emissions related to traditional energy sources across the state leading to overall better air quality. PTC incentives will help make Texas a hub for clean energy technology innovation, and production while creating jobs, attracting talent, and strengthening the state’s economic ecosystem. If you want additional information or help with assessing these substantial opportunities created by the IRA, please reach out to Andrew Hebert at ahebert@all4inc.com.

OSHA Expanding Protection Laws For Emergency Response Workers

Emergency Response Rulemaking

The federal Occupational Safety and Health Administration (OSHA) has announced that it will publish a proposal in January 2024 to expand and update current safety and health standards for emergency responders. This proposal is an effort to expand protection laws for our emergency responders as the current standard is viewed as outdated and fails to keep up with today’s industry hazards. The proposal will also include issuing a Notice of Proposed Rulemaking to replace the existing Fire Brigades standard, 29 CFR 1910.156. OSHA plans to rename the standard to the “Emergency Response” standard.

1980 Fire Brigade Standard

The Fire Brigade standard, 29 CFR 1910.156, was first published in 1980 by OSHA as a set of regulations to protect industrial and private firefighters. For the last 40 years, OSHA and employers have relied on the 1980 standard to protect first responders from workplace hazards. The issue is that first responders deal with an unpredictable and broad range of job hazards. The 1980 standard was not designed as a comprehensive emergency response standard to fully comprise the full range of job hazards faced by today’s first responders. The standard only covers specific job hazards, is outdated in protective equipment performance and industry practices, does not align with other federal agency’s (e.g., Federal Emergency Management Administration) emergency response guidelines, and conflicts with industry consensus standards.

Proposed Emergency Response Standard

The role of a first responder extends to any employee who is trained and is responsible for responding to any emergencies and is not limited to public employees only such as firefighters, police officers, or paramedics. The new proposed standard will include protections in line with national consensus standards to cover a broader range of first responders exposed to hazards during and after emergencies. Key proposed updates include the following:

- Changing protective clothing and equipment requirements.

- Expanding and updating job hazards faced by today’s first responders.

- Requiring employers to obtain baseline medical screening for all emergency responders.

- Ensuring continued medical surveillance for responders when they are exposed to the byproducts of fires and explosions more than 15 times annually.

The proposed standard will also include a variety of other protective requirements for workers whose primary job is in emergency response and for workers whose emergency response duties are in addition to their regular daily work duties. These employees, as a collateral duty to their regular daily work assignments, respond to emergency incidents and provide services such as:

- Firefighting

- Emergency medical service

- Technical search and rescue

Volunteers will also be further addressed in the proposal. Some states with OSHA-approved State Plans regard firefighters and other volunteers as employees under state law. Regardless of whether these volunteers are considered employees under federal law, such States must treat them as it does other emergency response workers under its analogue to any final standard resulting from this rulemaking.

What’s Next?

No further information has been released by the agency at this time. ALL4 will continue to monitor for any new information or key updates and will update this document as appropriate. ALL4 staff are experienced in planning for and implementing updated environmental, health, and safety regulatory requirements, including workplace safety procedures and training. If you have any questions on this topic, please contact Ivan Torres at itorres@all4inc.com and Victoria Sparks at vsparks@all4inc.com.

2024 Look Ahead Part 3

2024 Look Ahead: Occupational Health and Safety // Victoria Sparks

As we look back on 2023, the Occupational Safety and Health Administration (OSHA) was busy – expanding National Emphasis Programs (NEPs), hiring more inspectors, conducting more inspections, and expanding rules – all with the aim to ensure safe and healthful working conditions for workers. Looking ahead to what 2024 brings, OSHA will analyze significantly more electronically submitted injury and illness data, continue to focus on active NEPs, and bring awareness to workplace stress and mental health.

2024 Look Ahead: New Oil and Gas Greenhouse Gas Requirements // Roy Rakiewicz

Changes to the Standards of Performance for New Stationary Sources (NSPS) for oil and gas operations have been in the works for several years, dating back to the prior administration. The U.S. Environmental Protection Agency recently finalized a rule package to regulate greenhouse gas emissions (i.e., methane) under new 40 CFR Part 60 Subpart OOOOb – Standards of Performance for Crude Oil and Natural Gas Facilities for Which Construction, Modification, or Reconstruction Commenced After December 6, 2022 NSPS OOOOb)…

Continue reading about New Oil and GHG Requirements

Carrots and Sticks Driving Climate Disclosures and Sustainable Performance in 2024 // Connie Prostko-Bell

In 2024, Sustainability and ESG will continue to drive risk and opportunity domestically and globally. Economic mechanisms including regulation, incentives, market access requirements, and customer demands will compel market actors to quantify, disclose, and address impacts, risks, and opportunities (IRO) in order to compete and thrive.

Continue reading about Sustainability & ESG

Adopting Digital Solutions is Becoming Imperative for Meeting Market and Regulator Expectations // Linsey DeBell

New regulations and expectations around data availability and auditability are driving organizations toward implementing or updating EHS digital tools to make these objectives attainable. A spectrum of options exist, each with associated benefits and downsides as well as associated cost. Some of the high–level options include Option 1 Facility Level Deployments of Digital Solutions, Option 2 Leveraging Operations Systems, Data Lakes, and PowerBI, Option 3 Low Configuration EMIS Solution, and Option 4 Highly Tailored EMIS Solution.

Continue reading about Digital Solutions

Adopting Digital Solutions is Becoming Imperative for Meeting Market and Regulator Expectations

Expectations both internally and externally (public, regulatory agencies) are continually increasing around availability, quality, and transparency of environmental and health and safety (EHS) data. An emerging trend is a focus on auditability with some very stringent interpretations of this requirement appearing in recently approved regulations.

In 2024 and beyond, there will be more need and opportunity to leverage digital solutions to tackle ever-increasing demand for more auditability of compliance data, and in particular air emissions data. Implementing digital solutions will support these objectives. Take for example the New Mexico Ozone Precursor Rule: all records required by the rule must be 1) stored in a data system, 2) available to the agency in a report within three days of request, and 3) imported into the data system within three days of data collection or report finalization. Further, they are requiring inputs and methodologies for calculating emissions to be included in the reports. Requiring this level of accessibility to all compliance monitoring, recordkeeping and reporting is unprecedented and likely a harbinger of what is to come in other regulations. Another imminent opportunity for management of more data than ever before will be upcoming additional requirements under U.S. EPA’s Air Emissions Reporting Requirements (AERR) Rule. U.S. EPA proposed to add reporting requirements for hazardous air pollutants (HAPs) emitted over certain thresholds (many of which are very low) for thousands of facilities in various sectors. Essentially, facilities will need to use best available methods to quantify and report HAP emissions from all temporary, mobile, and stationary sources onsite to U.S. EPA electronically.

Not all operations will encounter the level of requirements in the New Mexico rule, but when this regulatory trend is combined with growing pressures around ESG reporting and Net Zero initiatives, most operations should be considering going digital. Digital solutions can be scaled to the current set of requirements and matured when/if requirements become more stringent. Even if you outgrow the functionality of your current system, it is easier to move from one digital solution to another than it is to go from spreadsheets, paper forms, and other such tools to your first digital tool. For those considering the move into a digital system for data management we’ve outlined some tiers of support to help identify what might be a match to your current needs.

Option 1: Facility Level Deployments of Digital Solutions

If consulting support is a key part of your current approach, then the most straightforward path to implementing a digital solution will be to enhance your consulting support with an embedded digital solution offering. This can look like having your consultant stand up a digital solution to support your facility level air emissions calculations. Like with any engagement, there are tiers of support levels. At the most basic level, you just get the outputs from the system, but the digital solution is there if you get agency requests that require an audit of the solution. Alternatively, you can be provided with access to the system for adding data, running reports, etc.

- The benefit of this approach is it allows you the power of a digital solution without the IT headache of owning and maintaining software.

- The downside is you typically have fewer options to tailor the solution to your needs and have less (sometimes much less) access.

Option 2: Leveraging Operations Systems, Data Lakes, and PowerBI

If the bulk of your required data exists in operational systems and the EHS-specific business logic is minimal, then using Data Lakes and a BI reporting tool to pull all the required data together and enhance it with simple calculated values might be the way to go. A good example of the kind of operation where this would work is an upstream oil and gas (O&G) field that is dominated by unpermitted well pads. In this type of operation, the majority of the data required for tracking air compliance, including calculating emissions, is stored in operational systems such as the asset management and work order system. In the case of a relatively mature data lake system, this can be the most efficient place to store all the air quality (AQ) compliance recordkeeping and emissions data.

- The benefit of this approach is it does not introduce the complexity of mirroring your complex and voluminous facility and asset hierarchy in your EMIS tool.

- The downside is you must architect the whole solution and make sure that basic features included in all EMIS such as data audit tracking are considered and addressed in your solution.

Option 3: Low-Configuration EMIS Solution

The degree of configurability supported in EMIS solutions is on a continuum. The move to cloud-based software as a service (SAAS) offerings has supported the emergence of several vendors that are focused on a higher degree of standardization. Standardization supports quicker implementations, ease of upgrade, and less required decision making. These solutions are a great fit for organizations that are willing to be flexible and have strong change management programs or are standing up a new business process and willing to conform to the solution.

- The benefit of this approach is ease of implementation and solution maintenance.

- The downside is you have to adjust your business process to match the solution or risk building many undesirable workarounds or low user adoption because it doesn’t fully support requirements.

Option 4: Highly-Tailored EMIS Solution

On the other end of the continuum are the solutions that support a high degree of configuration and even limited customization. These are a great fit for organizations that are heavily regulated, resulting in requirements that are not supported with typical best practice implementations, or have an existing business process that they want to keep.

- The benefit of this approach is having a solution that can scale to the complexities of your organization.

- The downside is higher effort and cost to design, implement and maintain the highly tailored solution.

Conclusion

It will be increasingly difficult to manage data, document data quality, maintain compliance, and meet investor expectations without adopting digital solutions to support your EHS business processes. The market has diversified, and a variety of approaches to implement these solutions exist. ALL4 can help you select a strategy that is aligned with your requirements. For more information about how ALL4 can help you understand your options for a new or updated digital solution, contact Linsey DeBell at ldebell@all4inc.com or (970) 217-7436.

2024 Look Ahead: New Oil and Gas Greenhouse Gas Requirements

Changes to the Standards of Performance for New Stationary Sources (NSPS) for oil and gas operations have been in the works for several years, dating back to the prior administration. The U.S. Environmental Protection Agency (EPA) recently finalized a rule package to regulate greenhouse gas emissions (i.e., methane) under new 40 CFR Part 60 Subpart OOOOb – Standards of Performance for Crude Oil and Natural Gas Facilities for Which Construction, Modification, or Reconstruction Commenced After December 6, 2022 (NSPS OOOOb). EPA also finalized 40 CFR Part 60 Subpart OOOOc – Emissions Guidelines for Greenhouse Gas Emissions from Existing Crude Oil and Natural Gas Facilities (EG OOOOc) under Clean Air Act (CAA) Section 111(d) to regulate methane emissions from existing oil and gas sources. While not addressed in this article, EPA also recently signed a proposed rule implementing provisions of the Inflation Reduction Act (IRA) related to reported waste greenhouse gas (i.e., methane) emissions, associated fees, and incentives for the early adoption of methane reduction practices as included in NSPS OOOOb and EG OOOOc. The NSPS OOOOb and EG OOOOc rule package builds upon the existing regulations, is highly nuanced, and is the first step in unifying the requirements for new and existing oil and gas operations. Please read on for additional details.

The regulatory process began on November 15, 2021 with EPA’s initial proposal of NSPS OOOOb and EG OOOOc. The process was interrupted on December 6, 2022 when EPA published a supplemental proposal to “…update, strengthen, and expand the standards proposed on November 21, 2021…” The new proposals included a “super-emitter response program,” refinements based on public comments received on the November 15, 2021 proposal, and implementation of methane requirements for states related to EG OOOOc. The final NSPS OOOOb and EG OOOOc rules were signed by the EPA Administrator on November 30, 2023 but have not yet been published in the Federal Register as of January 16, 2024. It is important to note that many of the requirements under NSPS OOOOb for “new, modified, and reconstructed” sources will gradually be required and implemented at “existing” sources as states finalize their plans to implement EG OOOOc or equivalent rules. Implementing the EG OOOOc requirements at “existing” low-producing sources could present technical and financial challenges to many operators.

NSPS OOOOb and its predecessors (i.e., NSPS OOOO and OOOOa) apply to affected “upstream” (i.e., well sites, storage tank batteries, gathering and boosting stations, and natural gas processing plants) and “midstream” operations (i.e., compressor stations and storage tank batteries) in the crude oil and natural gas category. Both NSPS OOOOb and EG OOOOc include a newly defined facility characterized as a “centralized production facility,” which is “…all equipment at a single surface site used to gather, for the purpose of sale or processing to sell, crude oil, condensate, produced water, or intermediate hydrocarbon liquid from one or more offsite natural gas or oil production wells.” While the NSPS OOOO and OOOOa rule iterations primarily regulate emissions of volatile organic compounds (VOC), NSPS OOOOb regulates both VOC and methane emissions and EG OOOOc regulates methane emissions.

Under NSPS OOOOb, the applicability date for affected new, modified, or reconstructed sources is December 6, 2022. Sources that commenced construction prior to December 6, 2022 are existing sources under NSPS OOOOb but remain subject to and affected by NSPS OOOOa. Sources will need to pay particular attention to the term “commenced” to ensure that potentially affected sources that are/were under construction between the effective date of the rule (December 6, 2002) and the rules’ signature date of November 30, 2023 are properly characterized as subject to NSPS OOOOa or OOOOb. As a reminder, “commenced” under 40 CFR 60.2 means that “… an owner or operator has undertaken a continuous program of construction or modification or that an owner or operator has entered into a contractual obligation to undertake and complete, within a reasonable time, a continuous program of construction or modification.”

Under EG OOOOc, states are required to develop and have EPA approve “plans” to regulate all existing oil and gas sources within 24 months of the effective date of the rule. The state-specific plan compliance dates for facilities cannot exceed 36 months after the plans are due to EPA (i.e., approximately 5 years total from the EG’s effective date). There is no “applicability date” for EG OOOOc because as emissions guidelines, EG OOOOc does not directly regulate affected sources but provides presumptive requirements for states for use in developing their plans. Applicability dates will be based on state-specific plans. EPA’s action on each State plan submission will be carried out via rulemaking, which includes public notice and comment.

“Existing” oil and gas sources that are currently subject to 40 CFR Part 60, Subpart KKK (NSPS KKK), Subpart OOOO (NSPS OOOO), or NSPS OOOOa will continue to be subject the applicable standards under each rule until a state or Federal plan implementing EG OOOOc becomes effective. After a plan’s implementation, any source that is not subject to NSPS OOOOb, as described, is by default an existing source subject to EG OOOOc and compliance with an implementing plan consistent with EG OOOOc will constitute compliance with the applicable older NSPS rules (i.e., Subpart OOOO, Subpart OOOOa). EPA has generally determined that the presumptive standards under EG OOOOc will result in the same or greater emission reductions than the current standards in the older NSPS.

A summary1 of key2 standards under NSPS OOOOb and EG OOOOc is provided in Table 1.

Table 1 | Summary of Key Standards

| Affected Facility | Final NSPS OOOOb Standard | Final OOOOc Standard |

| Fugitive Emissions: Multi-Wellhead Only Well Sites (two or more wellheads) |

|

Same as NSPS OOOOb |

| Fugitive Emissions: Well Sites with Major Production and Processing Equipment and Centralized Production Facilities |

|

Same as NSPS OOOOb |

| Fugitive Emissions: Compressor Stations |

|

Same as NSPS OOOOb |

| Storage Vessels: A Single Storage Vessel or Tank Battery with PTE of 6 tpy or more of VOC or PTE of 20 tpy or More of Methane | 95 percent reduction of VOC and methane. | 95 percent reduction of methane. |

| Process Controllers: Natural Gas-Driven | VOC and methane emission rate of zero. | Methane emission rate of zero. |

| Well Liquids Unloading | Perform best management practices (BMP) to minimize or eliminate methane and VOC emissions to the maximum extent possible from liquids unloading events that vent emissions to the atmosphere. | Same as NSPS OOOOb, methane only. |

| Non-wellsite Wet Seal Centrifugal Compressors | 95 percent reduction of methane and VOC emissions. | Monitoring and repair to maintain volumetric flow rate at or below 3 scfm per seal. |

| Non-wellsite Dry Seal Centrifugal Compressors | Monitoring and repair of seal to maintain volumetric flow rate at or below 10 scfm per compressor seal. | Same as NSPS OOOOb |

| Non-wellsite centrifugal compressors | Monitoring and repair or replacement of rod packing to maintain volumetric flow rate at or below 2 scfm per cylinder. | Same as NSPS OOOOb |

| Natural gas-driven pumps | VOC and methane emission rate of zero. | Methane emission rate of zero. |

| Subcategory 1 well completions (with hydraulic fracturing) |

|

Not applicable |

| Subcategory 2 well completions (with hydraulic fracturing) |

|

Not applicable |

| New Wells with Associated Gas that Commenced Construction after 790 Days after Date of Publication in the Federal Register3 | Route associated gas to a sales line; or, the gas can be used for another useful purpose that a purchased fuel, chemical feedstock, or raw material would serve, or recovered from the separator and reinjected into the well or injected into another well. | Not applicable |

One new key aspect under both NSPS OOOOb and EG OOOOc are the “super-emitter” provisions that are intended to promote early detection and mitigation of super-emitter events. A super-emitter event is defined as “…any emissions event that is located at or near an oil and natural gas facility (e.g., individual well site, centralized production facility, natural gas processing plant, or compressor station) that is detected using remote detection methods and has [a] quantified emissions rate of 100 kg/hr of methane, or greater.” Under the rule a “notifier,” which could be the source operator, a regulatory agency, or a qualified third party entity, can detect a methane emission event using satellite detection, remote sensing equipment on aircraft, or a mobile monitoring platform. The notifier must submit an event notification to the EPA through a new super-emitter portal that must provide specific information (i.e., notifier ID, date, location, facility owner/operator, methodology, documentation, etc.) within 15 days of the event. The EPA will review the notification and provide notice regarding the reported event to the source. The source is then required to initiate an investigation within five days of their receipt of notice from the EPA. The investigation must be completed in 15 days and must include key information as specified in the rule (i.e., event ID number, general facility information, is source subject to regulation, source of the event, is the event ongoing or not, when ended, end date and time of event, and certification). This new super-emitter provision could be a harbinger of what facilities can expect under future new or revised rules where remote sensing of releases is technically feasible.

The NSPS OOOOb and EG OOOOc rule package is substantial with many nuances that are not addressed within this article. ALL4 recommends that potentially affected facilities review the rule package to gain a basic understanding of all of its new requirements. Also, note again that many of the substantive requirements under NSPS OOOOb for “new, modified, and reconstructed” sources will gradually be required and implemented at “existing” sources as states finalize their plans to implement EG OOOOc or equivalent rules. Implementing the EG OOOOc requirements at “existing” low-producing sources could present technical and financial challenges to many operators. Please contact your ALL4 Project Manager or Roy Rakiewicz at rrakiewicz@all4inc.com if you have any questions.

1Derived from EPA summary.

2 Refer to the final rule for all applicable requirements.

3 See the final rule for additional time-graduated standards based on well commencement dates.

Carrots and Sticks Driving Climate Disclosures and Sustainable Performance in 2024

In 2024, Sustainability and ESG will continue to drive risk and opportunity domestically and globally. Economic mechanisms including regulation, incentives, market access requirements, and customer demands will compel market actors to quantify, disclose, and address impacts, risks, and opportunities (IRO) in order to compete and thrive.

Macro trends are likely to include:

- Adjustment of goals and declarations to align with provable metrics aligned with real world scenarios;

- Risk exposure driving stakeholders to demand tangible action to create value and avoid loss;

- Preparation for regulatory requirements related to impact disclosures;

- Market changes in response to supply chain constraints and disruption potential;

- Identification and pursuit of relevant incentives and market opportunities;

- Insurers increasing costs and denying coverage based on climate change risk.

Micro trends going into 2024 are likely to include three main groupings of businesses relative to their competitive position and climate change exposure.

- Leaders who have publicly declared carbon emissions goals, defined physical and transition risks and are working to implement actions to achieve the goals and address the risks;

- Companies who have quantified Scope 1 and 2 and will either tackle Scope 3 or set goals for reductions;

- Those who have waited for regulatory or market drivers and will need to react quickly to emerging requirements or threats.

Regulations

United States Securities and Exchange Commission (SEC) Rules

Release of the final SEC Climate Disclosure Rule was delayed again in October 2023. Currently it is expected to be released in April 2024. The proposal is to require listed companies to disclose both physical and transition risks as well as Scope 1, 2 emissions and Scope 3 emissions, if material. The proposal also included a third party verification requirement. There has been much public comment, both in favor of and opposing the rule. The element that raised the most objections relates to Scope 3 emissions disclosure. In late 2023 SEC Chair Ira Gensler said: “…what investors have told us in the comments that they’ve sent us is that understanding the emissions of a company’s supply chain helps understand what’s called transition risk. You know, what might be the future of that business,” Gensler said.

European Union (EU) Carbon Border Adjustment Mechanism

According to the European Commission: “The EU’s Carbon Border Adjustment Mechanism (CBAM) is our landmark tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries. By confirming that a price has been paid for the embedded carbon emissions generated in the production of certain goods imported into the EU, the CBAM will ensure the carbon price of imports is equivalent to the carbon price of domestic production, and that the EU’s climate objectives are not undermined.”

The CBAM will initially apply to imports of certain goods and selected precursors whose production is carbon intensive and subject to the most significant risk of carbon leakage: cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen.

On October 1, 2023, the CBAM entered into application in its transitional phase, with the first reporting period for importers ending January 31, 2024. Once the permanent system enters into force on January 1, 2026, importers will need to declare each year the quantity of goods imported into the EU in the preceding year and their embedded greenhouse gases (GHG).

Of note is that where it can be proven that a carbon price has already been paid on the material, that amount can be deducted from the amount due to the EU. So, for jurisdictions where a carbon tax is levied, the fees will be collected locally, rather than transferred to the EU.

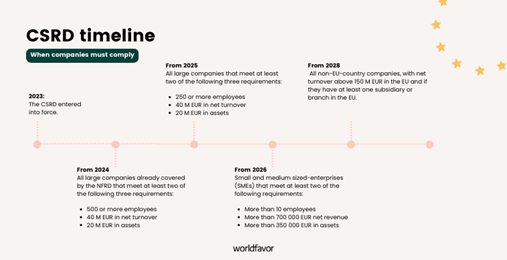

European Union Corporate Sustainability Reporting Disclosure (CSRD)

The CSRD will require comprehensive and granular disclosures covering the entire spectrum of sustainability topics. These disclosure requirements are detailed in 12 new European Sustainability Reporting Standards (ESRS) that have been drafted by the European Financial Reporting Advisory Group (EFRAG). These requirements apply to three categories of companies:

- All companies with securities listed on an EU-regulated market: This includes both EU and non-EU entities with listed debt or equity securities (with limited exceptions).

- “Large” EU companies that are not listed: Large is defined as companies that exceed certain asset, revenue and workforce size thresholds in two consecutive years. An EU subsidiary of a US company would be required to report if it exceeds those thresholds.

- EU companies that are part of a “large group” and not listed: Reporting is required for an EU entity (including an EU subsidiary of a US company) if it is the parent of a group that exceeds certain asset, revenue and workforce size thresholds in two consecutive years.

For U.S. companies with EU subsidiaries, it will be important to monitor the development of the SEC rules. The European Commission has indicated that if the SEC rules are adequate then those companies will not need to also report under the CSRD. However, if the SEC rules are not yet implemented, or if they are not considered to be adequate, U.S. companies could be required to report separately under the SEC and CSRD rules.

American State Level Requirements

Twenty-four states plus the District of Columbia have adopted specific GHG reduction targets to address climate change. Policies include carbon pricing, emissions limits, renewable portfolio standards, and steps to promote cleaner transportation. –Center for Climate and Energy Solutions.

These policies will most urgently impact market actors with significant emissions, high energy needs, and dependence on transportation and logistics.

The Product Stewardship Institute reports that 33 states have Extended Producer Responsibility Laws across 18 product categories including packaging, batteries, electronics, motor oil and more. In November 2023, New York sued Pepsi for plastic waste contamination. Expect to see continued pressure on companies to consider total product lifecycle impacts including end of life and resource recovery opportunities.

California

In 2023 California passed legislation requiring companies ‘doing business in California’ with over $1 billion in revenue globally to disclose Scope 1, 2, and 3 emissions across the organization (not just for their CA locations/operations). A companion bill was signed by the Governor requiring companies with revenues in excess of $500 million to disclose climate related financial risk exposure. The Governor required the legislature and the California Air Resources Board (CARB) to make modifications to lower the cost of compliance and create a reasonable timeline for compliance. Companies will not be required to comply until that work has been completed. It’s likely that the first reporting year will be 2025, at the earliest. Another uncertainty to be resolved is who will actually be subject to the regulation. In other words, how will California define “doing business in California.” Harvard Law School Forum on Corporate Disclosure opines that ultimately “doing business in California” will be interpreted in alignment with California Revenue and Tax Code 23101 “which defines the phrase expansively to include ‘actively engaging in any transaction for the purpose of financial or pecuniary gain or profit’ in California; being ‘organized or commercially domiciled’ in California; or having California sales, property or payroll exceeding specified amounts.”

Both disclosure rules allow for financial penalties for non-compliance. However, in early January both rules were defunded in Governor Newsome’s 2024/25 budget. The budget remains to be finalized.

New York’s CLCPA

The Climate Leadership and Community Protection Act (CLCPA), enacted in New York in 2019, sets an ambitious target of an 85% reduction in GHG emissions from 1990 levels by 2050. Aggressive goals aim for 70% renewable energy in the state’s electricity by 2030. To inform CLCPA’s implementation, the New York State Department of Environmental Conservation (NYSDEC) and the New York State Energy Research and Development Authority (NYSERDA) hosted webinars on the proposed “Cap-and-Invest” program (NYCI) in June 2023. These sessions, seeking participant feedback, guided the second New York Cap-and-Invest Pre-Proposal Outline, released on December 20, 2023. Formal regulations are anticipated in 2024, with no specified date. The NYCI and Mandatory Greenhouse Gas Reporting Programs aim to establish a statewide cap on climate pollution, progressively lowering each year to align with climate goals. NYCI targets “obligated entities,” which are major GHG polluters, ensuring they financially contribute to emissions reduction efforts. Revenue generated will fund clean energy projects, emphasizing communities historically affected by environmental pollution. The program supports energy efficiency, renewable energy, and clean transportation initiatives, contributing to New York’s sustainable future. An annual climate action credit will return money to residents, fostering energy affordability. The NYCI program contemplates accommodations for Energy Intensive and Trade Exposed industries (EITEs), such as cement, steel, and paper manufacturers. While additional allowances for EITEs are under consideration, the tradability of these allowances remains uncertain, inviting public input. Careful design and monitoring of the auction process will be crucial to prevent passing allowance costs to customers, avoiding price hikes for goods and services. Key compliance dates will include GHG reporting deadlines, emissions reduction plans, and the NYCI auction process, though specific deadlines are yet to be determined. Staying informed about CLCPA amendments or updates is essential. To stay informed about new developments and updates related to the CLCPA, you can refer to New York State’s climate policy website.

Market Demands

CDP Supply Chain

The CDP Supply Chain program has grown quickly with over 350 members in 2024. Through the program over 47,000 companies were asked to submit data on topics including climate, forests, water, and biodiversity. While most supply chain members are initially requesting data, many will ramp up demands with incentives for compliance and consequences for non-compliance in subsequent reporting periods. According to CDP in 2023, 746 financial institutions worth over US$136 trillion in assets requested information from more than 15,000 companies worldwide. CDP is anticipating significant growth in the Supply Chain program 2024.

Stock Exchanges

The United Nations backed Sustainable Stock Exchanges (SSE) Initiative was launched in 2009 to engage exchanges in a dialogue about how to promote better markets through sustainable business practices. Today, the SSE has 96 Partner Exchanges, covering 51,943 listed companies and over $88 trillion in U.S. domestic market capitalization. Almost every major stock exchange has joined the SSE in the past decade. The SSE has developed a “Model Guidance” report as a voluntary tool for exchanges to guide issuers on ESG reporting, and 72 of the 122 stock exchanges tracked by the SSE have published ESG reporting guides for their listed companies, compared to just less than one third when the Model Guidance was launched in 2015.

Of the 24 exchanges that required ESG as a listing rule as of 2019, 18 also directly provide companies with stock-exchange-authored guidance.

Climate related opportunities and risks

Inflation Reduction Act (IRA)

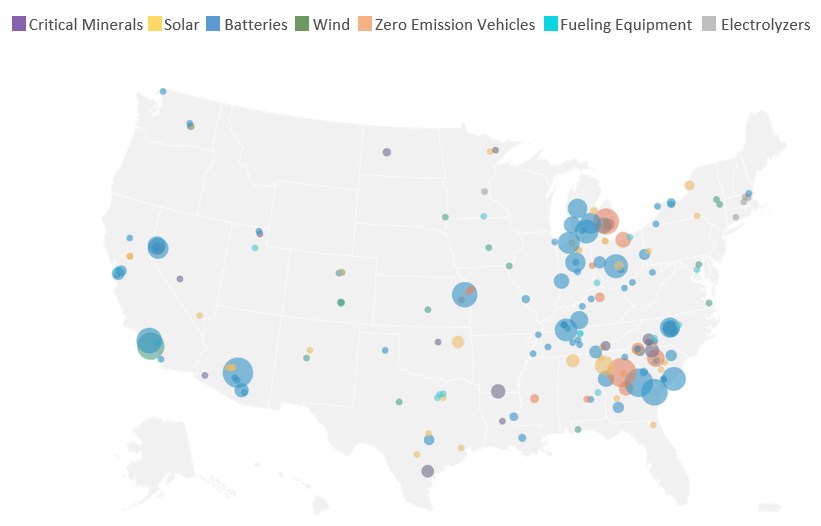

A total of 280 clean energy projects have been announced across 44 US states in the IRA’s first year, representing $282 billion of investment.

According to the Rhodium Group, there has been $213 billion of investments to manufacture and deploy clean energy since the passage of the IRA (see figure below). New investments have supported at least 272 new clean energy projects in 44 states, as documented by Climate Power, including:

- 91 new battery manufacturing sites—creating nearly 93,000 new jobs—in places such as Georgia, Kentucky, Missouri, Louisiana, South Carolina, and New York.

- 65 new or expanded electric vehicle manufacturing facilities, creating 32,000 new jobs in cities such as Savannah, Georgia; Montgomery, Alabama; Spartanburg and Columbia South Carolina; and Auburn Hills, Michigan.

- 84 new wind and solar manufacturing plants in cities such as Pensacola, Florida; Cochranton, Pennsylvania; and Georgetown, Texas.

Manufacturing investment announcement locations

October 1, 2021 – September 30, 2023

Source: Rhodium Group-MIT/CEEPR Clean Investment Monitor

Insurance

According to the International Association of Insurance Supervisors, “climate change is a source of financial risk, having an impact on the resilience of individual insurers as well on financial stability. Insurers are exposed to both transition and physical risks through their underwriting and investment activities.”

“The growing frequency and severity of floods, hurricanes, wildfires, droughts and other climate-related disasters has seen insurance payouts for natural catastrophes soar to an average $110 billion a year since 2017, more than twice the average over the previous five years,” according to Insure Our Future.

In 2023, insurers such as State Farm, Allstate, and Farmers pulled out of some residential and commercial property markets in states including Florida, California, and Louisiana. It’s critical that companies understand their physical and transition risks including not only direct exposure but also secondary exposure such as rising and prohibitive costs of typical business expenses such as insurance.

Conclusion

This is hardly an exhaustive list of the opportunities and obligations ALL4’s clients will encounter in 2024 with respect to the highly dynamic challenges of Sustainability and ESG. ALL4’s ESG & Sustainability practitioners have broad experience supporting manufacturers, natural resource companies, energy companies, and financial organizations qualify and quantify risk related to climate, compliance, circular economy, product level impacts and risks, supply chain exposure, pursuit of incentives, and investment and other critical business needs. We are here to help you thrive in a changing economy.

If you have questions or need some help please reach out to Connie Prostko-Bell, ESG & Sustainability Practice Director, cprostko-bell@all4inc.com, 610-422-1110.

2024 Look Ahead: Occupational Health and Safety

As we look back on 2023, the Occupational Safety and Health Administration (OSHA) was busy – expanding National Emphasis Programs (NEPs), hiring more inspectors, conducting more inspections, and expanding rules – all with the aim to ensure safe and healthful working conditions for workers. Looking ahead to what 2024 brings, OSHA will analyze significantly more electronically submitted injury and illness data, continue to focus on active NEPs, and bring awareness to workplace stress and mental health.

Updated Recordkeeping Requirement Took Effect January 1, 2024

Back in July 2023, the U.S. Department of Labor announced that a final rule expanding electronic submission requirements for injury and illness data of certain employers in designated high-hazard industries was imminent. The final rule took effect on January 1, 2024, and now includes the following submission requirements:

- Establishments with 100 or more employees in certain high-hazard industries must electronically submit information from their Form 300-Log of Work-Related Injuries, and Form 301-Injury and Illness Incident Report to OSHA once a year. These submissions are in addition to submission of Form 300A-Summary of Work-Related Injuries and Illnesses.

- To improve data quality, establishments are required to include their legal company name when making electronic submissions to OSHA from their injury and illness records.

OSHA believes that providing public access to the data will ultimately reduce occupational injuries and illnesses. “Congress intended for the Occupational Safety and Health Act to include reporting procedures that would provide the agency and the public with an understanding of the safety and health problems workers face, and this rule is a big step in finally realizing that objective,” explained Assistant Secretary for Occupational Safety and Health, Doug Parker. “OSHA will use these data to intervene through strategic outreach and enforcement to reduce worker injuries and illnesses in high-hazard industries. The safety and health community will benefit from the insights this information will provide at the industry level, while workers and employers will be able to make more informed decisions about their workplace’s safety and health.”

The final rule retains the current requirements for electronic submission of Form 300A information for establishments with 20-249 employees in certain high-hazard industries and for establishments with 250 or more employees in industries that must routinely keep OSHA injury and illness records.

OSHA’s 2024 Focus

In 2024 you will see OSHA continue to focus on previously identified key National Emphasis Programs (NEPs) such as combustible dust and warehousing operations. You will also see OSHA bring more attention to workplace stressors and mental health awareness.

National Emphasis Programs

NEPs are temporary programs that focus federal OSHA resources on particular hazards and high-hazard industries. Existing and potentially new NEPs are evaluated using OSHA inspection data, injury and illness data, National Institute for Occupational Safety and Health (NIOSH) reports, and peer-reviewed literature. OSHA will continue to focus on the following NEPs in 2024:

- Combustible Dust (Revised 1/30/2023)

- We will continue to see OSHA inspections of facilities that generate or handle combustible dusts likely to cause fire, flash fire, deflagration, and explosion hazards.

- In 2018, wood and food products made up an average of 70 percent of the materials involved in combustible dust fires and explosions. Incident reports indicate that the majority of the industries involved in combustible dust hazards are wood processing, agricultural and food production, and lumber production, but others are susceptible as well. These industries as well as industries that have had fatalities or catastrophes resulting from combustible dust, will be where OSHA focuses their inspections over the next year.

- Facilities that fall into these industries should perform a Dust Hazard Analysis (DHA), install dust control measures such as ducts, dust collectors and housekeeping programs, install protection measures such as explosion venting, and training employees on explosion hazards and the emergency action plan.

- OSHA revised and re-issued this NEP in 2023, which replaces a March 2008 directive and will remain in effect until a cancellation notice is issued.

- Fall Prevention/Protection (5/1/2023)

- The release of this NEP was based on Bureau of Labor Statistics (BLS) data and OSHA enforcement history. This was not a surprise to employers, specifically those in the construction industry, as fall prevention and protection remain at the top of OSHA’s most frequently cited standards. Look for the 2023 Top Ten list after the first week in April.

- Potentially all employers are subject to the NEP. Essentially, the NEP applies to all industries and authorizes compliance officers to initiate inspections whenever an observation of working at heights occurs. The NEP does not designate a specific height at which one must be working to initiate an inspection. OSHA will continue to focus on working at heights throughout 2024.

- A National Safety Stand-Down to Prevent Fall in Construction is planned for May 6th – 10th, 2024.

- Warehousing and Distribution Center Operations (7/13/2023)

- This NEP is in response to massive employment growth and high injury/illness and Days Away Restricted or Transferred (DART) rates that OSHA observed over the past years in this general industry sector.

- OSHA will target certain “high injury retail establishments,” including employers with the following North American Industry Classification System (NAICS) codes: Home centers – 444110; Hardware stores – 444130; Other building material dealers – 444190; Supermarkets and other grocery (except convenience) stores – 445110; and Warehouse clubs and supercenters – 452311.

- Under this NEP, OSHA will conduct comprehensive safety inspections focused on hazards related to powered industrial vehicles, material handling and storage, walking working surfaces, means of egress, and protection, with a focus on storage and loading areas. However, OSHA may expand an inspection’s scope when evidence shows that violations may exist in other areas of the establishment.

- Facilities can be prepared by drafting and reviewing written programs for these operations, providing routine training to their employees, and conducting routine workplace compliance evaluations and inspections.

- Expires 3 years after the effective date (unless revised) on July 13, 2026.

- Outdoor and Indoor Heat-Related Hazards (4/8/2022)

- The NEP creates, for the first time, a nationwide enforcement mechanism for OSHA to proactively inspect workplaces for heat-related hazards in general industry, maritime, construction, or agriculture operations alleging hazardous exposures to heat (outdoors and/or indoors). This means that OSHA can now launch heat-related inspections on high-risk worksites before workers suffer preventable injuries, illnesses, or fatalities.

- OSHA will be focusing on high-risk worksites such as agriculture, construction, landscaping, mail/package delivery, oil and gas well operations, both indoor and outdoor, on heat priority days when the heat index is expected to be 80°F or higher.

- Expires 3 years after the effective date (unless revised) on April 8, 2025.

So what will be the impact of these NEP for employers in the designated industries? They will no doubt lead to increased inspections and the possibility of citations and penalties. Employers in these industries should conduct reviews and evaluations of their safety and health programs and educate their safety personnel and employees on what to do if OSHA arrives for an inspection. ALL4 can help better prepare you for OSHA inspections by evaluating existing programs, writing new programs, providing training and materials, performing compliance gap assessments, and providing technical assistance in response to OSHA inspections.

Mental Health At Work

The Department of Labor is bringing more awareness and focus to its Mental Health at Work Initiative in 2024 after results from a 2021 survey by the American Psychological Association reported that 85% of employees reported that actions from their employer would help their mental health. The agency’s goal with programs like this is to bring more awareness to help employers gain confidence in speaking to employees about workplace stress, mental health, and substance abuse. During National Mental Health Awareness Month in May, OSHA will challenge employers to consider the role that workplace stress may have on their businesses. While this initiative is just guidance and tips for employers, OSHA will continue to publish information, training resources, and outreach materials on its Workplace Stress webpage.

What Else Is Next?

ALL4 is assisting clients with their health and safety programs, industrial hygiene assessments, and OSHA compliance. ALL4 will be actively reviewing OSHA news releases and final rules when published. We will be hosting webinars and publishing articles as new information develops. We also have extensive experience with OSHA compliance and are available to support OSHA compliance and management programs. Look for upcoming and past articles detailing each of the items discussed above. For more information about how ALL4 can help support your health and safety programs, contact Victoria Sparks at vsparks@all4inc.com or (859) 447-9156.

Resources:

https://www.osha.gov/news/newsreleases/national/07172023

https://www.osha.gov/enforcement/directives/nep

https://www.osha.gov/sites/default/files/heat-nep-factsheet-en.pdf

2024 Look Ahead Part 2

PFAS Expectations for 2024 // Kayla Turney

With the new year, we expect to see several of the same issues relating to per- and polyfluoroalkyl substances (PFAS), as well as a handful of new ones to tackle. While the regulatory landscape continues to change, there are a few general themes you should keep in mind for 2024 including: 1) expansion of rule applicability to more industrial sectors; 2) expansion of sampling requests and method availability; and 3) expansion of waste treatment initiatives and treatment options.

Look Ahead: Federal Water Regulations in 2024 // Tia Sova

In 2024 we will see a few changes to water regulations. We are finally approaching the compliance date of the 2021 Lead and Copper Rule Revisions. One of the major changes we will see in this rule is the requirement of a service line inventory that is due October 16th. Another regulation, which is to be finalized in September, is the Clean Water Act (CWA) Worst-Case Hazardous Substance Releases rule. The rule, which was originally proposed in 2022, will require certain facilities to prepare facility response plans in the event of a spill. This rule has been a topic of debate for industries for the last few years.

Continue reading about Water Regulations

Environmental Justice: Looking Ahead to 2024 // Rich Hamel

Environmental Justice (EJ) is one of the cornerstones of the Biden administration’s environmental agenda. Since early 2021, nearly every published document from the administration has referenced EJ. While thus far there has been little formal legislation related to EJ at the federal level, many states are moving forward with developing their own EJ policies and adding consideration of EJ to their permitting rules, either formally or informally. In 2023, we continued to see the federal administration pour millions of dollars into EJ programs in the form of grants, enhanced enforcement activities, and increased requirements that agencies include EJ as part of their project assessments. Later in the year, there were several significant legal developments that slowed some of the efforts by the United States Environmental Protection Agency (U.S. EPA) to force states to act on EJ that add some uncertainty to how aggressive U.S. EPA will continue to be going into 2024.

Continue reading about Environmental Justice

2024 Look Ahead: Chemical Industry Rules and RMP Revisions // Chris Ward

This year is going to be a big year for the chemical manufacturing industry. The United States Environmental Protection Agency (U.S. EPA) is under a consent decree to finish revisions to several National Emission Standards for Hazardous Air Pollutants (NESHAP) and New Source Performance Standards (NSPS) applicable to facilities in the Synthetic Organic Chemical Manufacturing Industry (SOCMI) and Group I and II Polymers and Resins (P&R) Industries by March 29, 2024.

Continue reading about Chemical Industry

2024 Look Ahead: Chemical Industry Rules and RMP Revisions

Chemical Industry Rules

This year is going to be a big year for the chemical manufacturing industry. The United States Environmental Protection Agency (U.S. EPA) is under a consent decree to finish revisions to several National Emission Standards for Hazardous Air Pollutants (NESHAP) and New Source Performance Standards (NSPS) applicable to facilities in the Synthetic Organic Chemical Manufacturing Industry (SOCMI) and Group I and II Polymers and Resins (P&R) Industries by March 29, 2024. Their proposal from April 25, 2023, contained revisions to 40 CFR Part 63, Subparts F, G, H, I (Hazardous Organic National Emission Standards for Hazardous Air Pollutants or HON), 40 CFR Part 63, Subpart U (P&R I), and 40 CFR Part 63, Subpart W (P&R II). Additionally, U.S. EPA has proposed the creation of four new subparts under 40 CFR Part 60: VVb (SOCMI Equipment Leaks), IIIa (SOCMI Air Oxidation Unit Processes), NNNa (SOCMI Distillation Operations), and RRRa (SOCMI Reactor Processes) and some revisions to existing NSPS subparts VV and VVa. ALL4 published an article on May 24, 2023 that summarized many of the changes included in the proposed rulemaking.

The HON, P&R I, and P&R II rules were last revised over a 5-year period between 2006 – 2011. With the expectation that a new Notice of Compliance Status (NOCS) will need to be submitted that will put the existing compliance program in the spotlight, many facilities are conducting comprehensive gap analyses of their compliance plans to confirm all requirements are addressed. Additionally, there is a need to evaluate the impact that the proposed changes will have on applicability and whether additional monitoring and controls will be required. We have been partnering with several clients on these types of analyses. These evaluations have included both looking at the impact across the entire organization as well as considering individual process units at a specific facility. Based on this experience, a few consistent areas of concern have been identified.

The removal of delay of repair for leaking equipment, prohibition on pressure relief devices (PRDs) releases, and the limits on maintenance vents and flares present a unique set of restrictions that may require operational changes or new controls in order to comply. The ethylene oxide standards should be considered collectively when evaluating your compliance options as these limitations influence each other. Additionally, there are limited options for devices that can control ethylene oxide (EtO) to 99.9% or less than 1 part per million by volume (ppmv).

All HON flares will now need to comply with the Refinery Sector Rule (40 CFR Part 63, Subpart CC) flare requirements. Although many of these flares are used to comply with other rules that already reference these requirements, there are many that are not. Compliance with these requirements can require substantial capital to upgrade relevant monitoring systems. The Modified El Paso Method has been added as a requirement for heat exchange systems. The method will require new lab equipment for those who plan to conduct the monitoring in-house or the hiring of a third party. There are new monitoring requirements for pressure relief devices (PRDs), and a requirement to estimate emissions associated with both PRDs releases and control device bypasses. Any historically exempted release associated with startup, shutdown, and malfunction (SSM) will no longer be allowed and regular or semi-regular SSM events that occur at a facility will need to be evaluated for control options moving forward. Fenceline monitoring will be required for sites that use, produce, store, or emit benzene, 1,3-butadiene, chloroprene, ethylene dichloride, EtO, or vinyl chloride. The fenceline monitoring method proposed by EPA results in several logistical concerns related to sampler deployment, field quality assurance and quality control (QA/QC), and laboratory QA/QC. Additionally, the generic use of the word “site” when prescribing which chemical manufacturing processing units (CMPUs) must conduct fenceline monitoring has generated confusion for situations where multiple companies operate at the same “site”. Finally, the new dioxin and furan standards for chlorinated process vents are going to result in testing at multiple facilities to determine whether they can comply without additional control.

The new NSPS subparts IIIa, NNNa, and RRRa include several changes from their predecessors. Similar to HON, P&R I, and P&R II, changes that may be the most impactful include requirements for flares to meet the Subpart CC requirements, limitations and monitoring on PRDs, and prohibition of control device bypasses.

It is expected that U.S. EPA will sign a final rule by the March 29, 2024 deadline. Compliance deadlines for the NESHAP subparts vary by requirement. Facilities must start conducting fenceline monitoring one year after the final rule and are required to comply with the root cause and corrective action analyses provisions three years after the final rule. Compliance is required within two years for ethylene oxide standards, and three years for everything else. Sources that were constructed, reconstructed, or modified after April 25, 2023 (the date of the proposed rule) will be subject to the new NSPS requirements. Facilities should evaluate projects that occurred after that date to determine whether those would be considered modifications and confirm whether they would be subject to the new NSPS subparts. They are required to comply with those requirements upon startup or within 60 days of publication of the final rule.

Volatile Organic Liquid Storage Vessels

U.S. EPA recently completed its review of the NSPS for Volatile Organic Liquid Storage Vessels (Including Petroleum Storage Vessels). As a result, on October 4, 2023 they proposed the new Subpart Kc. This new subpart will apply to volatile organic liquid (VOL) storage vessels that were constructed, modified, or reconstructed after October 4, 2023. It contains many new requirements that are different than the existing Subparts K, Ka, and Kb. ALL4 published an article that went into detail on the changes included in the proposed rule. The change that seems to be generating the most concern is the proposal that introducing and storing a VOL with a higher maximum true vapor pressure than the VOL previously stored will be considered a modification and result in the storage vessel being subject to the new Subpart Kc requirements. This means that any VOL storage vessels that have changed the product stored since October 4, 2023 would need to be evaluated to determine whether an NSPS modification occurred. There are several other changes in the proposed rule that could impact your VOL storage vessels, compliance will need to be demonstrated upon publication of the final rule. U.S. EPA has indicated in the regulatory agenda that they intend to finalize this rule by September 30, 2024.

RMP Revisions

The risk management program (RMP) provisions are included in 40 CFR Part 68 and include provisions that require facilities with extremely hazardous substances to develop a plan that identifies what types of incidents could occur, steps that are being taken to prevent chemical accidents, and procedures for how to respond to an incident should it occurs. On August 18, 2022, U.S. EPA proposed revisions to the existing program. ALL4 published an article on August 30, 2022 that summarized the changes that were included in the proposal. This included substantial changes to both the prevention program and emergency response program and RMP facilities will need to make revisions to their programs to align with the new requirements. It is expected that the publication of the final rule is imminent. It has been under review by the Office of Management and Budget (OMB) since September 25, 2023, and the original target date according to the regulatory agenda was December 2023. The program requirements will need to be implemented within three years of publication of the final rule, with four years for associated plans to be updated.

What Else is Next?

U.S. EPA activities in 2024 will also include reviewing the Chemical Manufacturing Area Source (CMAS) rule and the polyether polyols NESHAP. We will keep on top of activity related to these upcoming proposals. U.S. EPA must also finalize 2023 proposed revisions to the petroleum and chemical sector rules as a result of its reconsideration of tank degassing, PRDs, and other provisions. See ALL4’s article that describes the changes that were proposed.

ALL4 is assisting clients with evaluating the impact of the proposed SOCMI rules changes discussed above and will be actively reviewing the final rules when they are signed. We will be hosting in-person workshops in 2024 where we will provide a summary of the language contained in the final SOCMI rules. We also have extensive experience with the risk management program and are available to support reviews of existing programs and can help with updating existing plans. Look for an article on the final revised RMP requirements soon after signature of the final rule. We have created a chemical industry resources page that aggregates all related content in a single location and can help you to stay up to date with regulatory activity relevant to the chemical industry. For more information about how ALL4 can help you prepare for the chemicals rules revisions or comply with the new RMP requirements, contact Chris Ward at cward@all4inc.com or (770) 557-2798.