Carrots and Sticks Driving Climate Disclosures and Sustainable Performance in 2024

Posted: January 23rd, 2024

Authors: Connie P.In 2024, Sustainability and ESG will continue to drive risk and opportunity domestically and globally. Economic mechanisms including regulation, incentives, market access requirements, and customer demands will compel market actors to quantify, disclose, and address impacts, risks, and opportunities (IRO) in order to compete and thrive.

Macro trends are likely to include:

- Adjustment of goals and declarations to align with provable metrics aligned with real world scenarios;

- Risk exposure driving stakeholders to demand tangible action to create value and avoid loss;

- Preparation for regulatory requirements related to impact disclosures;

- Market changes in response to supply chain constraints and disruption potential;

- Identification and pursuit of relevant incentives and market opportunities;

- Insurers increasing costs and denying coverage based on climate change risk.

Micro trends going into 2024 are likely to include three main groupings of businesses relative to their competitive position and climate change exposure.

- Leaders who have publicly declared carbon emissions goals, defined physical and transition risks and are working to implement actions to achieve the goals and address the risks;

- Companies who have quantified Scope 1 and 2 and will either tackle Scope 3 or set goals for reductions;

- Those who have waited for regulatory or market drivers and will need to react quickly to emerging requirements or threats.

Regulations

United States Securities and Exchange Commission (SEC) Rules

Release of the final SEC Climate Disclosure Rule was delayed again in October 2023. Currently it is expected to be released in April 2024. The proposal is to require listed companies to disclose both physical and transition risks as well as Scope 1, 2 emissions and Scope 3 emissions, if material. The proposal also included a third party verification requirement. There has been much public comment, both in favor of and opposing the rule. The element that raised the most objections relates to Scope 3 emissions disclosure. In late 2023 SEC Chair Ira Gensler said: “…what investors have told us in the comments that they’ve sent us is that understanding the emissions of a company’s supply chain helps understand what’s called transition risk. You know, what might be the future of that business,” Gensler said.

European Union (EU) Carbon Border Adjustment Mechanism

According to the European Commission: “The EU’s Carbon Border Adjustment Mechanism (CBAM) is our landmark tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries. By confirming that a price has been paid for the embedded carbon emissions generated in the production of certain goods imported into the EU, the CBAM will ensure the carbon price of imports is equivalent to the carbon price of domestic production, and that the EU’s climate objectives are not undermined.”

The CBAM will initially apply to imports of certain goods and selected precursors whose production is carbon intensive and subject to the most significant risk of carbon leakage: cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen.

On October 1, 2023, the CBAM entered into application in its transitional phase, with the first reporting period for importers ending January 31, 2024. Once the permanent system enters into force on January 1, 2026, importers will need to declare each year the quantity of goods imported into the EU in the preceding year and their embedded greenhouse gases (GHG).

Of note is that where it can be proven that a carbon price has already been paid on the material, that amount can be deducted from the amount due to the EU. So, for jurisdictions where a carbon tax is levied, the fees will be collected locally, rather than transferred to the EU.

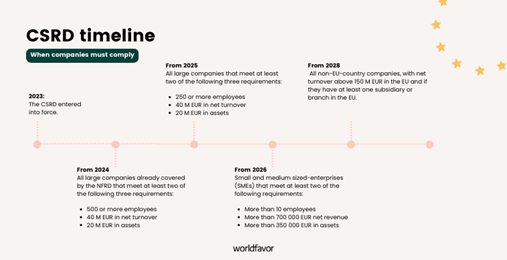

European Union Corporate Sustainability Reporting Disclosure (CSRD)

The CSRD will require comprehensive and granular disclosures covering the entire spectrum of sustainability topics. These disclosure requirements are detailed in 12 new European Sustainability Reporting Standards (ESRS) that have been drafted by the European Financial Reporting Advisory Group (EFRAG). These requirements apply to three categories of companies:

- All companies with securities listed on an EU-regulated market: This includes both EU and non-EU entities with listed debt or equity securities (with limited exceptions).

- “Large” EU companies that are not listed: Large is defined as companies that exceed certain asset, revenue and workforce size thresholds in two consecutive years. An EU subsidiary of a US company would be required to report if it exceeds those thresholds.

- EU companies that are part of a “large group” and not listed: Reporting is required for an EU entity (including an EU subsidiary of a US company) if it is the parent of a group that exceeds certain asset, revenue and workforce size thresholds in two consecutive years.

For U.S. companies with EU subsidiaries, it will be important to monitor the development of the SEC rules. The European Commission has indicated that if the SEC rules are adequate then those companies will not need to also report under the CSRD. However, if the SEC rules are not yet implemented, or if they are not considered to be adequate, U.S. companies could be required to report separately under the SEC and CSRD rules.

American State Level Requirements

Twenty-four states plus the District of Columbia have adopted specific GHG reduction targets to address climate change. Policies include carbon pricing, emissions limits, renewable portfolio standards, and steps to promote cleaner transportation. –Center for Climate and Energy Solutions.

These policies will most urgently impact market actors with significant emissions, high energy needs, and dependence on transportation and logistics.

The Product Stewardship Institute reports that 33 states have Extended Producer Responsibility Laws across 18 product categories including packaging, batteries, electronics, motor oil and more. In November 2023, New York sued Pepsi for plastic waste contamination. Expect to see continued pressure on companies to consider total product lifecycle impacts including end of life and resource recovery opportunities.

California

In 2023 California passed legislation requiring companies ‘doing business in California’ with over $1 billion in revenue globally to disclose Scope 1, 2, and 3 emissions across the organization (not just for their CA locations/operations). A companion bill was signed by the Governor requiring companies with revenues in excess of $500 million to disclose climate related financial risk exposure. The Governor required the legislature and the California Air Resources Board (CARB) to make modifications to lower the cost of compliance and create a reasonable timeline for compliance. Companies will not be required to comply until that work has been completed. It’s likely that the first reporting year will be 2025, at the earliest. Another uncertainty to be resolved is who will actually be subject to the regulation. In other words, how will California define “doing business in California.” Harvard Law School Forum on Corporate Disclosure opines that ultimately “doing business in California” will be interpreted in alignment with California Revenue and Tax Code 23101 “which defines the phrase expansively to include ‘actively engaging in any transaction for the purpose of financial or pecuniary gain or profit’ in California; being ‘organized or commercially domiciled’ in California; or having California sales, property or payroll exceeding specified amounts.”

Both disclosure rules allow for financial penalties for non-compliance. However, in early January both rules were defunded in Governor Newsome’s 2024/25 budget. The budget remains to be finalized.

New York’s CLCPA

The Climate Leadership and Community Protection Act (CLCPA), enacted in New York in 2019, sets an ambitious target of an 85% reduction in GHG emissions from 1990 levels by 2050. Aggressive goals aim for 70% renewable energy in the state’s electricity by 2030. To inform CLCPA’s implementation, the New York State Department of Environmental Conservation (NYSDEC) and the New York State Energy Research and Development Authority (NYSERDA) hosted webinars on the proposed “Cap-and-Invest” program (NYCI) in June 2023. These sessions, seeking participant feedback, guided the second New York Cap-and-Invest Pre-Proposal Outline, released on December 20, 2023. Formal regulations are anticipated in 2024, with no specified date. The NYCI and Mandatory Greenhouse Gas Reporting Programs aim to establish a statewide cap on climate pollution, progressively lowering each year to align with climate goals. NYCI targets “obligated entities,” which are major GHG polluters, ensuring they financially contribute to emissions reduction efforts. Revenue generated will fund clean energy projects, emphasizing communities historically affected by environmental pollution. The program supports energy efficiency, renewable energy, and clean transportation initiatives, contributing to New York’s sustainable future. An annual climate action credit will return money to residents, fostering energy affordability. The NYCI program contemplates accommodations for Energy Intensive and Trade Exposed industries (EITEs), such as cement, steel, and paper manufacturers. While additional allowances for EITEs are under consideration, the tradability of these allowances remains uncertain, inviting public input. Careful design and monitoring of the auction process will be crucial to prevent passing allowance costs to customers, avoiding price hikes for goods and services. Key compliance dates will include GHG reporting deadlines, emissions reduction plans, and the NYCI auction process, though specific deadlines are yet to be determined. Staying informed about CLCPA amendments or updates is essential. To stay informed about new developments and updates related to the CLCPA, you can refer to New York State’s climate policy website.

Market Demands

CDP Supply Chain

The CDP Supply Chain program has grown quickly with over 350 members in 2024. Through the program over 47,000 companies were asked to submit data on topics including climate, forests, water, and biodiversity. While most supply chain members are initially requesting data, many will ramp up demands with incentives for compliance and consequences for non-compliance in subsequent reporting periods. According to CDP in 2023, 746 financial institutions worth over US$136 trillion in assets requested information from more than 15,000 companies worldwide. CDP is anticipating significant growth in the Supply Chain program 2024.

Stock Exchanges

The United Nations backed Sustainable Stock Exchanges (SSE) Initiative was launched in 2009 to engage exchanges in a dialogue about how to promote better markets through sustainable business practices. Today, the SSE has 96 Partner Exchanges, covering 51,943 listed companies and over $88 trillion in U.S. domestic market capitalization. Almost every major stock exchange has joined the SSE in the past decade. The SSE has developed a “Model Guidance” report as a voluntary tool for exchanges to guide issuers on ESG reporting, and 72 of the 122 stock exchanges tracked by the SSE have published ESG reporting guides for their listed companies, compared to just less than one third when the Model Guidance was launched in 2015.

Of the 24 exchanges that required ESG as a listing rule as of 2019, 18 also directly provide companies with stock-exchange-authored guidance.

Climate related opportunities and risks

Inflation Reduction Act (IRA)

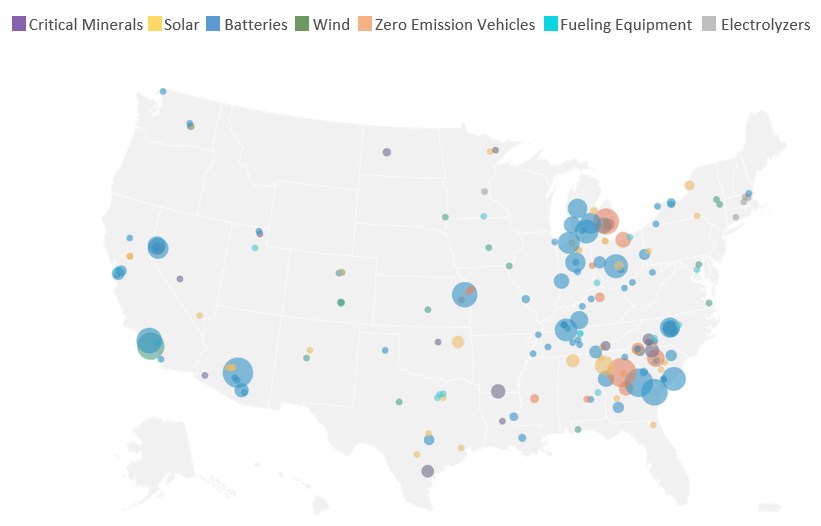

A total of 280 clean energy projects have been announced across 44 US states in the IRA’s first year, representing $282 billion of investment.

According to the Rhodium Group, there has been $213 billion of investments to manufacture and deploy clean energy since the passage of the IRA (see figure below). New investments have supported at least 272 new clean energy projects in 44 states, as documented by Climate Power, including:

- 91 new battery manufacturing sites—creating nearly 93,000 new jobs—in places such as Georgia, Kentucky, Missouri, Louisiana, South Carolina, and New York.

- 65 new or expanded electric vehicle manufacturing facilities, creating 32,000 new jobs in cities such as Savannah, Georgia; Montgomery, Alabama; Spartanburg and Columbia South Carolina; and Auburn Hills, Michigan.

- 84 new wind and solar manufacturing plants in cities such as Pensacola, Florida; Cochranton, Pennsylvania; and Georgetown, Texas.

Manufacturing investment announcement locations

October 1, 2021 – September 30, 2023

Source: Rhodium Group-MIT/CEEPR Clean Investment Monitor

Insurance

According to the International Association of Insurance Supervisors, “climate change is a source of financial risk, having an impact on the resilience of individual insurers as well on financial stability. Insurers are exposed to both transition and physical risks through their underwriting and investment activities.”

“The growing frequency and severity of floods, hurricanes, wildfires, droughts and other climate-related disasters has seen insurance payouts for natural catastrophes soar to an average $110 billion a year since 2017, more than twice the average over the previous five years,” according to Insure Our Future.

In 2023, insurers such as State Farm, Allstate, and Farmers pulled out of some residential and commercial property markets in states including Florida, California, and Louisiana. It’s critical that companies understand their physical and transition risks including not only direct exposure but also secondary exposure such as rising and prohibitive costs of typical business expenses such as insurance.

Conclusion

This is hardly an exhaustive list of the opportunities and obligations ALL4’s clients will encounter in 2024 with respect to the highly dynamic challenges of Sustainability and ESG. ALL4’s ESG & Sustainability practitioners have broad experience supporting manufacturers, natural resource companies, energy companies, and financial organizations qualify and quantify risk related to climate, compliance, circular economy, product level impacts and risks, supply chain exposure, pursuit of incentives, and investment and other critical business needs. We are here to help you thrive in a changing economy.

If you have questions or need some help please reach out to Connie Prostko-Bell, ESG & Sustainability Practice Director, cprostko-bell@all4inc.com, 610-422-1110.