House Bill 951 in North Carolina – What is it and What is Duke Energy’s Plan?

House Bill 951 Energy Solutions for North Carolina (HB 951), an energy bill including carbon reduction requirements, was signed into law by North Carolina Governor Roy Cooper on October 13, 2021. HB 951 is divided into four parts that task the North Carolina Utilities Commission (NCUC) with the following:

- Take all reasonable steps to achieve a 70% reduction in emissions of carbon dioxide (CO2) from electric public utilities from 2005 levels by the year 2030 and to achieve carbon neutrality by the year 2050

- Authorize performance-based regulation of electric public utilities

- Proceed with rulemaking on securitization of certain costs and other matters

- Allow potential modification of certain existing power purchase agreements with eligible small power producers

The following sections provide further details on the contents of HB 951, as well as a summary of the plan outlined by Duke Energy (the largest U.S. electric company by megawatts produced) in order to comply with the bill and common concerns.

House Bill 951

Part I – CARBON REDUCTION/FUEL TRANSITION/DECOMMISSIONING

SECTION I

- The NCUC must develop a plan with the electric public utilities to achieve the reduction goals no later than December 31, 2022. This can include at a minimum power generation, transmission and distribution, grid modernization, storage, energy efficiency measures, demand-side management, and the latest technological breakthroughs to achieve the least cost path to carbon reductions (Carbon Plan). The Carbon Plan will be reviewed every 2 years at which time both NCUC and the electric public utilities will determine if adjustments are necessary.

- Any new generation facility shall be owned and recovered on a cost-of-service basis except that:

- Existing laws apply with respect to energy efficiency measures and demand-side management

- Solar generation has a 45/55 split, where independent power producers own 45% and utilities own 55% for new solar and solar + storage generation

- Ensure all changes result in an improvement on adequacy and reliability of the power grid.

- Retain discretion for optimal timing to achieve the least cost path to compliance. NCUC cannot exceed the determined goal date by more than 2 years unless a nuclear or wind energy facility is constructed, which would require more time.

SECTION II

Each electric public utility will develop a program and file with NCUC for approval for competitive procurement of energy and capacity from renewable energy facilities, requiring:

- Limited to facilities with nameplate capacity of 80 megawatts (MW) or less placed in service after the date of the electric public utility’s initial competitive procurement.

- Public utilities issue requests in aggregate amount of 2,660 MW which will be allocated over 45 months.

SECTION III

The North Carolina Department of Environmental Quality (NCDEQ) must develop a plan “to ensure adequate financial resources for decommissioning of utility-scale solar projects”.

View HB 951

PART II – AUTHORIZE PERFORMANCE-BASED REGULATION OF ELECTRIC PUBLIC UTILITIES

- The NCUC is authorized to approve performance-based regulation (PBR) upon application of an electric public utility; the application will contain a decoupling rate-making mechanism for residential customer classes, one or more performance incentive mechanisms (PIM), and a multiyear rate plan (MYRP), where:

- MYRP will be fixed in the first year and have a maximum increase of 4% in years 2 and 3; The commission must ensure a PBR is fair to electric public utilities and customers and will not “rate shock” customers.

- Within 60 days of the years end, the commission needs to review revenue, the PIM, and the decoupling rate-making mechanism to decide if any amount needs to be collected from, or refunded to, customers.

- PIM rewards need to include rewards or penalties based on sharing of savings, differentiated authorized rates of return on common equity, and/or achievement of specific policy goals.

- The NCUC will decide whether the PBR application is adequate; once it is in effect (maximum 36 months) they may decide to review the plan, hold public hearings, or adjust base rates or PIMs as necessary.

- Electric public utilities must file a report annually for earned return on equity, revenue, and adjustments based on PIMs, if applicable.

- By April 1 of each year, the NCUC files a report for steps they and electric public utilities have taken to comply.

PART III – Rulemaking

- NCUC was required to “establish rules for securitization of costs associated with early retirement of subcritical coal-fired electric generating facilities” within 180 days of the effective date of the section.

- NCUC will develop rules to determine costs at 50% of the remaining net value of the subcritical coal-fired electric generating facilities.

- NCUC will evaluate and modify existing standby service charges, revise net metering rates, establish an on-utility bill repayment program for investments, and establish a voluntary program for industrial, commercial, and residential customers to purchase renewable energy or renewable energy credits; entities who elect to purchase renewable energy bear the full direct and indirect costs and entities who do not purchase are not advantaged or disadvantaged from cost impacts.

Part IV – POTENTIAL MODIFICATION OF CERTAIN EXISTING POWER PURCHASE AGREEMENTS WITH ELIGIBLE SMALL POWER PRODUCERS

- NCUC was required to decide on rates to be paid by electric public utilities for a one-time option to modify certain existing power purchase agreements with eligible small power producers within 120 days of the effective date of the bill.

- Amendment negotiations are encouraged if they treat small power producers in a nondiscriminatory manner.

DUKE ENERGY CAROLINAS CARBON PLAN

As outlined in HB 951, each electric public utility must file a program for approval with NCUC. The Carolinas Carbon Plan is the program filed by Duke Energy Carolinas, LLC (DEC) and Duke Energy Progress, LLC (DEP). These two companies constitute Duke Energy in the Carolinas.

The Carolinas Carbon Plan includes 2 paths and 4 portfolios. The baseline Duke Energy established using 2005 data shows that approximately 76 million tons of CO2 were emitted. In order to reach the carbon reduction goals, Duke Energy must cut their CO2 emissions to around 23 million tons per year. Duke Energy specifically created the plan so that there are definite steps to take in the immediate future, but with evolving needs and technology, it allows for flexibility in the future. The figure developed by Duke Energy as part of the Carolinas Carbon Plan, shown below, displays proposed near-term actions.

In general, these paths will increase electricity costs to the consumer by 1.9% to 2.7% annually through the year 2035. Duke Energy will phase out all coal generation by the year 2035, and the remaining coal-capable units that continue to operate beyond these planned retirement dates will be dual-fuel units operating primarily on lower-carbon natural gas. The Carolinas Carbon Plan utilizes existing mature technologies, such as solar, pumped hydro storage, and dispatchable natural gas units. The new technologies which are incorporated throughout the four portfolios include onshore and offshore wind, large scale battery storage, small modular reactors, and nuclear reactors. Each of the four portfolios relies on natural gas from the Appalachia region to provide sufficient power.

The following figures created by Duke Energy outline the components of each plan.

Duke Energy will continue to collect data to better estimate customer costs and have a more definite plan going forward. HB 951 requires that the plan is reviewed every 2 years, meaning that Duke Energy will have another report in the year 2024.

Duke Energy Carolinas Carbon Plan

COMMON CONCERN

Although HB 951 is a substantial step to reduce carbon emissions in North Carolina, many people still have concerns about this law, including customers, environmental groups, and electric companies themselves. A few of the most common concerns are:

- An increase in cost to customers.

- HB 951 lacks enforceability and the law seems to give the same power to companies as the NCUC.

- Although Duke Energy plans to cut CO2 emissions, they will still be permitted to burn natural gas, which leads to methane (CH4) emissions from both incomplete combustion and transmission leaks. CH4 has a 100-year global warming potential of 27-30 times that of CO2.

NCUC will accept written comments at any time regarding the Carbon Plan. To electronically submit a comment, you can use the link and reference Docket Number E-100, Sub 179, so the Commission knows your comment is related to the Carbon Plan.

If you have any questions or comments about HB 951 or the Carolinas Carbon Plan, contact Haley Zamorano at hzamorano@all4inc.com or your ALL4 project manager for more information.

Collecting and Storing Waste Batteries: Best Practices

Batteries are an essential part of many businesses; in the mid and late 1990’s the United States Environmental Protection Agency (EPA) created the Universal Waste standards, which provided an avenue to recycle many types of these batteries to divert from landfill. However, there was never clear guidance established on how to properly collect and store these hazardous wastes destined for recycling.

EPA recently released a request for information on the development of best practices for the collection of batteries to be recycled and voluntary battery labeling guidelines. This article reviews information provided by Call2Recycle, Inc.’s proposed best practices.

Some of the challenges faced in battery recycling are lack of understanding of different battery types, how to find batteries in battery containing equipment for proper disposal, and improper storage or disposal leading to battery fires.

The main battery types used by consumers are alkaline (non-rechargeable); Nickel Metal Hydride, Nickel Cadmium, and Nickel Zinc (rechargeable); Lithium and Lithium ion; and Lead acid batteries.

These different battery types make it more difficult for the average consumer to determine what type of battery they have and how to handle them. Most states do not have provisions around recycling non-rechargeable batteries, which can lead to confusion around what batteries can be thrown away and in some cases mismanagement of batteries that should be recycled. The proposed solution for this would be to standardize the labeling of all batteries to clearly mark what type of battery it is and implement education campaigns to inform the public of how to dispose of each type of battery.

The challenge with battery containing equipment is how to know what type of battery is in the equipment and where to send it at the end of its useful life. From hair trimmers to wireless headphones, our everyday lives contain many types of batteries that will eventually start to deteriorate, and we will want to get a new device. Where do we throw out the old one? For most people, it just goes into the trash – we aren’t sure where it goes. These items may contain a residual charge and if the battery is compromised, it can cause a fire. By partnering with the manufacturers, guidance and avenues for disposal can be provided to ensure these batteries inside of products are responsibly managed and recycled.

A crucial part of making battery recycling a success is education and training of the public and handlers of batteries. Once the basic understanding of battery types has been established, proper storage can begin, with determining the correct container for the consumer and the correct exterior labels for identification and shipment. However, not all batteries can be neatly packaged into a preordered box or drum for disposal.

Damaged batteries are also a concern because they cannot be stored or transported in the same way as regular, non-damaged batteries. The proposed safe handling practices for damaged or defective batteries is to place the battery in a plastic bag, place the battery or device in a non-flammable material and contact a local battery recycler for available options.

With society shifting towards more renewable energy options, electric vehicle (EV) batteries – and other high-energy batteries – are becoming a greater concern with proper handling and disposal. These batteries are more complex than AA or rechargeable batteries and dismantling these batteries for recycling comes with greater risks. Increased training, specialized tools, additional labeling, and other safe practices are proposed to minimize risk when handling these types of batteries.

With cooperation between different regulatory bodies, manufacturers, and consumers, the battery recycling framework can be strengthened, and we can create a more sustainable and safer renewable energy-focused society. The U.S. Department of Energy (DOE) believes up to 40% of the critical materials in batteries will be supplied from recycled batteries in the future.

If you have any questions regarding safe battery management or battery recycling, please contact Michelle Carter at mcarter@all4inc.com.

ESG Considerations of The US 2022 Inflation Reduction Act

If you’re like many Americans, you may be experiencing the impact of inflation on your wallet. The cost of gas, groceries, furniture, and travel, just to name a few, continue to climb. So much so, in fact, that (according to National Public Radio) consumer prices are increasing at a rate not seen in 40 years. Public Law 117-169, commonly referred to as the Inflation Reduction Act of 2022 (IRA or Act), was passed by Congress on August 7, 2022, and signed into law by President Biden on August 16, 2022. Although the primary aim of the Act is to curb the growth rate of inflation, the IRA is wide-ranging and includes climate, health care, and tax reform measures that address drug prices, clean energy spending, and a corporate minimum tax. Although the bill is extensive, this article is focused on the provisions of the legislation pertaining to climate change and clean energy investments.

One of the objectives of the IRA is to both control rising energy costs over the long term while reducing the risk and resulting costs posed by climate change by managing greenhouse gas emissions. The IRA aims to reduce U.S. GHG emissions by 40% from 2005 levels by 2030. After 2035 the Act aims to reduce cumulative GHG emissions by an additional 6.3 billion tons in the subsequent decade. According to the White House the Act is the “single largest and most ambitious investment in the ability of the United States to advance clean energy, cut consumer energy costs, confront the climate crisis, promote environmental justice, and strengthen energy security.”

The Act seeks to accelerate the energy transition to low carbon technologies, encourage domestic manufacturing (specifically relating to clean energy technologies such as solar, wind, carbon capture, and clean hydrogen), and improve U.S. energy security by reducing our dependence on foreign supplies of the minerals needed to support the energy transition. The Energy Security provisions within the Act are meant to launch a new American low-carbon energy system. The primary levers of the Act are tax incentives and direct investments. Some of the more immediate impacts include investment tax credits and production tax credits for renewable energy and tax credits targeting hard to abate sectors such as aviation fuel. Simultaneously the Act seeks to encourage domestic production of energy related infrastructure and equipment in order to secure the supply chain, build resilience and create jobs. The incentives for these sectors are made more usable by ensuring a longer horizon for viability, with 10-year time frames on availability rather that requiring congressional approval every 1, 2, or 3 years providing the certainty needed to make investment decisions far more justifiable and attractive. One example of encouraging domestic manufacturing is in the form of an increased tax incentive for companies that use a minimum domestic content threshold of American-made steel in their wind products. In addition, the Act recognizes that a new energy system requires a transition period and so includes provisions for maintained accommodation of oil and gas production on public lands. Of course, that transition period necessitates mechanisms that counter the continued emissions of GHGs and so must also include technologies to capture carbon dioxide from industrial and ambient sources. The 45Q tax incentives for Carbon Capture, Use and Sequestration receive significant increases in the amount of the credits and availability of direct payments significantly improving the investment calculus.

Moody’s Analytics states “the bill directs about $370 billion over 10 years toward promoting clean energy and climate resilience, with about two-thirds of the money coming in the form of tax credits for producing electricity from clean energy sources, investing in renewable energy technologies and addressing climate change through carbon sequestration, renewable fuel production, and clean energy manufacturing.”

Impacts to Industry

Highlights of the IRA that are likely of interest to ALL4 clients include the following:

- Amends the Clean Air Act to define GHGs as air pollutants.

- Proposed greenhouse gas regulation of power plants under Clean Air Act Section 111(d)

- $3 billion for ports to reduce their emissions

- $1.55 billion for grants and other assistance to reduce methane from the oil and gas sector

- $1 billion in grants and rebates for a clean heavy-duty vehicles program

- $5.8 billion in financial assistance for industrial facilities engaged in energy-intensive processes to install or retrofit technologies that reduce GHG emissions

- Significantly improves existing tax incentives for carbon capture and sequestration projects including dramatic acceleration of the per ton tax credit

- Direct carbon capture incentives increase from ~$36 per ton to ~$180 per ton

- Regulatory certainty of tax advantages supporting investment in renewables based on an extended horizon of 10 years.

- Increased viability and competitiveness of Sustainable Aviation Fuels

- Per gallon tax credit for SAF of ~$1.75 making them more competitive with typical fuel types

- Because Environmental Justice (EJ) continues to be a focus of the current Administration, the IRA directs $33 million for use in collecting data and tracking disproportionate burdens of pollution and climate change on EJ communities.

- $20 billion in loans for the purpose of building new clean vehicle manufacturing facilities and $2 billion to retool existing auto manufacturing facilities to build clean vehicles.

- $5 million for U.S. EPA to enhance standardization and transparency of corporate climate action commitments and plans to reduce greenhouse gas emissions

- Provides $5 billion for state and local agencies and tribes to develop and implement local climate pollution reduction strategies

Princeton Zero Labs estimates that the Inflation Reduction Act could drive $3.5 trillion in capital investments in new American energy supply including wind and solar investments in the next 10 years. This is significant not only to traditional market actors in the energy industry but also for other businesses looking to make capital investments to reduce their carbon liability, reduce their reliance on volatile energy markets, and generate alternative revenue sources.

Of course, renewables, as well as the drive to electrify the grid, require an enormous expansion in storage capacity, which is currently understood to be batteries. Therefore, the IRA also seeks to the stabilize the battery manufacturing supply chain in the U.S. while also lowering U.S. energy expenditures by at least 4% before 2030, according to preliminary analysis released Thursday by the Princeton University-led REPEAT Project.

What’s next?

We will still look for significant efforts to streamline permitting processes for energy infrastructure related projects in order to meet urgent timelines and realize the full impact benefit from these policy changes. However, the incentives in the IRA provide considerable opportunity for companies across a broad range of verticals to invest in preparing their organization to thrive in the next century by investing in climate change mitigation and abatement initiatives including renewable energy generation, energy storage capacity, carbon capture and sequestration, and domestic production capabilities.

One more thing

We have seen requirements in related legislation such as the CHIPs act basing eligibility for benefits on adherence to other ESG related metrics such as prevailing wage conformance. In order to ensure you qualify for tax credits, grants, and other policy incentives as implementation plans are formulated by various responsible agencies- which might be state or federal, it is important to prepare to define, measure and disclose material ESG metrics and to track progress against any stated goals.

If you want to explore opportunities under the Inflation Reduction Act for your organization connect with me at cprostko-bell@all4inc.com

Did You Know? Pennsylvania PPC Plans No Longer Require P.E. Certification

A Preparedness, Prevention, and Contingency (PPC) Plan is a type of emergency response plan required by the Pennsylvania Department of Environmental Protection (PADEP) for certain types of facilities. The purpose of the PPC Plan is to ensure that facilities have developed and implemented adequate actions and procedures to respond to emergencies and accidental spills of polluting substances. PADEP published a PPC Plan guidance document (No. 400-2200-001, Guidelines for the Development and Implementation of Environmental Emergency Response Plans) in April 2001 and updated it in August 2005. This document provides section-by-section guidance on drafting a compliant PPC Plan. This guidance document states that facilities subject to Section 313 of the Emergency Planning and Community Right-to-Know Act (EPCRA) of 1986 must have their PPC Plan certified by a Professional Engineer (P.E.) and that the P.E. must recertify the PPC Plan once per year.

One broad category of facilities that are required to prepare and implement a PPC Plan are those which have a National Pollutant Discharge Elimination System (NPDES) industrial stormwater or wastewater discharge permit. In PA, one mechanism for a facility to obtain NPDES stormwater coverage is via the PAG-03 Authorization to Discharge under the NPDES General Permit for Discharges of Stormwater Associated with Industrial Activity, or simply the PAG-03 General Permit. The PAG-03 General Permit includes a requirement for the facility to prepare and maintain a PPC Plan.

PADEP revises and republishes the PAG-03 General Permit roughly every five years. Prior to 2016, the PAG-03 General Permit explicitly required the annual P.E. certification for Section 313 facilities, consistent with the guidance document. However, the current version of the PAG-03 General Permit, issued September 2016 (currently administratively extended), does not mention the necessity to have a PPC Plan reviewed and certified by a P.E. ALL4 confirmed with PADEP that this P.E. certification (and annual recertification) has been removed entirely as of the issuance of the September 2016 PAG-03 General Permit. Therefore, PPC Plans are no longer required to have P.E. certifications for their initial versions or any subsequent updates.

One additional contradiction between the PAG-03 General Permit and the guidance document deals with the frequency which the PPC Plan needs to be reviewed and updated. The guidance document gives the requirement of a “periodic” review, whereas the current PAG-03 General Permit specifies that an annual review is required at a minimum, and when one or more of the following occur:

- Applicable PADEP or federal regulations are revised, or the General Permit is revised;

- The PPC Plan fails in an emergency;

- The facility’s design, industrial process, operation, maintenance, or other circumstances change in a manner that material increases the potential for fires, explosions, or other releases of toxic or hazardous constituents, or which changes the response necessary in an emergency;

- The list of emergency coordinators or equipment changes; or,

- When notified in writing by PADEP.

Note, PADEP currently has a draft PAG-03 General Permit published for review. Please visit ALL4’s article How will PADEP’s Updated PAG-03 General Permit Affect My Facility? for a review and summary of the changes.

If you have any questions regarding the PPC Plan, NPDES, EPCRA Section 313 applicability, or any other environmental compliance concerns, feel free to reach out to me at lzhu@all4inc.com or your ALL4 Project Manager.

Another National EJ Tool – Environmental Justice Index

On August 10, 2022, the U.S. Department of Health and Human Services (HHS) released a nation-wide place-based Environmental Justice (EJ) tool: the Environmental Justice Index (EJI). This tool aims to quantify the impact of environmental burden on communities from the perspective of health equity, or “the state where everyone has a fair and just opportunity to attain their highest level of health”. In addition to environmental burdens, EJI also attempts to quantify the health impacts of pre-existing chronic conditions and social factors on communities.

EJI’s focus on health conditions and social factors in addition to environmental concerns sets it apart from other nation-wide EJ tools, such as the White House Council on Environmental Quality’s (CEQ) Climate and Economic Justice Screening tool (CEJST) or the U.S. Environmental Protection Agency’s (U.S. EPA) EJSCREEN 2.0. For more information on these tools, read our article, Biden Administration Releases Two Environmental Justice Tools on the Same Day.

EJI also differs from other EJ tools in that it is the first federal tool to assign a single score EJ index at the census tract level. These subdivisions allow for the user to obtain social and health data in a pinpointed population of around 4,000 people. Each census tract around the nation is delivered a single score from EJI. This single score consists of data quantified from different indicators within the following modules:

- Environmental Burden Module – air pollution, potentially hazardous facilities, transportation infrastructure

- Social Vulnerability Module– race, ethnicity, socio-economic, housing

- Health Vulnerability Module – prevalence of pre-existing health conditions

Because the purpose of this tool is health equity, each indicator is quantified by being ranked against the rest of the U.S. The indicators are then combined into a single EJ score (the EJI) which aims to categorize the overall health impacts resulting from environmental burdens. The EJI of a given community is ranked against the rest of the US and is color-coded to demonstrate the cumulative impact of environmental factors. The intended use of this tool is for community health workers to identify the communities that are most at risk of health impacts from environmental burdens relative to other communities around the nation.

The scope of this tool is limited. The available documentation states that it is not designed to make definitive judgments on the environmental injustices within a given community and it should not be used to measure or quantify the risk of certain individuals within a community. However, because this tool is public, it can be used by non-governmental organizations to challenge permitting efforts within communities with a high EJI score in a manner similar to how these organizations might use other EJ tools. If you have concerns about the potential implications of this tool and you’d like to discuss them, feel free to contact myself or Rich Hamel. We are happy to help you navigate the current and future EJ policies and regulations or assist you in evaluating the potential EJ risk at your facility.

Too Long; Didn’t Read (TL;DR): What You Need to Know About South Coast AQMD Proposed Revisions to CEMS Requirements

WHAT IS THE AGENCY PROPOSING?

South Coast Air Quality Management District (AQMD) is the regulatory agency responsible for improving air quality for large areas of Los Angeles, Orange, Riverside, and San Bernardino counties in California. To streamline the monitoring requirements across facilities for the forthcoming Regional Clean Air Incentives Market (RECLAIM) Program transition, South Coast AQMD has proposed amendments to Rule 218, and has proposed two new rules, Proposed Rules (PR) 218.2 and 218.3, which are based on Rules 218 and 218.1, respectively. Rules 218 and 218.1 are the existing monitoring rules for continuous emissions monitoring systems (CEMS) applicable to all CEMS that are required by South Coast AQMD, except for CEMS under the existing RECLAIM Program. CEMS that are currently operated under the RECLAIM Program are subject the monitoring requirements in Rules 2011 and 2012. Proposed Rules 218.2 and 218.3 will effectively replace Rule 218 and 218.1 for non-RECLAIM facilities, and Rules 2011 and 2012 for RECLAIM facilities upon exiting RECLAIM.

WHEN IS THE AGENCY PROPOSING TO MAKE THESE CHANGES EFFECTIVE?

Proposed Rules 218.2 and 218.3 are proposed to apply as follows:

For non-RECLAIM CEMS:

- At the time of CEMS certification/recertification between January 1, 2022 and January 1, 2025

- No later than January 1, 2025

For (former) RECLAIM CEMS:

- At the time of CEMS certification/recertification after the facility exits RECLAIM

- No later than 24 months after exiting RECLAIM

HOW DOES THIS AFFECT ME?

As an existing RECLAIM facility:

- Transition to a command-and-control structure and a five ton per day NOX emissions reduction using Best Available Retrofit Control Technology (BARCT) as soon as feasible, and no later than January 1, 2025. (TL;DR: RECLAIM will not exist after January 1,2025)

- RECLAIM CEMS currently subject to Rule 2011 and Rule 2012 will be required to transition to Proposed Rules 218.2 and 218.3 after exiting RECLAIM and certifying the CEMS in accordance with Proposed Rules 218.2 and 218.3. For most units, the implementation of Proposed Rules 218.2 and 218.3 CEMS would be staggered based on equipment modifications made to meet NOX emission limits required in landing rules.

As both an existing RECLAIM facility and an existing non-RECLAIM facility:

- PR 218.3 adds provisions that provide specifications on how to handle data measured below 10% or above 95% of the upper span value, emissions data averaging methods, data substitution methods, data availability requirements, and CEMS out-of-control periods. The data handling requirements in PR 218.3 are unique and are not currently implemented by the South Coast AQMD or other regulatory agencies. These data handling requirements will require DAHS software reprogramming. Some of the more significant changes in the proposed rules include requirements to:

- Utilize a unique-to-South Coast AQMD data substitution procedure for missing/invalid CEMS data. Data substitution is required when demonstrating compliance with 24-hour or 365-day rolling average mass emission limits. The data substitution procedure detailed in PR 218.3 somewhat aligns with the procedure specified in Rule 1109.1; however, there are several exceptions and considerations unique to PR 218.3 [Paragraph (i)(11)].

- Utilize a new data procedure for startup or shutdown of missing minute data to determine mass emissions for any startup or shutdown minute with no valid data. The startup/shutdown data substitution procedure is based on the percent of missing data and is also unique to PR 218.3 [Paragraph (i)(13)].

- Utilize a NOX conversion factor of 1.214 x 10-7 or 1.195 x 10-7 lbs/ft3 to calculate NOX mass emissions for RECLAIM CEMS. Both of the specified NOX conversion factors differ from the commonly used NOX conversion factor of 1.194 x 10-7 lbs/ft3.

WHAT SHOULD I DO NOW?

January 1, 2025 does sound far away, but by the end of this year, it will only be two years out. Whether you are an existing RECLAIM facility operating NOX CEMS under Rules 2011 and 2012, or a non-RECLAIM facility operating CEMS under existing Rules 218 and 218.1, you will have to comply with the final requirements in Proposed Rules 218.2 and 218.3. Do you have a plan to maintain compliance with your existing or potentially new CEMS? If not, ALL4 can help. Please do not hesitate to reach out to jprendergast@all4inc.com if you have any questions regarding these proposed rules and their impact to you or other CEMS-related questions.

U.S. EPA Proposes PFAS CERCLA Hazardous Substance Designation

On September 6, 2022, the United States Environmental Protection Agency (U.S. EPA) published the proposed rule “Designation of Perfluorooctanoic Acid (PFOA) and Perfluorooctanesulfonic Acid (PFOS) as CERCLA Hazardous Substances.” Under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA), U.S. EPA is proposing to designate perfluorooctanoic acid (PFOA) (CAS# 335-67-1) and perfluorooctanesulfonic acid (PFOS) (CAS# 1763-23-1), including their salts and structural isomers as Hazardous Substances. U.S. EPA is proposing to set the reportable quantity for these substances at one pound in a 24-hour period.

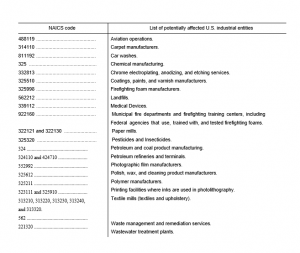

The five categories of entities potentially affected by this action include:

- PFOA and/or PFOS manufacturers (including importers and importers of articles).

- PFOA and PFOS processors.

- Manufacturers of products containing PFOA or PFOS.

- Downstream product manufacturers and users of PFOA and PFOS products.

- Waste management and wastewater treatment facilities.

The following list of North American Industrial Classification System (NAICS) codes is provided in the proposed rule as a guide to potentially affected facilities.

WHAT DO YOU NEED TO KNOW?

There are four items to consider with the proposed regulation that may affect your facility operations:

- Reporting – The designation would require a facility to report a release (other than a federally permitted continuous release) of PFOA or PFOS in quantities equal to or greater than the RQ (one pound) or more in a 24-hour period immediately to the National Response Center (NRC).

Because PFOA and PFOS are not currently regulated under air, water, or solid waste permitting programs, your facility may need to comply with CERCLA and Emergency Planning and Community Right-to-Know Act (EPCRA) continuous release reporting requirements.

- Disclosure – Under the proposed rule, PFOA and PFOS use or storage on site would need to be disclosed during an All Appropriate Inquiry as part of the Phase I Environmental Site Assessment.

- Transportation – U.S Department of Transportation (U.S. DOT) will regulate the transportation of PFOA and PFOS.

- Investigation/Remediation – U.S. EPA or states could require potentially responsible parties to address PFOA or PFOS releases that pose an imminent and substantial endangerment to public health or welfare or the environment. The most recent S. EPA Regional Screening Levels (RSL) (May 2022) use new toxicity values due to Agency for Toxic Substances and Disease Registry (ATSDR) updates for both PFOA and PFOS. RSLs will be heavily relied upon in the development of any remediation goals at the federal, state, and local (tribal) levels.

COSTS – WHAT IMPACTS WILL THIS REGULATION HAVE ON THE REGULATED COMMUNITY?

The Office of Management and Budget (OMB) requested U.S. EPA provide an assessment of the economic impact of the regulation. U.S. EPA contends that an economic assessment is not required under CERCLA; however, they did produce a draft Economic Assessment in August 2022. The assessment identifies and quantifies costs related to reporting requirements and transportation but falls short of quantifying costs related to investigations and remediations given the uncertainty of cleanup standards, available technologies, and requirements for disposal. U.S. EPA has downplayed these costs in the assessment. The costs for assessment of properties such as car washes (listed as a potentially affected industry) could be high with respect to the value of the company and land. This has held true for industries such as Dry Cleaners in the past.

Industries listed above with wastewater treatment facilities may see higher costs for disposal and changes to acceptable disposal practices such as land application. Industries would also be required to provide a notice of release for sludges and wastewater containing PFAS because the compounds are not currently regulated under the National Pollutant Discharge System (NPDES) permitting program. Additional reporting of PFAS compounds under the Toxic Release Inventory (TRI) is proposed as U.S. EPA has proposed removal of the de minimus exception for PFAS.

WHAT SHOULD I DO NEXT?

If you are one of the listed NAICS codes or have known quantities of PFOA or PFOS at your facility, you should prepare for new reporting requirements for CERCLA, EPRCA or TRI, or compliance with DOT changes. ALL4 can assist you with those compliance strategies, planning, and implementation. You should also look at costs for assessments/investigations and disposal costs as part of your annual fiscal budgets.

U.S. EPA is receiving comments on the proposed regulation until November 7, 2022. We expect to see a final rule in Spring 2023. The PFAS regulatory landscape is rapidly changing with proposed and finalized rules under TSCA (Toxic Substances Control Act), EPCRA, CWA (Clean Water Act), and CAA (Clean Air Act) programs. U.S. EPA plans to establish the maximum contaminant levels (MCL) for PFOS and PFOA, which will become default cleanup levels for groundwater in most states. The RSLs will continue to be revised as U.S. EPA evaluates additional studies and updates the risks associated with the compounds. ALL4 will continue to provide information and updates on PFAS regulations as they develop. If you would like to know more about how ALL4 can assist you with your CERCLA, EPCRA, or general environmental and health and safety issues, please contact Karen Thompson at kthompson@all4inc.com or one of our regional offices.

Fugitive Fenceline Monitoring Requirements Continue to Roll Out

The U.S. Environmental Protection Agency (U.S. EPA) and State air regulatory agencies continue to utilize U.S. EPA Methods 325A (Sampler Deployment and VOC Sample Collection) and 325B (Sampler Preparation and Laboratory Analysis) as part of new and amended regulations and Clean Air Act (CAA) Information Collection Requests (ICR) in support of National Emission Standards for Hazardous Air Pollutants (NESHAP) reviews. Method 325A and 325B were originally promulgated in 40 CFR Part 63 Appendix A in support of amendments to the Petroleum Refinery Sector NESHAP. The primary purpose of including fenceline monitoring in air regulations is to require facilities to monitor for and reduce fugitive emissions from their processes.

U.S. EPA Method 325A describes the collection of volatile organic compounds (VOC) at or inside a facility property boundary or from fugitive area emissions sources using passive (diffusive) tube samplers. Method 325A describes how many samples are required and where to locate the samples based on the size and shape of a facility’s property boundary. Per Method 325A, the passive tubes are deployed for a two-week period and, depending on the size of your facility, include 12 to 35 sample locations as well as at least one duplicate site and one sample blank for quality control (QC) purposes.

U.S. EPA Method 325B describes the preparation of the sampling tubes, shipment and storage of exposed sampling tubes, and analysis of the tubes collected. Method 325B is primarily used by the laboratories completing the analysis. The sampling tubes are analyzed by thermal desorption coupled with gas chromatography/mass spectrometry (TD-GC/MS) which has the ability to measure a number of VOC constituents. Method 325B also requires measurements of local meteorological data including wind speed, wind direction, temperature, and barometric pressure collected from an on-site or nearby meteorological station following U.S. EPA’s “Quality Assurance Handbook for Air Pollution Measurement Systems – Volume IV: Meteorological Measurements” requirements which is incorporated by reference at 40 CFR §63.14.

The original Petroleum Refinery Sector NESHAP only required the measurement of benzene; however, as U.S. EPA and State agencies continue to develop new fenceline monitoring requirements the list of Hazardous Air Pollutants (HAP) of concern has expanded depending on the type of sources being evaluated. For example, the Chemical Manufacturers ICR issued earlier this year included a request for benzene and 1,3-butadiene monitoring data and the Coke Ovens ICR issued in June 2022 included a request for benzene, toluene, ethylbenzene, xylenes, and 1,3-butadiene monitoring data. In addition, the Chemical Manufacturers ICR included a requirement to perform a Tentatively Identified Compound (TIC) analysis with the passive tubes which is a “catch-all” type of analysis.

Currently, ALL4 is also aware of a couple proposed (and soon to be proposed) rules that will include Method 325A/B fenceline monitoring requirements. U.S. EPA is currently under a consent order to determine if revisions are necessary to the hazardous organic NESHAP (HON) and sign a proposed rule by December 16, 2022. It is expected that proposed revisions to HON will include Method 325A/B fenceline monitoring requirements. We may also see U.S. EPA propose to include fenceline monitoring requirements as part of their review of the Organic Liquids Distribution NESHAP this fall (you may recall that they proposed to require fenceline monitoring in 2019 but did not finalize it in the 2020 revised rule). In addition, the Maine Department of Environmental Protection (MDEP) has proposed a rulemaking that includes requirements for owners and operators of petroleum storage facilities that operate internal or external floating roof tanks to conduct ongoing fenceline monitoring in accordance with Methods 325A and 325B to monitor for benzene, ethylbenzene, toluene, and xylenes. ALL4 expects the trend of more and more fenceline monitoring requirements to continue for the foreseeable future, especially with agencies’ focus on addressing environmental justice and desire to reduce air toxics exposures in overburdened fenceline communities.

ALL4 continues to monitor air regulatory actions for new fenceline monitoring requirements. If you have any questions about Method 325A/B fenceline monitoring or if your facility needs to implement a Method 325A/B fenceline monitoring program, please contact Dan Dix at ddix@all4inc.com or at 610.422.1118.

Onsite with ALL4

I joined ALL4 in February 2022 as a Consulting Engineer after spending about seven years working for other consultants and in industry. One month into starting my new job at ALL4, I felt like I was starting to get the hang of things. I had found my new routine, was working on interesting projects, and began connecting with my co-workers in the Atlanta office. When I was asked around that time if I would want to provide onsite support to one of our clients in the Rocky Mountain region, I was a little apprehensive. How would this type of opportunity align with my career goals and trajectory? Would I be able to stay connected to my new workplace while physically working elsewhere?

Some candid conversations with the Project Manager and my Coordinator helped me reframe the opportunity and see how spending some time onsite could help me reach the next stage in my career. A couple days later, I was meeting with the client and we both agreed that based on my previous experience I would be a good fit.

What does a day onsite look like?

I quickly learned that, much like consulting, there is no “typical” day. My time is split between traveling to the Rockies to work on location and providing remote support from Atlanta. Each day I take on the responsibilities of the currently vacant air specialist position at the site. Recently, I have been busy preparing quarterly and semiannual compliance reports for the various air regulations the facility is subject to. Occasionally, urgent items pop up that need to be addressed and my to-do list gets completely rearranged. I also have had opportunities to serve as the environmental representative for a construction project and to work through a facility shutdown. I collaborate with people across the plant, including other environmental personnel, operations, maintenance, and management to get my daily tasks done.

How has being onsite benefited me?

While I am not yet done with my onsite role, this project has already provided many opportunities for professional growth. Prior to this project, I have worked with many clients in the same industry sector focusing on a small part of the plant. Here, I have been exposed to the whole facility, quickly gaining knowledge of new regulations and compliance programs that are applicable to other industries and other clients I work with, too.

Despite this project having the feeling of being back in industry, I also have been able to grow my consulting skills. While on location, I’ve spent countless hours with my clients and built strong relationships with them where we can talk about work but also our lives outside of it. I’ve grown my project management skills as well, working with a team across the facility to complete some of my compliance tasks. These skills will help me as I work towards my next promotion.

This year ALL4 has been focused on creating connections and despite being away from the office I’ve been able to maintain my connectedness to ALL4. For instance, once a week, the Atlanta office carves out time to step away from our computers and have lunch together. I’ve also been able to participate in recess events, like bowling and happy hours, when I’m in town. I’m even making new connections through a program where we get randomly paired up with another employee to have a 30-minute conversation each month.

Being Your Client

Where I Started

My name is Madison Jones, and I am a Consulting Engineer at ALL4. I started my career here in July 2019 immediately after graduating from the Georgia Institute of Technology where I majored in environmental engineering and minored in climate change. I joined ALL4 because their values resonated with me and I was interested in environmental consulting. In the past three years, I’ve worked under managers in Georgia, Pennsylvania, and North Carolina on projects ranging from emissions inventories, greenhouse gas reporting, chemical inventories, state and federal permitting, and many others. While I spend most of my days in the Atlanta office, a few day-long site visits to clients were sprinkled into my first two years.

Where I’ve Been

In August 2021, I got my first onsite opportunity to support a pulp and paper mill in eastern Georgia. The job entailed being onsite two days per month to complete their routine monthly wastewater sampling and reporting. This support lasted about five months. My days at the pulp and paper mill consisted of mostly office work, reviewing calculations, and making sure all data made sense and was complete, plus one or two drives around the mill to understand the process better.

In February 2022, my office leader asked if I was interested in supporting a client with their wastewater sampling and reporting. This role included spending about three days per month for three months (…which turned into six months) collecting wastewater samples from seven of their sites and then reporting the data once we got it back from the lab. I normally spent one day driving roughly 300 miles around the metro Atlanta area to all seven sites, stopping at each ready-mix plant, and putting samples in a cooler. While back in the office, I worked with the client to submit each report once the results were processed.

Where I’m Going

One of the aspects that I enjoy about onsite client support is getting out of the office. Instead of being cooped up at my desk, I get to pick what sunny days I want to travel around town. But there’s a lot more to it.

I’m also at a point in my career where I can identify other areas that clients may need assistance. Being there in person, I spend a day in their shoes and see firsthand where there are gaps that ALL4 can help fill. These two onsite support opportunities were designed to temporarily fill staff positions while our clients found permanent staff. Originally designed to help our clients sustain during transition, they’ve become opportunities where ALL4 can help them grow and improve their operations.

Lastly, supporting clients firsthand has reaffirmed my desire to be a consultant. As a consultant, I can flex my schedule, I can lean on others for support, and I have countless technical resources a dial away. By completing onsite client support early on, I have quickly gained more understanding and empathy of our clients’ jobs and needs, as well as confidence interacting with our clients.

I appreciated having the opportunity to learn more about what it’s like to work at a facility and experience the responsibilities our clients have firsthand. Client interface and brand-building are part of career progression at ALL4, and my onsite client support has directly aided in charting my path by instilling confidence, providing client-facing opportunities, and building my brand both internally and externally as an aspiring project manager.