US Power Sector: 2026 Lookahead

Posted: January 29th, 2026

Authors: Rich H.

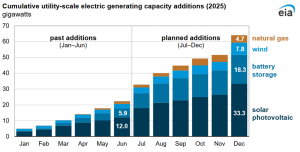

2025 was an interesting year in power in the United States, with the power sector expanding at breakneck speed driven by the rapid expansion of data centers and the energy needs to support artificial intelligence (AI). While the final numbers on capacity additions have not yet been published, if the projected numbers for the second half of 2025 were met, about 64 gigawatts (GW) of new electricity generating capacity will have been deployed, with more than half (33.3 GW) coming in the form of new solar photovoltaic generation, and over 18 GW of new battery storage:

Data source: U.S. Energy Information Administration, Preliminary Monthly Electric Generator Inventory, June 2025

Interestingly, according to the U.S. Solar Market Insight Q4 2025 report, 73% of all solar capacity installed was built in “red” states: Texas, Indiana, Florida, Arizona, Ohio, Utah, Kentucky, and Arkansas. 11.7 GW of solar power were installed in the 3rd quarter of 2025 alone.

Meanwhile, gas-fired power is being permitted as fast as the supply chain will allow, with about 5 GW of new capacity projected to have come online in 2025 and many new gas-fired power plants in various stages of the permitting process.

Battery power is also becoming a significant factor in the power industry, and at one point in March of 2025, 10% of the power on the Electric Reliability Council of Texas (ERCOT) grid was from battery storage, the first time this had ever happened.

In coal, the Trump administration issued Executive Order (EO) 14241 which was designed to reinvigorate the coal industry. While no new coal-fired generation was deployed or announced, just under 1 GW of coal-fired power that was scheduled to be retired has been extended through a number of Department of Energy 202(c) emergency orders requiring various coal-fired assets to stay online.

Where are we going?

According to ICF, electricity demand in the U.S. is expected to grow 25% by 2030 and 78% by 2050 compared to 2023 levels. In order to meet the 2030 total, the U.S. would need to deploy power at about twice the rate it currently is. Data centers alone are expected to require as much as 44 GW of new capacity.

According to Deloitte, to achieve these goals, investments of ~$1.4 trillion may be necessary. To get there, however, we are likely to need to see significant amounts of private equity investment, as the traditional route of raising capital for these projects, rate-based changes, is mostly maxed out and is not expected to cover this cost.

In terms of the capacity itself, where will it come from? At present, it appears that new gas-fired power is being deployed about as fast as it can, hindered primarily not by regulatory concerns but by supply chain as turbine vendors are currently back-ordered by several years. The Trump administration is actively putting the brakes on new renewable solar- and onshore and offshore wind-energy projects, having canceled over 226 GW of previously approved projects in 2025 alone. Coal doesn’t seem to be the answer with no new coal coming online or planned and less than 1 GW of previously scheduled-to-retire coal-fired units staying online. Nuclear, both in the form of large utility scale reactors and new small modular reactor (SMR) technology is coming, backed by billions of dollars of investment by hyper-scalers who need the power for their new data centers, but it’s still seemingly years away. How policy and the critical need for new generation intersect will be a key thing to watch in 2026.

Regulatory Direction

The Trump administration has signaled a deregulatory approach and in March of 2025 U.S. Environmental Protection Agency (U.S. EPA) Administrator Lee Zeldin announced the largest deregulatory action in U.S. history. For more on what has been referred to as the “31 flavors” and how those actions might impact the power sector, see our 4 The Record article. Most of these actions have taken form largely not in eliminating existing regulations, but in canceling or significantly reducing regulations that were proposed or in planning during the Biden Administration. The two most important of these to the power sector are:

- Revisions to Standards of Performance for New Stationary Sources (NSPS) for Stationary Combustion Turbines(revised Subparts GG and KKKK and new Subpart KKKKa at 40 CFR Part 60) were just finalized on January 15th and are now effective. As expected, the final Subpart KKKKa is less stringent than the proposed rule, with primary revisions being that the Best System of Emissions Reduction (BSER) is selective catalytic reduction (SCR) only for new, large, highly-utilized combustion turbines, and a new subcategory for temporary turbines that are in place for less than 24 months having a nitrogen oxides (NOX) limit of 25 parts per million (ppm) at 15% dioxygen (O2) or 0.092 pounds per million British Thermal Units (lb/MMBtu). There are two repercussions for the power industry, both positive: First, the determination that SCR is BSER only applies to highly utilized utility scale turbines, for which Best Available Control Technology (BACT) would almost always require SCR for NOX control regardless. Second, the split out of temporary turbines with a two-year time period at an emission rate that is easily achievable for most turbine types, such as 25 ppm, allows for a lot of flexibility for those projects that require temporary power while their permanent power source is being purchased and installed, especially data center projects. For a full discussion of what is in the revised rule, see our recent article on the topic.

- Standards of Performance for Greenhouse Gas (GHG) Emissions from Modified Coal-Fired Steam Electric Generating Units (EGUs) and New and Reconstructed Stationary Combustion Turbine EGUs (40 CFR Part 60, Subpart TTTTa) were promulgated in May 2024 but subsequently proposed for repeal or significant revision in June 2025. If the rule were to remain in place, it could significantly hamper gas-fired power generation as many new turbines would need to be limited to low-capacity factors in order to comply with the GHG limits. U.S. EPA was originally expected to promulgate a final rule in December 2025 but the government shutdown caused a delay and we now expect to see a final rule sometime in the first half of 2026, following a decision on the fate of the GHG endangerment finding. While the lack of a decision on Subpart TTTTa has caused a delay in submittal of permit applications or issuance of permits for some projects given the associated uncertainty about an achievable BACT standard that accommodates high utilization and the possibility of low load operation, the expectation is that Subpart TTTTa, along with a number of other GHG standards, will be repealed or significantly revised eventually.

For more insight on expected changes to other environmental regulations, see our air and water lookahead articles.

Power Sector in 2026

Regardless of any regulatory changes, ALL4 continues to see several fast-track programs bring new gas-fired power generating facilities online, including the PJM regional transmission organization (RTO)’s Reliability Resource Initiative, and Midcontinent Independent System Operator’s (MISO) similar proposed Expedited Resource Adequacy Study (ERAS) program for its region. These fast-track programs are tempered by the fact that large turbine vendors in the U.S. are currently backlogged on combustion turbine orders for two or more years, with no relief in sight. The supply chain concerns are further exacerbated by cost concerns associated with general confusion about the administration’s tariff program and associated international trade issues. Additionally, despite the critical need for additional electricity generation, many power projects, especially gas-fired power, continue to face significant public opposition, which not only adds more challenges to completing the permitting process but may also cause lengthy delays as permits get appealed.

Regardless of these challenges, utilities, power developers, and data center developers are expected to continue to permit and construct facilities as fast as the permitting process and supply chain for equipment will let them. We also expect to see companies investing more in the deployment of large-scale Reciprocating Internal Combustion Engines (RICE) for electricity generation, as well as increased deployment of fuel-cell technology as industry explores ways to get power to the grid as quickly as possible.

ALL4 will continue to track developments in regulatory and technical requirements related to the power sector in an era of expanding demand growth. ALL4 has significant power sector experience related to the entire life cycle of a power project, from due diligence and site selection to permitting and modeling, then to commissioning and ongoing compliance for electricity-generating facilities of all fuel types. That experience is combined with our established working relationships with numerous state agencies and U.S. EPA. ALL4 provides a full range of environmental, health and safety (EHS), and data services to our clients to help them meet their permitting, monitoring, testing, recordkeeping, and reporting challenges. If you’d like to learn more about our capabilities in the power sector, please contact Rich Hamel or your ALL4 project manager and stay tuned for the debut of our quarterly power sector newsletter, coming soon!