Internal Revenue Code Section 45Q – Carbon Oxide Sequestration Tax Credit

Posted: April 11th, 2022

Authors: Connie P.Congress first introduced section 45Q of the tax code in 2008 as part of the Energy Improvement and Extension Act. The credit is meant to incentivize investment in carbon capture and sequestration (CCS) technologies. The credit also supports beneficial use of carbon oxides instead of sequestration though at a lower credit amount per ton. Generally speaking the credit is intended for power plants and other stationary industrial facilities emitting carbon oxides, direct air capture (DAC) projects and beneficial use projects. The owner of the capture equipment is eligible to claim the credit or may transfer the credit to the market actor storing or using the carbon oxides.

What is Carbon Capture and Sequestration (CCS)?

Carbon capture refers to extraction of carbon oxides from active anthropogenic sources such as power plants or large industrial processes. It can also refer to capture of carbon oxides from the atmosphere, called Direct Air Capture (DAC). Sequestration is the process of ‘permanently’ securing carbon oxides or otherwise altering them to eliminate them from contributing to the atmospheric burden and driving global warming.

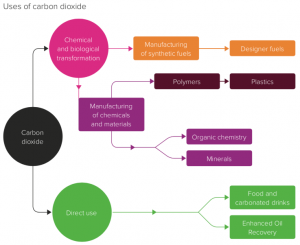

Figure 1 CCS Schematic (Subsurface depth to scale, 5,280 feet equals one mile) Source: USEPA

Figure 1 CCS Schematic (Subsurface depth to scale, 5,280 feet equals one mile) Source: USEPA

What is Carbon Capture and Utilization (CCU)?

The CC part of CCU is the same as the CC part of CCS. The difference is in what becomes of the carbon once it is captured. The U in CCU refers to the application of the captured carbon to so-called ‘beneficial uses’. Not all beneficial uses are equally beneficial. This variation is somewhat reflected in the value of the tax credits in 45Q where the credit is less for CO2 used for Enhanced Oil Recovery (EOR). Technologies are not mature enough yet but incentives such as 45Q can help drive innovation reveal opportunities for new revenue streams.

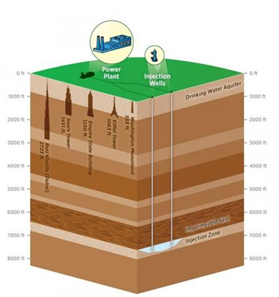

Figure 2 Ways to Use CO2 Royal Society

What is Being Proposed?

45Q was reformed and expanded in 2018 and is again up for amending in the 117th Congress under S.986 The Carbon Capture, Utilization, and Storage Tax Credit Amendments Act. The 2018 enhancements included extending the credit to eligible carbon monoxide in addition to carbon dioxide making the credit more widely accessible. While carbon monoxide has only weak radiative properties it contributes more significantly to global warming indirectly primarily by reacting with hydroxyl (OH) radicals rendering them unavailable to react with more potent greenhouse gases such as methane. When OH reacts with methane it reduces the lifetime of the molecule in the atmosphere thus reducing the global warming potential of the molecule. In addition 2018 reforms included broader eligibility for beneficial use projects and increased credit values.

Key changes proposed in the current legislation involve:

- Direct Pay provides a mechanism for market actors who earn tax credits under 45Q to instead realize equivalent cash payments. The credits would be treated as taxes paid and if the results in the taxpayer exceeding their tax liability, they could receive a cash refund from the IRS.

- Extending the window to start construction five years to 2030.

- Raising the credit per ton amounts – Currently credit values are set to ramp to $35 ton for carbon oxides stored geologically as a result of being used for enhanced oil recovery (EOR), $35 / ton for beneficial uses and $50 / ton for geologic storage not as a result of EOR by 2026. The proposed amendments: ‘Increase the 45Q credit value for direct air capture projects from $50 to $120 per metric ton for CO2 captured and securely stored in saline geologic formations and from $35 to $75 per ton for CO2 securely stored in oil and gas fields, or for beneficial utilization as fuels, chemicals, and useful products’ according to the Carbon Capture Coalition.

- Reduced thresholds – currently power plants must capture at least 500,000 tons annually and other types of facilities or projects must capture 100,000 or 25,0000 tons to quality for the credit. The current proposal would remove those requirements making the credit available to a much larger number of market actors.

According to Madelyn Morrison, External Affairs Manager of the Carbon Capture Coalition, “Congress now must deliver the broad portfolio of federal policy support for carbon management in pending budget reconciliation legislation, including direct pay and multi-year extension of the 45Q tax credit, increased credit values for industry, power and direct air capture, and dramatically reduced annual capture thresholds. Combined with the commercialization funding contained in the infrastructure law, these enhancements to the 45Q tax credit would result in an estimated 13-fold increase in carbon management capacity and annual CO2 emissions reductions of 210-250 million metric tons by 2035.”

It’s been a year since S986 was introduced in the Senate and referred to the Finance Committee. No action has been taken since then. The landscape of carbon taxes and credits, incentives and deterrents, risks and opportunities will grow increasingly complex as governments and market actors urgently seek to address climate change. It can be bewildering. A great place to get started is to understand the carbon footprint of your processes and products against the regulatory and competitive markets in which you operate. ALL4’s ESG and Sustainability, Air Quality, Carbon and Climate experts stand ready to help you navigate and innovate. You can contact Connie Prostko-Bell at cprostko-bell@all4inc.com or 610-422-1110.

Sources: USEPA, Carbon Capture Coalition, Great Plains Institute, Congress.gov, Hepburn, C., Adlen, E., Beddington, J. et al. The technological and economic prospects for CO2 utilization and removal. Nature 575, 87–97 (2019).