A Closer Look at the SEC’s Proposed Climate Related Disclosure Rule

Posted: May 6th, 2022

Authors: Daryl W.

On March 21, 2022, the U.S. Securities and Exchange Commission (SEC) proposed new rules that would require publicly traded companies to disclose climate-related risks in annual reports and public filings, such as Form 10-K reports. The approximately 500-page draft rule and a fact sheet are available from the SEC website at https://www.sec.gov/news/press-release/2022-46.

The rule is currently open to public comment, with the deadline for comments being extended until June 17, 2022. The comment period was extended from May 20, 2022, after 21 States Attorneys General, the U.S Chamber of Commerce, and numerous trade and industry associations requested an extension. The SEC is planning to finalize the rule by the end of the year. However, as of this week, SEC has already received over 8,100 comments and many more are expected before the end of the comment period.

The proposed rule would require companies to report climate-related risks that are reasonably likely to have a material impact on their business, results of operations, or financial condition. Climate-related metrics, including greenhouse gas (GHG) emissions, would be required in a note to audited financial statements. More specifically, the proposed rules would require public companies to disclose information including:

- The oversight and governance of climate-related risks by the board and management.

- How any climate-related risks identified have had, or are likely to have, a material impact on the business and consolidated financial statements, which may manifest over the short-, medium-, or long-term.

- How any identified climate-related risks have affected, or are likely to affect, strategy, business model, and outlook for the company.

- Processes for identifying, assessing, and managing climate-related risks, and whether such processes are integrated into the overall risk management system or processes for the company.

- If the company has adopted a transition plan as part of its climate-related risk management strategy, a description of the plan, including the relevant metrics and targets used to identify and manage any physical and transition risks.

- If the company uses scenario analysis to assess the resilience of its business strategy to climate-related risks, a description of the scenarios used, as well as the parameters, assumptions, analytical choices, and projected principal financial impacts.

- If the company uses an internal carbon price, information about the price and how it is set.

- The impact of climate-related events (e.g., severe weather events, other natural conditions, and physical risks) and transition activities (including transition risks) on financial statement line items, and disclosure of financial estimates and assumptions impacted by climate-related events and transition activities.

- Scopes 1 and 2 GHG emissions metrics, separately disclosed, expressed both by constituent greenhouse gases and in the aggregate, and in absolute and intensity terms. In some cases, companies must obtain an attestation report (i.e., verification) from an independent attestation service provider covering, at a minimum, Scopes 1 and 2 emissions disclosure.

- Scope 3 GHG emissions and intensity, if material, or if the company has a GHG emissions reduction target or goal that includes its Scope 3 emissions.

- Any climate-related targets or goals, including:

- The scope of activities and emissions included in the target, the time by which the target is intended to be achieved, and any interim targets;

- How the company intends to meet its climate-related targets or goals;

- Relevant data to indicate whether the company is making progress toward meeting the target or goal and how progress has been achieved, with updates each fiscal year; and

- If carbon offsets or renewable energy certificates (“RECs”) have been used as part of the plan to achieve climate-related targets or goals, certain information about the carbon offsets or RECs, including the amount of carbon reduction represented by the offsets or the amount of generated renewable energy represented by the RECs.

When responding to any of the proposed rules’ provisions concerning governance, strategy, and risk management, companies may also disclose information concerning any identified climate-related opportunities.

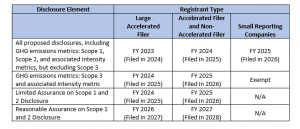

Reporting Phase-in Schedule

The proposed rules would be phased in over time, with an additional phase-in period for Scope 3 emissions disclosures and the assurance requirements. If the proposed rules are adopted with an effective date in December 2022, a company with a December 31st fiscal year-end would report as follows:

Toward Universal Climate Accounting Standards

The SEC’s proposed rule aligns closely with many of the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations. Most of the TCFD’s requirements for disclosure of Scope 1, 2, and 3 emissions and the focus on climate governance, strategy, and risk management are reflected in the proposed SEC regulation. The proposal also requires companies to report these climate-related risks if they are likely to have material impacts on the business over short-, medium-, and long-term periods, similar to the TCFD’s strategy disclosure recommendations.

Last November, the International Financial Reporting Standards (IFRS) Foundation, a global organization that oversees financial accounting standards in more than 140 countries, including Canada, the United Kingdom, and the European Union, founded the International Sustainability Standards Board (ISSB). Following release of the SEC proposed rule, the ISSB released a first draft of its general sustainability-related and climate-related disclosure standards on March 31, 2022. While the details of the ISSB draft disclosure standards will be the subject of a future 4 The Record article, it can be said that these draft standards also closely follow the guidance of the TCFD recommendations.

Since the IFRS governs financial reporting in capital markets in more than 140 countries, and the SEC governs U.S. capital markets, which are the largest and deepest in the world, the SEC and ISSB would ideally collaborate closely in the development of the final rules and standards. Just as we need universal financial accounting standards, we also need universal climate accounting standards.

ALL4 will continue to monitor development of the SEC climate related disclosure rule and the ISSB disclosure standards as they develop. If you have questions regarding these proposals, reach out to one of our team members – Daryl Whitt at dwhitt@all4inc.com or Connie Prostko-Bell at cprostko-bell@all4inc.com.