Clean Water Act Facility Response Planning for Hazardous Substances

As we start 2025 it is important to note that we are moving closer to the compliance deadline of the U.S. Environmental Protection Agency’s (U.S. EPA) Clean Water Act (CWA) Hazardous Substances Facility Response Plans (FRP) regulation under 40 CFR 118. Think of this rule as more advanced Spill Prevention, Control and Countermeasure (SPCC) for chemicals.

If you own or operate a non-transportation related, onshore facility with any CWA hazardous chemicals, as identified under 40 CFR §117.3, and have proximity to navigable waters you will need to determine whether the facility will be subject to the rule and, if applicable, submit a FRP to U.S. EPA by June 1, 2027.

What should I be doing now?

First, determine the maximum quantity onsite of all CWA hazardous substances with a reportable quantity (RQ) located at your facility. The maximum quantity onsite is the total aggregate quantity for each CWA hazardous substance present at all locations within the entire facility at any time. Keep in mind there is no container size exemption, and you also need to account for mixtures containing CWA hazardous chemicals.

Next, determine if your property boundary or nearest opportunity for discharge is located within one-half (0.5) mile of navigable waters or conveyances to navigable waters. If your facility is in proximity to navigable waters, conduct worst case discharge modeling for each CWA hazardous chemical with a maximum quantity onsite greater than or equal to 1,000 times the RQ. Modeling will need to be used to determine planning distances, which are determined as the concentration of each CWA hazardous chemical at endpoints including:

- Public water systems,

- Fish, wildlife, and sensitive environments (FWSE), and

- Public receptors, including parks, recreational areas, docks, or boat launches.

Any model used to determine the planning distance must include considerations for both adverse weather including extreme weather events, temperature fluctuations, rising seas, storm surges, inland and coastal flooding, drought, wildfires, permafrost melt in northern areas, and from potential fires or explosions at the facility.

Additionally, each U.S. EPA Regional Administrator can require a facility to prepare and submit an FRP regardless of whether the criteria noted above are met.

If required, an FRP must include:

- Identification of Qualified Individuals (QI) who will require specialized training,

- Identification of key response resources, including local firefighting equipment,

- Established contracts to ensure the availability of proper response personnel and equipment, including response resources with firefighting capability and the availability of resources if facility or mutual aid resources are not capable of handling a worst case discharge incident resulting from a fire or explosion,

- Routine employee training outside of QI training,

- Annual response drills in coordination with the Local Emergency Planning Committee (LEPC) and fire departments,

- Risk identification, characterization, control, and communication,

- Communication plans with LEPC and fire departments, and

- Release detection including hazardous air releases resulting from discharges.

What’s next?

If you have questions about how the CWA Worst Case Discharge rule could affect your facility’s compliance procedures, or need help with starting your facility applicability evaluation, conducting a comprehensive inventory, modeling planning distance, or developing an FRP, please reach out to me at mdabrowski@all4inc.com.

In 2025 U.S. EPA is expected to provide additional compliance guidance. ALL4 continues to monitor all updates published by U.S. EPA on this topic, and we are here to answer your questions and assist your facility with any aspects of FRP compliance.

Water Quality Compliance in the Trump Era

With anticipated budget cuts to the U.S. Environmental Protection Agency (U.S. EPA) under the incoming Trump administration, environmental groups are emphasizing the importance of state action to regulate industrial discharges under the Clean Water Act (CWA). As federal priorities are changing, state environmental agencies are well-positioned to step in and fill perceived gaps in regulating discharge of pollutants of concern, particularly in industries like chemicals, plastics, petrochemicals, and power generation.

Challenges of Outdated Effluent Limit Guidelines (ELGs)

The term “outdated” refers to Effluent Limit Guidelines (ELGs) that have not been revised to reflect current technological advancements or emerging environmental concerns. Many ELGs were established decades ago and no longer align with the best available pollution control technologies or address newly identified pollutants, such as per- and polyfluoroalkyl substances (PFAS). For example, the ELGs for plastics and petrochemical facilities have remained largely unchanged since 1993, despite advancements in treatment technologies capable of significantly reducing discharges of toxic and non-conventional pollutants as well as more sensitive test methods capable of detecting these pollutants at much lower concentrations.

This regulatory gap leaves states without updated federal guidance, often resulting in Best Professional Judgment (BPJ)-based permit limits developed inconsistently between states and without clear federal guidance. However, in its final days, the outgoing Biden Administration U.S. EPA issued a guidance document for implementing case-by-case technology-based effluent limitations (TBELs). The guidance outlines a framework and presents resources available for permit writers to implement BPJ-based permit limits “for specific industrial categories or, where national ELGs are not applicable, on a case-by-case (also described as best professional judgement or BPJ) basis by the permit writer.” Environmental groups like the Environmental Integrity Project (EIP) have historically called for updated standards, highlighting the role of outdated ELGs in contributing to significant pollution in water bodies surrounding industrial facilities.

While BPJ is a term many responsible for permit compliance may recognize, everyone may not have full appreciation for its implications. BPJ allows states to set facility-specific discharge limits for pollutants of concern when federal standards are absent or outdated. This flexibility is especially relevant for emerging contaminants like PFAS, where federal ELGs have lagged. For instance, U.S. EPA missed its September 2024 target to propose PFAS-specific ELGs for the Organic Chemicals, Plastics, and Synthetic Fibers (OCPSF) sector, leaving states open to take independent action.

PFAS compounds, often termed “forever chemicals” due to their persistence in the environment, remain a focal point of regulatory concern. States can regulate PFAS through BPJ-based permit limits and conditions for direct dischargers and pretreatment requirements for indirect dischargers. Publicly owned treatment works (POTWs) also have the authority to mandate monitoring and reduction of PFAS in industrial wastewater before it enters municipal sewer systems.

While states can incorporate PFAS requirements, many are waiting for federal guidance to ensure consistency and legal defensibility; it is yet to be seen if that lasts into the new administration. Even a proposed federal rule would provide clarity, empowering states to navigate the PFAS permitting in a more concerted way.

Moving Forward: State and Local Action

As federal resources and priorities shift, states and POTWs have the opportunity to take action in implementing permit limits that could outpace federal ELGs. States are also responsible for developing their own water quality standards, which can apply statewide or on a watershed- or waterbody-specific basis. What’s more, some states may opt to develop more strict water quality standards, and associated criteria, in an effort to ensure that water quality doesn’t suffer in the absence of federal regulation.

By leveraging BPJ-based permit conditions and enforcing stricter discharge standards, state agencies can fill regulatory gaps, real or perceived, to address emerging contaminants like PFAS or increase regulations for certain industrial sectors.

Broader Implications for Industrial Sectors

U.S. EPA’s recent efforts to evaluate and update ELGs for various industries—including battery manufacturing, centralized waste treatment, and oil and gas extraction—are now in question. Environmental groups are pushing for updates to decades-old standards in other sectors as well, such as plastics manufacturing, petrochemical facilities, and oil refineries. A 2023 report from the EIP asserts that outdated ELGs contribute to significant pollution in water bodies surrounding industrial facilities.

EIP and other organizations have filed lawsuits and petitions urging U.S. EPA to strengthen ELGs for sectors that discharge toxic or non-conventional pollutants. For example, they have called for new regulations on petroleum coke calcining facilities, which currently lack ELGs for both process wastewater and stormwater discharges.

The future of U.S. EPA’s ELGs for steam electric power plants is also uncertain. These regulations, which include stringent zero-discharge standards for certain wastewater streams, are being challenged in court by industry groups and some states. Environmental advocates, however, argue that the technology to meet these standards is both available and cost-effective.

How ALL4 Can Help

For industrial clients navigating these challenges, ALL4 offers comprehensive support to ensure compliance with both state and federal requirements. Our team of experts specializes in:

- Site-Specific Permitting Solutions: We craft customized strategies to meet permit requirements, whether they are BPJ, water quality-based, and/or stricter ELG requirements.

- PFAS Monitoring and Management: ALL4 helps industrial clients design and implement effective PFAS monitoring programs to meet current and emerging regulatory standards.

- Regulatory Advocacy and Support: We keep you informed of the latest regulatory changes and represent your interests in navigating evolving compliance landscapes.

- Leveraging Advanced Technologies: Our team can support identifying and integrating cutting-edge pollution control technologies, supporting cost-effective compliance for your project or facility.

If you have any questions or would like to discuss how ALL4 can help you with these efforts, please reach out to Cody Fridley at 269.716.6537 or cfridley@all4inc.com.

2025 Look Ahead – Data Centers

Data centers can get a bad rap – large buildings near residential areas, consuming power, drawing water, creating an inescapable hum. No industry is perfect. But what else? Data centers generate large tax revenues for localities (and in Loudoun County, VA, for example, thereby reduce the tax burden on residents), their owners give back to the communities and invest in the alternative energy industry to help solve concerns around power, and if you use the internet, drive an electric car, make plans using a smart phone – you need them; the “cloud” lives inside of data centers. As Artificial Intelligence (AI) expands, we’re only going to need them more, and the U.S. government agrees. During his last week in office, former President Biden signed an Executive Order (EO) committing Federal support to ensure American leadership in AI, which includes facilitating the construction of data centers through several measures, catalyzing clean energy generation, and creating partnerships. During his first week in office, President Trump highlighted strategic partnerships and billions of dollars in AI infrastructure investment.

So in 2025, what challenges does the data center industry face to remain good environmental stewards while making solid business decisions to deliver the connectivity we expect? As a rapidly growing industry for ALL4, and one in which we utilize all four of our practices, here is what we see:

Where to Build and What is Required

It used to be all about “fiber” (the cables and their components used to transmit data). It’s why Northern Virginia has led the data center space for so long. While fiber is still important, availability of power now dominates the conversation. For context, the servers used to host the internet, AI, data for electric vehicles, etc. need continuous power, which means data centers need continuous power. This comes in many forms, but predominantly they are powered by electricity from the utility company backed up by emergency generators using diesel-fired engines that kick on when the main power supply is interrupted. Where there are delays until utility power is available, access to natural gas is a growing topic as more data centers consider on-site power generation (natural gas-fired engines or turbines) to span the gap until they get electricity. Community opinion can also be a consideration along with environmental constraints (e.g., water availability, air permitting), particularly as data center campuses grow larger for economies of scale and to handle the data needs of the future.

We see a growing interest and need in site selection/air permitting studies. Permitting requirements vary so much state to state. In some cases, building a data center even in one county versus another can have significant impacts on budget, capacity, equipment procurement, and more, just considering air quality permitting requirements. This is why a site selection/air permitting study as part of due diligence is important before land is purchased. In addition, such a study can help with initial project budgeting and timelines, and understanding what challenges air permitting may present in terms of equipment procurement and installation dates.

If you are a hyperscaler or colocation, air permitting has always been important to consider. Smaller data centers called “edge” data centers, built closer to population centers to increase service, sometimes install only a handful of emergency engines; however, as requirements get tighter, air permitting can be a limiting factor for them also. We also see more property management companies in the data center space or those focused primarily on energized shells in business parks, and while they use it a little differently, they too need a site selection/air permitting study for proposed sites.

The following factors drive the need for those studies:

- Air emissions thresholds that trigger complex permitting from one county to the next can differ by up to 300%, limiting how many engines can be installed at a facility, or requiring expensive air pollution control equipment [often selective catalytic reduction (SCR) units for oxides of nitrogen (NOX) reduction]. If engines are needed to provide primary or back-up power to a facility, to ensure continuous power, limiting the number of engines limits the amount of server capacity that facility can hold. We see this in Texas, for example; the Dallas-Fort Worth (DFW) area is a severe non-attainment area for ozone, thus creating a major source threshold for NOX emissions, the largest pollutant from the combustion of diesel fuel, of 25 tons per year (tpy). For those data centers built in Austin, El Paso, and many locations outside of DFW or Houston, that threshold is 100 tpy for NOX.

- Many states have increased their focus on emissions of air toxics, and include diesel particulate matter (DPM) in those evaluations. These air toxics programs often require air dispersion modeling as part of air permitting and can lead to the need for air pollution control equipment like diesel particulate filters (DPFs) or oxidation catalysts (DOCs) to reduce emissions of air toxics or DPM. California [focused more on particulate matter (PM)], Oregon, New Jersey, Georgia, and others lead state/district agencies on requirements for air toxics.

- Public input on air permits has been commonplace for decades, depending upon the type of permit, type of facility, or general public interest. With the increased initiatives around Environmental Justice (EJ), air permitting requirements are changing to respond to these areas of concern. Because EJ is so localized and every state handles it differently, it is important to understand the EJ landscape when considering a new site. A facility to be located in or near an overburdened community may need to conduct air dispersion modeling, which can 1) extend the timeline for air permitting, 2) result in the installation of air pollution control equipment on engines that would not have otherwise needed it, and/or 3) require more time to engage with the community ahead of engine installation.

- There is a lot of discussion about the impacts of lower National Ambient Air Quality Standards (NAAQS) – we are looking at you, PM5, and changing attainment status designations – and for good reason. These lower ambient standards and major source thresholds can increase air permitting requirements and risk to the project, expand permitting timelines, and/or trigger the need for air pollution control equipment, all of which impact costs and construction schedules.

When it comes to air permitting strategy, there are really only three levers to pull – regulatory burden (e.g., the type of permit or permitting program selected), capital expenditure (e.g., type of engines purchased, air pollution control equipment, construction delays), and operational flexibility (e.g., fuel consumption or hours of operation limits, restrictions on when and/or how many engines can be simultaneously operated). The ideal strategy finds the best lever position for all three, balancing risk, cost, and future needs.

Power

We have all read news stories about the power crunch, and power is a challenge that will require many solutions. The predictions for total U.S. data center electricity consumption in 2028 from the 2024 Report on U.S. Data Center Energy Use produced by Lawrence Berkeley National Laboratory are attention-grabbing, and states are conducting reviews of the impacts of the data center industry generally, such as the Joint Legislative Audit and Review Commission (JLARC) report for Virginia published on December 9, 2024.

Data centers have been building substations to support their campuses for years, but the power challenge now extends beyond that. Buying land where there is power, finding ways to move to the front of the line to get power where they want to build, and/or generating power themselves, at least in the interim – that’s what data centers focus on now. We hear about programs where localities/local utilities will prioritize facilities in the power queue that take on some of the power burden. The emergency generators are often the first place they look, and facilities are encouraged to participate in some form of demand response or peak shaving program. Programs to make use of emergency generators to stabilize the grid are not new but the power crunch and high energy prices are creating more interest in the data center community in such uses.

However, the Federal engine rules and subsequent determinations by the U.S. Environmental Protection Agency (EPA) are strict about what generators can participate in financial arrangements and when, and no state or locality can be less strict than U.S. EPA. For example, U.S. EPA has clarified that for a generator to operate as a non-emergency unit (according to U.S. EPA’s definition), the engine must be a Tier 4 certified engine, not a Tier 4 compliant engine (i.e., add-on emissions controls), beginning with engines manufactured in 2011. In addition, for those facilities installing Tier 4-certified engines, either as part of sustainability goals/good stewardship programs or as part of a demand response business model, the inducement override can only be used in an emergency that could impact public health, not just because the power went out and an engine ran out of diesel exhaust fluid. In August 2022, U.S. EPA issued an enforcement alert for engines operating out of compliance; while data centers may be disappointed that the numerous emergency generators installed all across the U.S. are restricted in how they can participate in power solutions, we want the industry to be aware of the risks and review their engines carefully before entering into any programs. The good news is that there are some local utility programs designed specifically to meet the financial arrangement criteria of the Federal emergency engine definition for easier enrollment of emergency generators.

A common on-site power generation method is natural gas-fired engines or turbines, which are proven, deployable technologies. The downside is that the air permitting requirements for the emergency generators at data centers pale in comparison to what is usually needed for 24/7 gas-fired power generation, even with air pollution control equipment; lead time to allow for permitting is key. On the plus side, we see equipment that can use natural gas now but also switch to hydrogen as that source of fuel becomes available to more facilities, helping data centers to future-proof their facilities and meet sustainability goals. Over the last year or two, the idea of small modular reactors (SMRs) has been a hot topic at data center conferences. While that technology advances, data center partnerships with owners of existing nuclear reactors have dominated the recent conversation; it will be interesting to see how the idea plays out among the various agencies and stakeholder groups. Investments in and deployment of other alternative energy sources such as fuel cells, wind, solar, etc. continue as well. The data center industry has both the motivation and the means to invest and promote energy development because a sustainable power portfolio must contain diverse energy sources, providing both a consistent base load and ability to cover the peaks.

The data center industry and the sustainability space are interconnected in many areas, and power is one of the biggest. In addition to looking for ways to reduce power consumption and supporting communities by facilitating reliable power, alternative sources of energy, clean energy as the Executive Order described it, will continue to be of vital interest. For more on sustainability, see Connie Prostko-Bell’s 2025 Look Ahead article. While not data center-specific, Connie notes several topics that apply directly to this industry: energy, supply chain, regulatory reporting, greenhouse gas emissions, building performance standards, carbon footprint, water consumption, waste disposal, and risk. Two examples of data centers and sustainability come to mind outside of the power space:

- Just last fall, we all saw the article about Microsoft incorporating wood into some of their new buildings to reduce steel and concrete to lower the carbon footprint.

- Community involvement is of particular focus inside the data center industry but not often discussed outside of it. The data center space (made up of owners, operators, customers, support contractors, and more) collects toys or food for local communities, fundraises and donates to charities, lights up their buildings in team colors to support the local high school, and engages in community activities (both before the data center is built to answer questions about the upcoming facility and through on-going involvement). In addition, they are crafting and teaching education courses to develop a workforce for 2025 and beyond, and spurring a renewed interest in and demand for people to work in trades through their expansion across the U.S. and the world.

What Else is Changing

Data centers are having to rethink their design and equipment, and do their best to future-proof as technology advances. The power density within the same server rack is changing rapidly – with AI and other high-performance computing (HPC) functions, the power density can be 5 to 10 times higher than what’s required for the cloud. Not only does this draw more power, and create space challenges to install the corresponding emergency generators (e.g., we see bigger campuses and a lot of stacking of engines now), but the process to manage the heat generated by the server rack also changes. You may have heard about liquid cooling, the re-emerging technology to help cool HPC systems because liquid conducts heat more efficiently than air. Most data centers have relied upon air cooling, the traditional air conditioning approach using cooling towers, chilled water loops, and/or refrigerant-containing equipment, and this will continue to be needed. But in order to implement liquid cooling technologies, such as immersion cooling or direct-to-chip cooling, there are many considerations and changes needed both to the server and the data center. For new sites, this can be part of the planning; for existing sites, retrofits can pose a challenge.

Uninterruptible Power Systems (UPS) are another hot topic as they serve a critical function for data centers. Because back-up engines take time to start-up in the event of a power outage, data centers use a UPS to keep providing power to the servers until the emergency generators take over. For many data centers, a static UPS formed by a large quantity of batteries is used. Because of the great number of batteries required for a large data center, battery-based UPS have undergone some changes in recent years, such as moving from predominantly lead-acid to lithium-ion. In 2023 and 2024, ALL4 published a lot of content about batteries, including this webinar on supply chain, this article on best practices, and this webinar about lithium ion battery safety and compliance. But there is significant discussion now about dynamic UPS, also called rotary UPS, which consist of a generator directly coupled with an energy storage system rotating on a shaft. The most common type is referred to as a Diesel Rotary Uninterruptible Power Supply (DRUPS). If the power fails, part of the energy in the storage system (e.g., flywheel) drives the generator to start producing electricity and another part of the energy supports quick start-up of the engine, which can reduce or eliminate the reliance on battery UPS.

There are reliability, cost, and space differences between the technologies to consider, but because the dynamic UPS systems usually involve fuel combustion, air permitting considerations are also important to evaluate. If you are considering such a system, please involve your environmental consultant early in discussions, just like you would for your emergency generators and potential on-site generation plans.

Conclusion

ALL4 is proud to partner with data centers all over the U.S. to support: site decisions, budget and equipment planning through air permit strategies, construction schedules through comprehensive and turnkey permitting efforts, sustainability goals and reporting, health and safety needs, and compliance with environmental requirements through diligent reporting, training, tool development (including digital solutions), auditing, and more.

If you are considering on-site generation or a dynamic UPS, give us a call.

If you are looking to buy land in a new area and want to talk about the potential for EJ engagement or air pollution control equipment, give us a call.

If you want to talk with a certified energy manager, discuss storage tanks or water permitting, or chat about universal waste, give us a call.

Please connect with me, Sharon Sadler, WDC Office Leader and ALL4 Data Center Lead, at ssadler@all4inc.com or 571-392-2595.

Looking Ahead – Fenceline Monitoring

In 2024, the U.S. Environmental Protection Agency (U.S. EPA) finalized new fenceline monitoring requirements associated with amendments to Standards of Performance for New Stationary Sources (NSPS) and National Emission Standards for Hazardous Air Pollutants (NESHAP) associated with the following source categories:

- Coke Ovens: Pushing, Quenching, and Battery Stacks (PQBS) and Coke Oven Batteries (COBs) – 40 CFR Part 63, Subpart L.

- Synthetic Organic Chemical Manufacturing Industry (SOCMI) and Group I Polymers and Resins (P&R) – 40 CFR Part 63, Subparts F, G, H, and I.

- Iron and Steel Manufacturing – 40 CFR Part 63, Subpart FFFFF.

In 2025, facilities subject to these rules should be preparing to comply with these new fenceline monitoring requirements. For Coke Ovens and SOCMI/Group I P&R, U.S. EPA promulgated monitoring requirements in the Federal Register and is in the process of doing the same for Iron and Steel Manufacturing once they designate a sampling and analysis method. The table below summarizes fenceline monitoring requirements for each category.

For details on the location and number of sampling sites, sampling and analysis, action levels, root cause and corrective actions, and reporting requirements, see ALL4’s 4 The Record Articles on Coke Oven Fenceline Monitoring and SOCMI/Group I P&R Fenceline Monitoring.

Conducting a pilot study ahead of the required fenceline monitoring implementation date is key to understanding how emissions from your facility impact fenceline concentrations and identifying potential areas of concern before implementing a comprehensive monitoring program. A secondary benefit of a pilot study is that it allows your facility to address the logistics of conducting a fenceline monitoring program by working with the sampling staff and the analytical laboratory to address sampling, analysis, and data interpretation. The pilot study could focus on smaller process areas or the site as a whole.

New Administration – What’s Next?

With the administration change, a common question asked is will these monitoring requirements remain in place or is there a possibility of a pause or reconsideration. In 2016, the same question was asked about fenceline monitoring as part of the Petroleum Refinery Sector Rule (40 CFR Part 63, Subpart CC) as monitoring requirements were finalized in 2015 (before an administration change).

In 2016, the Refinery fenceline monitoring requirements were not reconsidered or stayed. For the current fenceline monitoring requirements that were published in the Federal Register in mid-2024 for Coke Ovens and SOCMI/Group I P&R, it is uncertain whether U.S. EPA will reconsider them or if litigation will result in changes to the fenceline monitoring provisions; the possibility exists that the schedule will continue as outlined but it is still too early to tell. For the Iron and Steel Manufacturing Facilities, there is a potential for a delay since the fenceline monitoring methodology has not been published.

Two other rules that ALL4 is watching are the recently proposed updates to the Polyether Polyols NESHAP (40 CFR Part 63, Subpart PPP) and the Chemical Manufacturing Area Sources (CMAS) NESHAP (40 CFR Part 63, Subpart VVVVVV), which include fenceline monitoring similar to that included in the SOCMI and Group I P&R NESHAP. These rules may expand the universe of chemical facilities subject to federal fenceline monitoring requirements. Facilities subject to these rules should engage with their industry associations, as well as ALL4, to provide comments on the proposed changes and evaluate their impacts.

How can ALL4 help?

ALL4 closely tracks regulatory actions and developments from U.S. EPA and can help facilities interpret and address new requirements, and plan, prepare, and execute fenceline monitoring programs. We are currently assisting facilities with pilot studies and can support your needs as well. ALL4 can also evaluate data from ambient monitoring sites near your facility and how your facility may be impacting monitored concentrations. For more information, please contact Kyle Hunt at khunt@all4inc.com or Dustin Snare at dsnare@all4inc.com.

Chemicals and Ethylene Oxide Lookahead

Continuing the momentum of the past several years as the United States Environmental Protection Agency (U.S. EPA) is conducting its required periodic reviews of air rules, 2025 promises to bring additional changes to regulations for the chemical industry, including users of ethylene oxide (EtO). This article mainly covers updates to three major chemicals air rules for the Synthetic Organic Chemical Manufacturing Industry, Polyether Polyols Production, and Chemical Manufacturing Area Sources, but multiple other rules affecting industry are also covered, including an outlook for Toxics Substance Control Act updates in 2025.

U.S. EPA finalized revised standards for the Synthetic Organic Chemical Manufacturing Industry (SOCMI) on May 16, 2024. This action included changes to National Emissions Standards for Hazardous Air Pollutants (NESHAP) and Standards of Performance for New Stationary Sources (or “New Source Performance Standards,” NSPS) for several rules including 40 CFR Part 63, Subparts F, G, H, I (HON), 40 CFR Part 63, Subpart U (Polymers and Resins I, or P&R I), and 40 CFR Part 63, Subpart W (P&R II). U.S. EPA also finalized four new subparts under 40 CFR Part 60: VVb (SOCMI Equipment Leaks), IIIa (SOCMI Air Oxidation Unit Processes), NNNa (SOCMI Distillation Operations), and RRRa (SOCMI Reactor Processes).

Multiple industry representatives have filed both judicial petitions for review and petitions for agency reconsideration. Petitioners have been busy preparing court briefs and oral arguments; however, it is currently unknown how the change in U.S. EPA administration will impact the pending litigation and reconsideration. We expect 2025 will bring some clarity to the future of several provisions, including those related to controlling emissions of ethylene oxide (EtO) and dioxins and furans, as well as those related to fenceline monitoring. Stay tuned to our 4 The Record Articles for updates on these rules throughout 2025.

Polyether Polyols Production Industry

On December 27, 2024, U.S. EPA proposed changes to the NESHAP for Polyether Polyols Production, commonly referred to as the “PEPO NESHAP,” codified under 40 CFR Part 63, Subpart PPP. As with their HON review, U.S. EPA performed a second risk analysis under Clean Air Act (CAA) Section 112(f) and is proposing that risks from EtO emissions from PEPO sources are unacceptable. To address risk, U.S. EPA is proposing additional control requirements for EtO emissions from process vents, storage vessels, equipment leaks, heat exchange systems, and wastewater. U.S. EPA is also proposing rule updates as part of their CAA Section 112(d)(6) technology review for heat exchange systems, storage vessels, process vents, and equipment leaks. Additionally, U.S. EPA is proposing fenceline monitoring requirements under CAA Section 112(d)(6) along with several other important changes as part of a gap-filling exercise. A brief summary of the proposed changes is provided below.

Changes to Address Risk

According to U.S. EPA’s proposal, risk from the PEPO source category is driven by emissions from wastewater and equipment leaks and there are six facilities with a maximum individual lifetime cancer risk (MIR) greater than 100-in-1 million. The table below presents the standards U.S. EPA is proposing to reduce emissions of EtO from PEPO facilities.

| For the Source Type Below: | That Contain the Following Amount of EtO: | Facilities Must Reduce EtO Emissions by: |

| Equipment Leaks | 0.1% by weight | Monitoring connectors and gas/vapor light liquid valves on a monthly basis using a leak definition of 100 parts per million by volume (ppmv) with no skip period or delay of repair unless the equipment can be isolated such that it is no longer in EtO service; and

Monitoring pumps on a monthly basis using a leak definition of 500 ppmv with no delay of repair unless the equipment can be isolated such that it is no longer in EtO service. |

| Heat Exchange Systems | 0.1% by weight | Monitoring on a weekly basis for leaks using the Modified El Paso Method and repairing leaks above the leak action level (6.2 ppmv as methane in the stripping gas) within 15 days with no delay of repair allowed. |

| Process Vents | Vents that contain 1 ppmv or more of EtO (uncontrolled) and when combined emit 5 lb/yr or more of EtO (Uncontrolled) | Venting to a flare meeting the Refinery Sector Rule (40 CFR Part 63, Subpart CC) requirements; or

By venting to a control device that reduces EtO by 99.9% by weight or to a concentration of less than 1 ppmv or to less than 5 lb/yr for all combined process vents. Additionally, facilities would not be able to use the extended cookout (ECO) pollution prevention technique or existing production-based limits in place of the proposed provisions above. |

| Storage Vessels | 0.1% by weight | |

| Wastewater | 1 part per million by weight (ppmw, annual average) | Reducing the concentration of EtO in the wastewater to less than 1 ppmw.

Additionally, U.S. EPA is proposing to add provisions prohibiting the injection of wastewater, or water that contains or has contacted EtO into a heat exchange system. |

| Pressure Release Devices (PRD) | 0.1% by weight |

|

| Pressure Vessels | 0.1% by weight, any capacity |

|

| Flares used to comply with process vent and storage vessel EtO control requirements or where leaks from equipment in EtO service are routed to a flare | Meeting the Refinery Sector Rule (40 CFR Part 63, Subpart CC) flare requirements at 40 CFR §§63.670 and 63.671. | |

U.S. EPA estimates that the proposed requirements above will reduce the MIR of the PEPO source category to 100-in-1 million. Although U.S. EPA is proposing fenceline monitoring requirements for EtO, they are doing so under their CAA Section 112(d)(6) technology review, which is described below.

Changes to PEPO based on U.S. EPA’s Technology Review

U.S. EPA is proposing several changes to the requirements for heat exchange systems, storage vessels, process vents, and equipment leaks as part of a technology review. These changes are summarized in the next table.

| Source Type | Proposed Rule Requirements |

| Heat Exchange Systems |

|

| Storage Vessels |

|

| Process Vents |

|

| Equipment Leaks |

|

In addition to the above requirements, U.S. EPA is also proposing a fenceline monitoring program for PEPO facilities under the CAA Section 112(d)(6) technology review. Facilities that use, produce, store, or emit EtO would be required to conduct fenceline monitoring. Facilities would be required to place eight ambient air sampling canisters around their fencelines and potentially rotate the sampling locations for each sampling event based on the magnitude of the facility perimeter. Sampling events would be conducted every five days for a period of 24 hours. Facilities would be required to calculate the difference between the highest and lowest individual sample for each sampling event (known as “Δc”) and maintain their annual average Δc value below an action level of 0.2 micrograms of EtO per cubic meter (µg/m3). If the action level is exceeded, facilities would conduct a root cause analysis and implement corrective actions to reduce emissions if the source of the exceedance is under their control. The fenceline monitoring data would be electronically reported on a quarterly basis.

Changes to PEPO based on CAA Section 112(d)(2), (d)(3), and (h)

U.S. EPA is proposing several additional changes consistent with CAA Sections 112(d)(2), (d)(3), and (h) as summarized in the table below.

| Source Type | Proposed Requirements |

| Non-Flare Control Devices |

|

| Adsorbers |

|

| Flares |

|

| Bypass Lines |

|

| Maintenance Activities |

|

| Pressure Vessels |

|

| Surge Control Vessels and Bottoms Receivers |

|

| Transfer Operations |

|

U.S. EPA is proposing two additional changes as part of their CAA Sections 112(d)(2), (d)(3), and (h) review. First, the agency is proposing to add butylene oxide to the list of HAP presented in Table 4 to subpart PPP (Known Organic HAP from Polyether Polyol Production). Second, U.S. EPA is proposing to remove the exemption for reactions/processing that occur after completion of epoxide polymerization and all catalyst removal steps; instead, U.S. EPA is proposing to require control of emissions from these unregulated sources (including solvent removal, purification, drying, and solids handling).

Other Changes

U.S. EPA is proposing several other changes to Subpart PPP including a 5-year repeat performance testing requirement, electronic reporting requirements, and requirements for monitoring adsorbers that cannot be regenerated and regenerative adsorbers that are regenerated offsite. U.S. EPA is also proposing to remove the provision exempting sources from determining uncontrolled process vent emissions when complying with the percent reduction and production-based emissions limits.

Proposed Compliance Dates

Sources that were constructed or reconstructed on or before December 27, 2024 would be required to comply with the EtO control requirements two years from the effective date of the final rule and all other control requirements three years from the effective date of the final rule, with the exception of the fenceline monitoring requirements. Sources would be required to start collecting fenceline monitoring data within two years, and would be required to implement correction actions within three years. Sources that are constructed or reconstructed after December 27, 2024 would be required to comply with the new requirements upon the effective date of the final rule or upon startup, whichever is later.

Chemical Manufacturing Area Sources

On January 22, 2025, U.S. EPA published a proposed rule updating the NESHAP for Chemical Manufacturing Area Sources, otherwise known as the CMAS NESHAP. The proposed rule is a result of the U.S. EPA’s CAA Section 112(d)(6) technology review of the generally available control technology (GACT) standards previously promulgated in 2009. Furthermore, U.S. EPA is using their authority under CAA Section 112(c)(5) to establish an additional category/subcategory of sources in response to identifying a threat of adverse effects to human health or the environment. As a result of the 2016 update to the integrated risk information system (IRIS) value for EtO, the U.S. EPA is proposing to add “Chemical Manufacturing with Ethylene Oxide” to the source category list along with GACT standards per CAA Section 112(d)(5). The new are source category would include “processes that produce a material or family of materials described by NAICS code 325 where EtO is used as a feedstock, generated as a byproduct, or is the material produced.”

U.S. EPA is proposing EtO GACT standards for equipment leaks, heat exchange systems, process vents, storage tanks, wastewater, transfer operations, pressure vessels, and pressure relief devices (PRDs). These standards mirror what we have seen in other recent updates to chemical sector rules include the Miscellaneous Organic Chemical Manufacturing NESHAP (MON) and the HON. U.S. EPA is also proposing a fenceline monitoring program for EtO emissions.

U.S. EPA is proposing additional GACT standards for non-EtO emissions including a PRD work practice standard, requirements for bypasses, and revisions to requirements for pressure vessels. Revised requirements for equipment leaks, heat exchange systems, and process vents are also being proposed under U.S. EPA’s technology review. Below is a summary of the proposed rule.

Controls to Address Risk

U.S. EPA is proposing that sources will be newly subject to CMAS if they own or operate a CMPU located at an area source of hazardous air pollutants (HAP) and:

- EtO is used as a feedstock at an individual concentration greater than 0.1% by weight;

- EtO is produced as a product of the CMPU;

- EtO is produced as a byproduct and is present in any liquid stream (process or waste) at a concentration of 1 ppmw or more; or

- EtO is produced as a byproduct and is present in any continuous or batch process vent at a concentration of 1 ppmv or more.

The table below presents the standards U.S. EPA is proposing to reduce emissions of EtO from CMAS facilities.

| For the Source Type Below: | That Contain the Following Amount of EtO: | Facilities Must Reduce EtO Emissions by: |

| Equipment Leaks | 0.1% by weight | Monitoring connectors and gas/vapor light liquid valves on a monthly basis using a leak definition of 100 ppmv with no skip period or delay of repair unless the equipment can be isolated such that it is no longer in EtO service; and

Monitoring pumps on a monthly basis using a leak definition of 500 ppmv with no delay of repair unless the equipment can be isolated such that it is no longer in EtO service. |

| Heat Exchange Systems | 0.1% by weight | Monitoring for leaks using the Modified El Paso Method first monthly for six months and then quarterly, and repairing leaks above the leak action level (6.2 ppmv as methane in the stripping gas) within 15 days with no delay of repair allowed. |

| Process Vents | Vents that contain 1 ppmv or more of EtO (uncontrolled) and when combined emit 5 lb/yr or more of EtO (uncontrolled) | Venting to a flare meeting the Refinery Sector Rule (40 CFR Part 63, Subpart CC) requirements; or

By venting to a control device that reduces EtO by 99.9% by weight or to a concentration of less than 1 ppmv or to less than 5 lb/yr for all combined process vents. |

| Storage Vessels | 0.1% by weight | |

| Wastewater | 1 ppmw | Reducing the concentration of EtO in the wastewater to less than 1 ppmw in accordance with the Group 1 wastewater treatment requirements under the HON.

Additionally, EPA is proposing to add provisions prohibiting the injection of wastewater, or water that contains or has contacted EtO into a heat exchange system. |

| Pressure Release Devices | 0.1% by weight |

|

| Pressure Vessels | 0.1% by weight, any capacity |

|

| Transfer Operations | Any transfer operation at the CMPU |

|

| Flares used to comply with process vent and storage vessel EtO control requirements or where leaks from equipment in EtO service are routed to a flare | Meeting the Refinery Sector Rule (40 CFR Part 63, Subpart CC) flare requirements at 40 CFR §§63.670 and 63.671. | |

In addition to the above proposed requirements to address risk from EtO emissions, U.S. EPA is also proposing a fenceline monitoring program for CMAS facilities that use, produce, store, or emit EtO by referencing the fenceline monitoring provisions for EtO from HON. Facilities would be required to place eight ambient air sampling canisters around their fencelines and potentially rotate the sampling locations for each sampling event based on the magnitude of the facility perimeter. Sampling events would be conducted every five days for a period of 24 hours. Facilities would be required to calculate the difference between the highest and lowest individual sample for each sampling event (known as “Δc”) and maintain their annual average Δc value below an action level of 0.2 micrograms of EtO per cubic meter (µg/m3). If the action level is exceeded, facilities would conduct a root cause analysis and implement corrective actions to reduce emissions if the source of the exceedance is under their control. The fenceline monitoring data would be electronically reported on a quarterly basis.

New GACT Standards Under CAA Section 112(d)(5)

U.S. EPA is also proposing the following new GACT standards pursuant to CAA Section 112(d)(5):

| Source Type | Proposed Rule Requirements |

| PRDs |

|

| Bypass Lines |

|

| Pressure Vessels |

|

Proposed Revisions from U.S. EPA’s CAA Section 112(d)(6) Technology Review

U.S. EPA also conducted a CAA Section 112(d)(6) technology review for CMAS. As indicated in the table below, U.S. EPA has proposed technology review-based changes for equipment leaks, heat exchange systems, and process vents; however, no potential changes were proposed for storage tanks, wastewater, flares, or fenceline monitoring (other than those for source in EtO service as described above).

| Source Type | Proposed Rule Requirements |

| Equipment Leaks |

|

| Heat Exchange Systems |

|

| Process Vents |

|

Other Proposed Changes

U.S. EPA is proposing several other changes in addition to the new GACT standards under CAA Section 112(d)(5) and technology review-based standards under CAA Section 112(d)(6). These include electronic reporting, removal of the affirmative defense provisions, repeat performance testing, and edits to address incorrect section references and minor editorial revisions.

For electronic reporting, facilities would be required to submit compliance status reports, performance test reports, flare management plans, and periodic reports (including fenceline monitoring reports) through U.S. EPA’s Central Data Exchange using the Compliance and Emissions Data Reporting Interface (CEDRI). Facilities would be required to submit results of performance testing using the Electronic Reporting Tool (ERT) and semiannual compliance reports would be submitted using U.S. EPA-developed reporting templates.

U.S. EPA is also proposing to remove the existing affirmative defense provisions consistent with a 2014 D.C. Circuit court case that vacated affirmative defense provisions for Portland cement kilns. In proposing to remove the provisions at 40 CFR §63.11501(e), U.S. EPA states that it may use its case-by-case enforcement discretion to provide flexibility in enforcement decisions.

Facilities are currently allowed to use engineering assessments and design evaluations to demonstrate compliance with process vent and storage tank emissions limits; however, U.S. EPA is proposing to remove that flexibility and instead require sources to conduct performance tests at least once every five years to demonstrate compliance with emissions limits.

U.S. EPA is also proposing several editorial edits and clarifications. The agency provides a list of these edits in the preamble to the proposed rule. The following is a list of notable revisions U.S. EPA is proposing:

- Removal of the provision at 40 CFR §63.11498(b) that exempts facilities from complying with the wastewater control requirements in Table 6 of the rule during periods of startup and shutdown.

- Addition of 40 CFR Part 60, Subparts VVa, VVb, IIIa, NNNa, and RRRa to the overlap provisions in 40 CFR §63.11500(b).

- Removal of the provisions that allow facilities to skip semiannual reporting for periods where certain events do not occur [40 CFR §63.11501(d)].

- Revisions to the definitions of “batch process vent, continuous process vent,” and “in organic HAP service,” to clarify that the specified HAP concentration cut-offs do not apply when evaluating whether vents, wastewater, equipment, and heat exchange systems are “in EtO service.”

Proposed Compliance Dates

U.S. EPA is proposing that facilities that are constructed or reconstructed before the rule’s proposal date would be required to comply with the requirements for control of EtO within two years of the final rule. Facilities would have three years to comply with all non-EtO related requirements. Facilities would be required to start collecting EtO fenceline monitoring data two years after the effective date of the final rule and begin conducting root cause analysis and performing corrective actions three years after the effective date. Sources that commenced construction or reconstruction after the proposal date would be required to comply with all provisions upon the effective date of the final rule, or upon startup, whichever is later.

Additional Chemicals and EtO Related Air Rules

U.S. EPA’s regulatory agenda indicates the agency will be addressing two additional air rules and one method related to chemicals and/or EtO.

U.S. EPA is expected to issue a proposed risk and technology review for Hospital Ethylene Oxide Sterilizers in the fall of this year and it will likely contain revised provisions in light of the revised EtO IRIS value, but the extent of those revisions will likely be foreshadowed by the new administration’s actions related to the SCOMI, PEPO, and CMAS rules.

U.S. EPA’s regulatory agenda also indicates that the agency plans to issue a final reconsideration rule for the Polyvinyl Chloride and Copolymers (PVC) NESHAP sometime this fall. U.S. EPA issued a proposed reconsideration rule in November of 2020, but since then, the agency has not taken the rule back up again. At issue are process vent and wastewater emissions limits, as well as requirements for storage vessels and PRD monitoring.

On a more straightforward note, U.S. EPA’s regulatory agenda indicates that the agency plans to revise U.S. EPA Method 325A/B (used for fenceline monitoring) to incorporate new uptake rates and sorbents consistent with the additional chemicals to which the method is applied under the fenceline monitoring program in the HON (i.e., chloroprene, 1,3-butadiene, and ethylene dichloride). The agenda indicates U.S. EPA plans to issue a proposal in February and a final rule in June.

Toxic Substances Control Act

Barring any major changes from the new administration, 2025 is also likely to be a significant year for activity related to the Toxic Substances Control Act (TSCA). On December 18, 2024, U.S. EPA began the risk evaluation step for five chemicals: vinyl chloride, acetaldehyde, acrylonitrile, benzenamine, and 4,4’-methylenebis(2-chloroaniline) (MBOCA). U.S. EPA also announced the prioritization process for the next five chemicals: benzene, ethylbenzene, naphthalene, styrene, and 4-tert-octylphenol. When a risk evaluation results in a finding of unreasonable risk, U.S. EPA then begins a risk management process that involves developing a rule to protect workers, consumers, and/or the environment from the identified risks. For example, in December 2024, U.S. EPA issued a final rule to ban all uses of trichloroethylene, ban all consumer uses and many commercial uses of perchloroethylene, and require worker protections for all remaining uses of perchloroethylene. They also finalized their technology review of the Perchloroethylene Dry Cleaning NESHAP with no changes in acknowledgement of the impending ban.

Since December, U.S. EPA has finalized TSCA risk evaluations from formaldehyde, diisodecyl phthalate (DIDP), and diisononyl phthalate (DINP). The agency found unreasonable risk for all three chemicals. U.S. EPA also recently released a draft scoping document for vinyl chloride.

Later this year, we expect to see proposed regulations for 1,4-dioxane formaldehyde following U.S. EPA’s late 2024 findings of unreasonable risk. We also expect to see proposed regulations for DIDP, DINP and final regulations for 1-bromopropane, and n-methylpyrrolidone (NMP) late this year.

For additional information, visit U.S. EPA’s Risk Management for Existing Chemicals under TSCA | US EPA and stay current with our “4 The Record” series for updates from our TSCA experts.

Moving Forward

ALL4 has already begun evaluating the impacts of the above-mentioned proposed rule changes for our clients that operate CMAS and PEPO sources. Additionally, ALL4 is assisting clients with their review and implementation of the SOCMI rule changes. We will be updating our clients and readers of our “4 The Record” series as these rules evolve. Updates will also be posted to our chemical industry resources page. If you have questions about any of the topics covered above or how ALL4 might be able to help your facility plan for and comply with evolving regulations, contact your ALL4 project manager or Philip Crawford at pcrawford@all4inc.com.

Environmental Justice Lookahead: Rollback of Environmental Justice at the Federal Level is Here

Environmental Justice (EJ) continued to be a cornerstone of the Biden administration in 2024, seeing the administration award nearly $2 billion in EJ and climate justice related funds to communities and award nearly $69 billion in funds towards environmental efforts in general. Additional EJ developments at the Federal level in 2024 included:

- Establishment of Technical Assistance Centers to provide assistance in developing and funding EJ projects.

- The repeated legal setbacks in the United States Environmental Protection Agency (U.S. EPA) use of Title VI of the Civil Rights Act to advance the Biden administration’s EJ agenda.

- The unveiling of the Environmental Justice Clearinghouse, a repository of EJ-related resources.

- Release of EJScreen Version 2.3, which included new environmental indicators, new map layers, and demographics data.

- U.S. EPA published the draft Interim Framework for Advancing Consideration of Cumulative Impacts.

- Release of Version 2.0 of the Climate and Economic Justice Screening Tool (CEJST)

- Development of pilot indicators of Environmental Health Disparities including Blood Lead Levels, Age-adjusted hypertension, population in counties meeting the PM5 National Ambient Air Quality Standards, Adverse Birth Outcomes, Childhood Asthma Prevalence, and Life Expectancy.

On the state and local front, states continued to develop their own EJ policies, mapping tools, and rulemaking where EJ is an integral part of the permitting process. Some of these included:

- Massachusetts Department of Environmental Protection (MassDEP) finalizing its rule to require cumulative impact assessments that examine 33 environmental, health, and socioeconomic indicators for existing environmental burden for air quality permitting projects near EJ communities.

- Release of the City of New York’s EJ Mapping Tool (EJNYC), that identifies disadvantaged communities (DAC) within New York City.

- The City of Chicago unveiled the city’s first cumulative impact assessment report that identifies the city’s goals, process, findings, and recommendations.

- Colorado undertaking a rulemaking process to require cumulative impact assessments to advance EJ within the state.

- Michigan Department of Environment, Great Lakes and Energy (EGLE) signing an agreement with U.S. EPA under Title VI of the Civil Rights Act to require all hazardous waste permit applicants to perform EJ analyses.

Administration Change and Things to Look for in 2025

Day one of President Trump’s administration saw three executive orders (EO) aimed at rolling back EJ requirements. The first EO, entitled “Initial Rescissions of Harmful Executive Orders and Actions” completely rescinded Biden’s Executive Order 14096, Revitalizing Our Nation’s Commitment to Environmental Justice for All, and EO 14008, Tackling the Climate Crisis at Home and Abroad. EO 14096 created the White House Office of Environmental Justice that was responsible for coordinating EJ efforts across the federal government. EO 14096 also was paving the way for creating a more unified approach for how federal agencies would consider EJ in their review of permits and other federal actions. EO 14008 established the Justice40 initiative that required 40% of the overall benefits of certain Federal investments be in disadvantaged communities. Trump’s EO revoked both of the Biden EO’s effective immediately.

A second Trump EO, Ending Radical and Wasteful Government DEI Program and Preferencing, results in the following impacts to EJ at the federal level:

- Terminates all EJ offices and positions.

- Requires a list to be submitted to the Office of Management and Budget (OMB) of agency or department EJ positions and programs in existence on November 4th, 2024, and an assessment whether these positions or programs have been relabeled to preserve their pre-November 4th function.

- Requires a list to be submitted to OMB of all Federal grantees who received federal funding to advance EJ programs, services, or activities since January 20, 2021.

- Directs each deputy agency or department head to assess the operational impact (i.e., cost) of EJ programs and policies.

- Requires that OMB convene a monthly meeting to hear reports from all deputy agency or department heads on the prevalence and the economic and social costs of EJ programs.

In a third Trump EO, Unleashing American Energy, Trump terminated the Green New Deal, the program that was responsible for distributing funds appropriated through the Inflation Reduction Act (IRA), which was being used to provide funding to carry out environmental and climate justice activities to benefit underserved and overburdened communities.

With all these day one actions, we can expect federal involvement in EJ related activities to come to a screeching halt. On Tuesday January 21, 2025 the Office of Personnel Management (OPM) directed heads of all U.S. agencies to end diversity programs, and place federal Diversity, Equity, Inclusion, and Accessibility (DEIA) staff on paid leave, effective by 5 pm Wednesday January 22, 2025 and to take down all outward facing media (websites, social media accounts, etc.). The same memo set deadlines of Thursday January 23rd to compile lists of DEIA offices and employees as of November 5, 2024, and a deadline of a plan for a reduction in force action for employees who work in DEIA offices by January 31, 2025.

Based on the above executive orders, and the OPM memo, at the federal level we can expect:

- The messaging around EJ to significantly decline.

- Support/updates for tools like EJScreen, ECHO Clean Air Tracking Tool (ECATT) tool to be greatly reduced and the potential for these tools to be completely taken off-line.

- CEJEST has already been taken offline.

- Funding for support of EJ-related programs to be withdrawn or cancelled.

- No progress on the cumulative impacts assessment framework.

However, we should continue to see EJ-related requirements for state permitting matters essentially unchanged in states where there is already a process established. One area to watch is around the data availability associated with tools like EJScreen, which many state agencies rely upon for their own analyses supporting EJ and the extent to which the Trump administration attempts to claw back funds awarded under the IRA.

Conclusions

There are lots of developments in the EJ world with things changing literally from moment to moment. While it appears that the federal government will retreat from EJ-related activities for the time being, EJ activities at the state level will continue. ALL4 will continue to follow EJ activity at both the state and federal level and can help you navigate EJ concerns and strategize around appropriate EJ approaches given the regulatory uncertainty. For more information, please contact Joe Sabato.

Connecticut’s IGP: Public Comment & Summary of Changes for 2nd Draft Permit

The Connecticut Department of Energy and Environmental Protection (DEEP) Water Permitting and Enforcement Division (WPED) is in the process of reissuing their National Pollutant Discharge Elimination System (NPDES) industrial stormwater general permit (IGP), a general permit that follows the multi-sector format of the United States Environmental Protection Agency’s (U.S. EPA) 2021 national industrial stormwater permit (MSGP). The original 45-day public comment for the reissuance began on March 11, 2024, ahead of the current permit’s expiration date on September 30, 2024.

As discussed in an earlier ALL4 blog, the proposed IGP contains more substantive changes than the previous re-issuances in 2016 and 2021. During the 45-day comment period, WPED received over 100 comments from various groups and U.S. EPA Region 1 on the proposed IGP. As a result of those comments, an updated draft IGP has been issued for a 30-day public comment period beginning on December 30, 2024.

Summary of Changes to the December 2024 IGP:

- Additional documentation has been added in Appendix H to include a flow chart providing guidance for semiannual benchmark monitoring and corrective actions, spanning from July 2025 to June 2030 to assist permittees in determining if a corrective action is required and when sampling is complete.

- Clarifications to Sector C (Chemical and Allied Products Manufacturing and Refining) and Sector O (Steam Electric Power Generation) for stormwater and non-stormwater discharge authorizations and prohibitions. The updated draft includes updated prohibitions to Sector C for runoff from phosphate fertilizer manufacturing coming into contact with storm water and discharges from coal storage piles at steam electric generating facilities for Sector O.

- Additional Control Measures updates to Sector Q (Water Transportation) and Sector R (Ship and Boat Building and Repair Yards) for minimizing the release or discharge of propylene glycol.

- Updates to the schedule for monitoring and data reporting for sector-specific federally required Effluent Limitation Guidelines.

- Sector AF (Federal, State, or Municipal Fleet Facilities) was modified for Sector-Specific Monitoring Requirements to include Federal, State, or Municipal Facilities without Vehicle Maintenance and Repair requirements. Permittees for facilities that do not conduct vehicle repair and maintenance on-site must review the Storm Water Pollution Prevention Plan (SWPPP) and existing stormwater control measures if for any parameter sampled the value is above the benchmark but is less than two times greater than the benchmark threshold or if the value is equal to or greater than two times the benchmark. Upon review of the SWPPP and stormwater control measures, the permittee must implement additional measures to help reduce the parameter exceedance for both exceedance types. When a parameter value exceedance is greater than or equal to two times the benchmark, additional sampling is required following the implementation of additional control measures to demonstrate effectiveness.

What Actions Do You Need to Take?

Additional information concerning the registration and renewal process will be posted by DEEP, however renewal registrations are not yet required at the time of this publication and should not be submitted. Facilities with existing permit coverage under the October 1, 2021, IGP will continue to have permit coverage under this general permit until DEEP has reissued the IGP. Following the issuance of the draft IGP, permittees will have 120 calendar days to renew their facility’s coverage under the general permit. Permittees should review the draft December 2024 IGP to familiarize themselves with sector specific changes and permit condition updates during this current 30-day public comment period.

If you have any questions regarding the draft December 2024 IGP updates or what your next steps should be to prepare for the issuance of the IGP, please reach out to me at cnagel@all4inc.com. ALL4 will continue to track updates to the IGP, and we are here to help with any actions your facility may need to take.

U.S. Power Sector: Looking Ahead to 2025

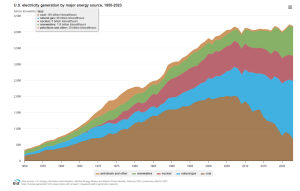

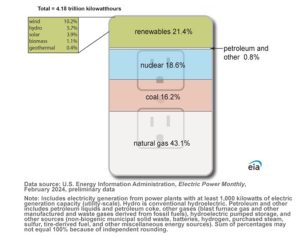

The power sector in the United States is poised to change significantly in the next 25 years. The rate of power generation has remained relatively flat over the past 20 years, largely due to the wide scale deployment of residential rooftop solar panels and widespread improvements in energy efficiency (Figure 1), and since 2019, the U.S. has produced more electricity than it has consumed. This relatively static need for capacity has eased the process of retiring older fossil fuel plants and replacing them with newer, more efficient plants and renewable energy generation. In fact, by 2023, the contribution of renewables of all types to the U.S. power mix was more than the contribution from coal-fired power generation or nuclear power generation (Figure 2).

Figure 1: Electricity Generation by Major Source, 1950-2023

Figure 2: U.S. Electricity Generation by Source Type, 2023

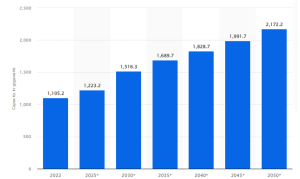

The days of static power demand growth are over, with the anticipated generated capacity needs expected to nearly double by 2050 (Figure 3). To accommodate this massive power demand growth, the United States will need to rapidly deploy new power generation facilities of all types: natural gas-fired plants, solar, wind, hydro, and potentially nuclear. Here at ALL4 we’re already seeing this shift as our partners in the power sector are actively considering new facilities and expansions at existing plants across the country.

Figure 3: Projected Power Sector Capacity 2022-2050 (GW)’

The primary drivers of power demand growth are the explosive growth of data centers, the increased energy needs to power electric vehicles (EVs), and the energy needs associated with the use of Artificial Intelligence (AI) in all aspects of computing. AI searches, while incredibly powerful, require as much as 10 times the electricity of a typical non-AI search using one of the common search engines.

No one solution will be enough to meet the projected capacity needs. Rather, it will be a mix of new fossil fuel-fired capacity in the form of natural gas (and potentially hydrogen), continued expansion of utility scale wind and solar power plants along with battery storage at a utility scale, and the continued development of small modular nuclear reactors (SMR). Various programs, including environmental justice initiatives in many areas, have increased public awareness of energy development projects resulting in skepticism and sometimes open hostility to expansion and even repowering projects. Developers will need to use effective communication and engage the local communities around the projects to alleviate concerns and avoid project delays.

Regulatory Environment in 2025

The trend over the past twenty years, though dependent on which administration was in power, has been an increase in regulatory oversight, especially in the case of fossil-fuel plants. On the air side, this includes regulating emissions of regulated new source review (NSR) pollutants, hazardous air pollutants (HAP), and greenhouse gases (GHG). New non-air rules were also passed related to wastewater emissions and coal-ash, specifically targeting the coal-fired power industry. ALL4 anticipates that the Trump administration will be far less active in terms of regulatory action, and many currently proposed rules, or rules that were finalized during the Congressional Review Act (CRA) period (after August 16, 2024), are likely to be stayed, delayed or weakened. The rules that we are watching in 2025 are highlighted below:

- U.S. EPA issued a new set of Effluent Limitation Guidelines (ELG), managing wastewater discharge from coal-fired power plants, in April.

- The Biden administration proposed a federal coal combustion residual (CCR) permitting rule in May, 2024, but never finalized it, and it now appears it may never be finalized. Meanwhile, several states have petitioned to manage their own CCR permitting rules and are in various stages of approval.

- Standards of Performance for New Stationary Sources (NSPS) for Greenhouse Gas Emissions From New, Modified, and Reconstructed Fossil Fuel-Fired Electric Generating Units: 40 CFR Part 60, Subpart TTTTa was finalized in April 2024 and the U.S. EPA recently denied all petitions to stay the rule. However, ALL4 anticipates that the new administration may move quickly to reverse or revise the rule. Emissions Guidelines for GHG emissions from coal-fired plants that do not plan to permanently shut down by January 1, 2032, were also finalized last spring under Subpart UUUUb. U.S. EPA said at the time that they were further considering emissions guidelines for combustion turbines, but such a rule is not likely to be a priority under this administration.

- An updated NSPS for Stationary Combustion Turbines (Subpart KKKKa) was proposed in December 2024. As I discussed in my blog on the topic, the proposed rule would define post-combustion selective catalytic reduction (SCR) as the best system of emissions reduction (BSER) for most base-loaded combustion turbines and set the nitrogen oxides (NOx) emissions limit for natural gas-fired turbines to 3 ppm. Because most newer large gas-fired combustion turbines already use SCR and are typically limited to more stringent NOx emissions rates through best available control technology (BACT) or lowest achievable emissions rate (LAER) requirements, the proposed Subpart KKKKa standards for these units could be finalized with minor revisions. Aside from the proposed limits for large turbines, there are other proposal provisions that may merit comment and may be revised. The rule is required to be finalized by November 2025 in accordance with a consent decree.

- Revisions to the revised National Emissions Standard for Hazardous Air Pollutants (NESHAP) for Stationary Combustion Turbines (Subpart YYYY) are expected to be proposed in mid-2025. There is no regulatory deadline for this update, but it is in response to a petition for reconsideration on the 2020 Risk and Technology Review (RTR) and U.S. EPA has to “gap fill” because there are types of turbines that are not currently subject to standards.

Additional ongoing regulatory issues that are of concern to the power sector include: The Good Neighbor Plan (currently stayed), the next Regional Haze Rule planning period, and the Mercury and Air Toxics Standards (MATS).

ALL4 will continue to track developments in regulatory and technical requirements related to the power sector in an era of expanding demand growth. ALL4 has significant power sector experience related to permitting and compliance for electricity-generating facilities of all fuel types combined with established working relationships with numerous state agencies and U.S. EPA. ALL4 provides a full range of environmental health and safety (EHS) and data services to our clients to help them meet their permitting, monitoring, testing, recordkeeping, and reporting challenges. If you’d like to learn more about our capabilities in the power sector, please contact Rich Hamel or your ALL4 project manager.

2025 Lookahead: Resiliency Planning in Stormwater

Executive Summary

U.S. EPA defines “resilience” as “the ability to prepare for, withstand, and successfully recover from a disaster.” In 2021, U.S. EPA renewed its National Pollutant Discharge Elimination System (NPDES) Multi-Sector General Permit (MSGP) for Stormwater Discharges Associated with Industrial Activity, and the renewed permit included requiring subject facilities to consider implementing structural improvements, enhanced/resilient pollution prevention measures, and other mitigation measures to minimize impacts of stormwater discharges from major storm events such as hurricanes, storm surge, extreme precipitation, and flood events (i.e. more extreme weather as a function of climate change). Subject facilities were required to document any such existing control measures in their Stormwater Pollution Prevention Plan (SWPPP) and to consider additional measures. While the U.S. EPA MSGP applies only in areas and classes of discharge that are outside of the scope of a state’s NPDES program authorization, (see Appendix C to the for a list) in 2024, states renewing their own MSGPs have adopted similar requirements, and we expect this trend to continue into 2025.

Article

Though the vast majority of industrial facilities in the United States with stormwater discharge maintain stormwater permit coverage issued by their State, the United States Environmental Protection Agency (U.S. EPA) Multi-Sector General Permit (MSGP) serves as a guide to states when it is time to renew their own permits (every five years). While many states issue one MSGP, some states, such as Alabama, New Jersey and North Carolina, issue multiple general permits specific to individual industry categories.

Multiple states renewed their own MSGP in 2024, including Rhode Island, which followed U.S. EPA’s lead in adding resiliency planning requirements to their permit. Connecticut also issued a draft MSGP with very similar requirements (a second draft Connecticut MSGP is now out for public comment and still contains resiliency planning requirements). The resiliency planning requirements in U.S. EPA and Connecticut MSGPs do not require facilities to implement prescriptive additional stormwater control measures (Rhode Island’s MSGP does state that facilities “must implement” measures), but facilities must document existing measures in their SWPPP as well as “considerations made to select and design control measures…to minimize pollutants discharged via stormwater” (2021 U.S. EPA MSGP), including (emphasis added):

- Reinforce materials storage structures to withstand flooding and additional exertion of force;

- Prevent floating of semi-stationary structures by elevating to the Base Flood Elevation (BFE) level or securing with a non-corrosive device;

- Delaying delivery of exposed materials when a storm is expected or store materials as appropriate;

- Temporarily store materials and waste above the BFE level;

- Temporarily reduce or eliminate outdoor storage;

- Temporarily relocate any mobile vehicles and equipment to higher ground;

- Develop emergency procedures for major storms and conduct training.

States with stormwater general permits set to expire and/or expected to be renewed in 2025 include Alaska, Minnesota, Mississippi, North Dakota, Tennessee, Vermont (expired 7/12/24, draft issued), and Wisconsin. In renewing their permits, these states may adopt similar provisions regarding resiliency as the 2021 U.S. EPA MSGP.

If this weren’t enough, in December 2024, U.S. EPA issued a proposed 2026 MSGP for public comment (public comment period ends on February 11, 2025). Among other changes, the proposed 2026 MSGP includes even more onerous and robust revisions to the consideration of stormwater control measure enhancements for major storm events, including:

- New considerations based on whether a facility has been exposed to major storm events under “current conditions” (defined as the 100-year flood) or may be exposed to major storm and flood events based on best available data;

- Removing the word “temporarily” from considerations pertaining to storing materials and waste above the BFE level, reducing or eliminating outdoor storage, and relocating mobile vehicles and equipment to higher ground;

- Changing references to “base flood elevation” to “flood level,” with a definition;

- Adding a control measure to identify emergency contacts for staff and contractors, and;

- Adding several definitions including: