Waste Emissions Charge for Petroleum and Natural Gas Systems Rule

On January 26, 2024, the U.S. Environmental Protection Agency (U.S. EPA) proposed the “Waste Emissions Charge for Petroleum and Natural Gas Systems Rule,” otherwise known as the methane fee rule or “Waste Emissions Charge” rule (89 FR 5318). As part of the Inflation Reduction Act, Congress added Section 136 to the Clean Air Act (CAA), which directs U.S. EPA to collect a waste emissions charge (WEC) on excess methane emissions from petroleum and natural gas facilities. The program applies to facilities subject to the Greenhouse Gas Reporting Program (GHGRP) (40 CFR Part 98, Subpart W) that report emissions of more than 25,000 metric tons (mt) of carbon dioxide equivalents (CO2e) per year.

All segments under Subpart W are subject to the WEC except for distribution. Facilities that emit methane over the facility-specific waste emissions threshold would be required to pay a fee for those excess emissions. Reporting would start next year (2025) and for reporting year 2024 the fee is $900 per mt of methane. The fee increases to $1,200 per mt in 2025 and $1,500 per mt in 2026 and thereafter. The WEC fees would be calculated and paid by March 31 of each year and any revisions to reporting would be due by November 1. Late payments would be subject to interest and facilities filing late would be assessed a daily penalty.

In conjunction with this proposal, U.S. EPA has either proposed or finalized changes to other related rules. These include 40 CFR Part 98, Subpart W, and the Standards of Performance for New Stationary Sources (NSPS) and Emissions Guidelines (EG) for the oil and natural gas source category. On August 1, 2023, U.S EPA proposed changes to Subpart W to add “other large release events” as a new reportable emissions source. U.S. EPA also proposed several changes to emissions calculation methodologies and emissions reporting requirements to align with the objectives of the WEC rule.

When Congress developed CAA Section 136, they referenced U.S. EPA’s November 15, 2021 proposed rulemaking for 40 CFR Part 60, Subparts OOOOb and OOOOc. Subsequently, U.S. EPA issued a supplemental proposal for those rules on December 6, 2022, and issued pre-publication versions of the final rules on December 2, 2023, which have yet to be published in the Federal Register. New standards for “super-emitter” events related to large methane releases from (or near) oil and gas facilities are addressed in 40 CFR Part 60, Subpart OOOOb under §60.5371b. U.S. EPA expects that facilities in compliance with the final OOOOb and OOOOc rules would not incur charges under the WEC rule or would eventually be exempt as described later in this article.

Waste Emissions Thresholds

The proposed waste emissions thresholds were established by congress and are formatted as a percentage of the total natural gas or oil throughput of the facility. The WEC only applies to the methane emissions that exceed the waste emissions threshold calculated using these percentages. The thresholds vary by industry segment and are summarized in the table below:

| Industry Segment | Methane Intensity |

| Onshore petroleum and natural gas production | 0.20 percent of natural gas sent to sale from facility; or 10 mt of methane per million barrels of oil sent to sale from facility, if facility sends no natural gas to sale |

| Offshore petroleum and natural gas production | |

| Onshore petroleum and natural gas gathering and boosting | 0.05 percent of natural gas sent to sale from or through facility |

| Onshore natural gas processing | |

| Onshore natural gas transmissions/compression | 0.11 percent of natural gas sent to sale from or through facility |

| Onshore natural gas transmission pipeline | |

| Underground natural gas storage | |

| LNG import and export equipment | 0.05 percent of natural gas sent to sale from or through facility |

| LNG storage |

Certain gathering and boosting and natural gas processing industry segments may have zero throughput values because these facilities either receive no natural gas, or process or dispose of natural gas received in a manner that results in sending zero quantities of natural gas to sale. U.S. EPA provides a few examples of these facilities including gathering and boosting stations that receive natural gas and reinject it underground and fractionation plants that only receive and process natural gas liquids. In these cases, U.S. EPA proposes that all reported methane emissions would, by default, exceed the threshold. U.S. EPA is requesting comment on this approach, and an alternative approach that would consider all reported emissions below the waste emissions threshold.

Facility Methane Emissions, Facility WEC Calculation, and Netting

After calculating a facility’s waste emissions threshold, an owner and operator would then calculate their “facility applicable emissions” by subtracting the waste emissions threshold from the total methane emissions reported under Subpart W for the facility. Any emissions value greater than zero is then considered the “facility applicable emissions.” Any exemptions, as described herein, are then subtracted from the facility applicable emissions to calculate the “WEC applicable emissions.”

Facilities under common control across all applicable industry segments would then be allowed to net their WEC applicable emissions, adding together the positive and negative WEC applicable emissions calculated in the previous step. Any net emissions above zero are then multiplied by the $/mt charge to calculate the WEC obligated party’s total WEC, or WEC obligation. In the preamble to the proposed rule, U.S. EPA provides insight into its interpretation of CAA Section 136 for establishing concepts of “common ownership or control for netting of emissions,” which facilities are eligible for netting, and what emissions may be considered in the netting process. Some of the key points from this discussion are:

- The “owner or operator” for purposes of common control is the “owner or operator” reported under Subpart W at 40 CFR §98.4(i)(3);

- Only facilities that have Subpart W emissions greater than 25,000 mt CO2e are eligible for netting; and

- Facilities that receive the regulatory compliance exemption are not eligible for netting (because they would have zero WEC applicable emissions).

Verification

U.S. EPA proposes to verify WEC filings using information submitted with the WEC filing, 40 CFR Part 98 reports, other credible evidence, and audits of facilities, potentially at the expense of the auditee. The verification process would overlap with the Subpart W verification process because much of the data submitted under Subpart W underpins the WEC filing. Respondents would be required to resubmit their filing within 45 days of being contacted by U.S. EPA or from self-discovery of a substantial error, with possible extensions of up to 30 days. Furthermore, resubmission of a Subpart W report would require updating the WEC filing, up until November 1.

Exemptions

CAA Section 136 provides three exemptions to lower applicable fees or avoid the fees entirely. These exemptions include:

- Production segment emissions resulting from unreasonable delays in permitting gathering or transmission infrastructure necessary for offtake of increased volume as a result of methane emissions mitigation implementation;

- Emissions that are in compliance with the final emissions requirements under CAA Sections 111(b) and (d) (i.e., the NSPS and EG) – considering several caveats as described below; and

- Emissions from wells that are permanently shut in and plugged.

U.S. EPA provides criteria and their justification for what constitutes an “unreasonable delay” in permitting of gathering or transmission infrastructure related to the first exemption. Those criteria include:

- Facility emissions must exceed the waste emissions threshold;

- The entity seeking exemption and the entity seeking the permit must not contribute to the permitting delay;

- The exempted emissions are only those from flaring gas (in accordance with all applicable regulations) that would have been mitigated without the delay; and

- A period of 30 to 42 months (to be specified in the final rule) must have passed since the relevant permit application was considered complete.

U.S. EPA expects sites seeking this exemption could include oil production sites planning to send gas to sale instead of flaring and sites that produce natural gas, condensate, or natural gas liquids that expand operations and must flare gas because no pipeline is available.

U.S. EPA also discusses details related to the regulatory exemptions. The key points from U.S. EPA’s discussion include:

- The exemption would not become available until the Administrator determines that the final NSPS Subpart OOOOb and all EG Subpart OOOOc-implementing state and Federal plans are approved and in effect (this could take several years);

- The exemption would also not become available until the Administrator determines that the emissions reductions achieved by the final requirements are at or above the level that would have been achieved by the NSPS Subpart OOOOb/EG Subpart OOOOc 2021 proposal;

- A “Subpart W facility” would be able to claim the exemption for all facility emissions (not just those covered by the NSPS and EG requirements) if all the CAA Section 111(b) and/or (d) “facilities” or sources at the facility are in compliance (no deviations or violations in the reporting year) with the applicable CAA Section 111 requirements.

It’s important to note that U.S. EPA would be required to make the determinations in items 1 and 2 above before any facilities could claim the regulatory exemption.

For the plugged well exemption, only those emissions above the waste emissions threshold would be considered for exemption. The well would be required to be permanently shut-in and plugged with a metal plate or cap, and in accordance with all Federal, state, and local requirements for closure (with the exception of notifications, reporting, or site remediation). The emissions eligible for exemption would be those that occur at the well level, including wellhead equipment leaks, liquids unloading, and workovers in the reporting year in which the well was plugged.

Wrap-Up

Comments on the proposed rule were originally due by March 11th, but U.S. EPA recently extended the comment period to March 26, 2024. We expect that U.S. EPA will receive a substantial number of comments on the proposal related to clarification of applicability, the proposed definitions for facilities, and overlap with other oil and gas regulations.

U.S. EPA is hosting several webinars on the proposed rule, and the next event occurs on March 5th. If you have questions regarding the proposed rule, we recommend checking out the U.S. EPA webinars, and then reaching out to your ALL4 project manager to understand how we can help you navigate the upcoming requirements.

Considerations when selecting an EHS MIS tool

Management information systems (MIS) are used for the coordination, communication, and analysis of information in an organization. There are multiple software solutions out on the market and the MIS selection process for Environmental Health and Safety (EHS) compliance systems can be daunting, but leveraging objective data in the selection process can help ensure the decision is the right one for both the organization and the end users. It can also unearth important requirements that an organization may have been unaware of. Finding the right organizational fit and high user adoption is the goal.

Leveraging Market Data in the Selection Process

Using data to support the selection process can ensure the decision is robust. The difficulty is deciding what data to use, especially when solution demos or previous experience with a tool might be the only data point an organization may have prior to implementation. Subjective data collected from exciting solution demos, aversion to known systems, emotional attachment, or political factors can skew the decision-making process.

The selection process can be data driven by scoring different vendor modules against an organization’s goals. By using market research tools like the Verdantix, Green Quadrant: EHS Software 2023 report, we can leverage data on the strengths of the vendor down to specific modules, which can be adjusted to fit the organization making the selection.

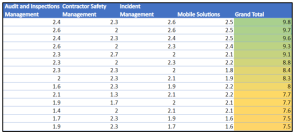

Table 1

ALL4 Dynamic Selection Analysis

Source: Data from Green Quadrant: EHS Software 2021, 26 January 2021. Table created by ALL4.

Determining the Right Fit for the Organization

The MIS tool needs to be as closely aligned as possible with business processes in the organization. This can help ensure quality data and organizational adoption. Additional organizational considerations include:

- Variety of tools

- If a software vendor offers a suite of five tools and four of the five tools align well with organizational processes, it may be the best overall option.

- Planning for tools that are vital to implement now, and those that can be planned for in the future.

- Grouping the tools implemented in the most efficient way.

- Configurability

- How configurable the software is will be a major consideration impacting the implementation; if the organizational process is complex, configurability may be key in matching the software to intended use.

- If the organization is amenable to adapting or updating their process to be more closely aligned with a tool, that may impact which tools are available to select.

To find out more about the different tiers of digital solutions see the 4TR article.

Determining the Right Fit for the User

When selecting an MIS tool another major consideration is how well the system fits the end user in the organization. Simplicity in user interface and user experience is usually the best option and can have a significant role in user adoption. Additional user considerations include:

- Ease of use

- Availability of mobile applications.

- Planning for user roles that are in the system frequently compared to those rarely in the system.

- Human-computer interaction; optimizing the tool for users with accessibility needs such as color-blindness or different levels of technological experience and comfort.

- Ease of maintainability by administrators

- Allowing business administrators to help manage the system can be a benefit to the organization, while the IT team can support with best practices.

- The business users may understand their data needs better than the software vendor or an IT team.

- User experience issues may be more rapidly addressed by business administrators rather than having to work with the vendor or an IT team.

- Allowing business administrators to help manage the system can be a benefit to the organization, while the IT team can support with best practices.

Conclusion

An MIS tool can improve processes and save users time, however, selecting the tool that best fits the organization and the user is difficult. By using requirements analysis tools that leverage market data we can help ensure the right tool for both users and the organization is selected. We have built requirements analysis and selection tools that incorporate this dynamic analysis to make the selection process clearer and help simplify the decision-making process for organizations by tailoring the tool to their organization.

ALL4’s Digital Solutions Practice has extensive experience helping clients scope, select, implement, maintain, and upgrade various types of digital tools. If you would like to discuss a digital solution for your company, please contact Noah Zetocha at nzetocha@all4inc.com or 402-853-2538.

Legacy Data Migration Planning and Approach

What is Legacy Data Migration and Why is it Needed?

Legacy Data Migration is the process of moving data from one storage system to another. As companies move systems such as from a home-grown system to a Commercial Off-the-Shelf software (COTS) or from one COTS to another, there is a desire to move legacy data from the older application into the new application. Data may have to be moved out of older systems for various reasons such as decommissioning of the old system, to enhance performance, to reduce upkeep of multiple systems, and for application consolidation.

Legacy Data Migration Planning

Legacy Data Migration is often time consuming and expensive. As data becomes more complex, you may need to spend more time preparing, transforming, and cleansing data for import into the new system. Legacy data migration planning includes identifying business rules to help focus your efforts on making sure only the legacy data you need is moved to your new system. These business rules can be factors such as regulatory reporting requirements, company record retention policies, data importance, and Key Performance Indicators (KPIs) trending and analysis over time. The data not being migrated into the new system can still be preserved by storing it in database tables, Excel spreadsheets, or PDF extracts of reports on a network drive or a central location such as SharePoint, in case it needs to be reviewed later or for trending and analysis using Business Intelligence Tools such as Microsoft Power BI or Tableau.

Legacy Data Migration Approach (Extract, Transform, Load)

ALL4 follows the ETL (Extract, Transform, and Load) approach for legacy data migration.

Extract – Once business rules are established for the data to be migrated and what information (fields) must be extracted from the legacy system are determined, mapping is developed between the legacy tables/fields and the destination system tables/fields to ensure everything has a home in the system. Data is usually extracted in Excel spreadsheets or delimited text files to load into the new system.

Transform – Business rules will guide the transformation and cleansing of data. Transformation may be required for multiple reasons, some of which are:

- The new system could have different options or nomenclature for choice lists than the legacy system.

- There could be legacy data that does not have a one-to-one match in the new system, but the data has to be preserved for reference.

- There may be required data in the new system not previously required in the legacy system.

- The legacy system may have records such as Corrective Actions or Tasks associated with an employee who is no longer with the company, but the information has to be preserved without creating the inactive employee records in the new system.

Once the transformation rules are established, procedures should be developed to apply rules as uniformly as possible. In some cases, it may not be possible to apply the transformation rules programmatically and manual intervention may be required. The end result of this step is fully populated import templates that can easily be loaded into the new system.

The transformation process may include cleanup of data quality issues often encountered with older data.

Load – A small subset of data should first be loaded into a TEST environment to confirm data is being imported correctly and appears in the correct locations in the application. This allows errors to be caught early and corrected for proper loading in the system. After data is successfully loaded into the TEST environment, data can be imported into the production environment. Data checks are done on the imported data by comparing the record counts in the import templates with the uploaded record counts. Thorough testing should be done to make sure all the data is migrated and correctly appears in the application and reports.

Depending on the volume of data and the implementation schedule for the new system, the ETL process may have to be done multiple times. If the legacy system is still online when the initial data set is extracted, a delta extraction, transformation, and load will have to be done either during a blackout period right before the Go Live of the new system or post cutover to the new system.

Summary

Legacy Data Migration is a critical task and can be very involved, but proper preparation, planning, and execution can reduce costs and headaches. A well-thought-out strategy will help your new system be a success and improve adoption of the new system by internal stakeholders.

ALL4’s Digital Solutions Practice has extensive experience helping clients with legacy data migration. Our team can help in developing the strategy and performing the legacy data migration. If you would like to discuss further, please contact Anubha Garg at agarg@all4inc.com or 281-201-1245.

Industrial Stormwater Applicants Dodged the PFAS Bullet… Industrial Wastewater Not So Lucky

In December 2023, PA Department of Environmental Protection (PADEP) updated its National Pollutant Discharge Elimination System (NPDES) Individual Industrial Wastewater permit application process, and PFAS (per- and polyfluoroalkyl substances) are now included as required pollutants to be sampled. These emerging contaminants, found in cleaning products, firefighting foams, industrial coatings, and more have been raising eyebrows due to their environmental persistence and potential health risks, and PADEP is taking action.

What has changed?

- Individual Wastewater Permit Applications are now required to include analysis for four PFAS compounds as part of Pollutant Group 1 testing. These include Perfluorooctanoic acid (PFOA), Perfluorooctanesulfonic acid (PFOS) Perfluorobutanesulfonic acid (PFBS), and Hexafluoropropylene oxide dimer acid (HFPO-DA). This is a noteworthy change, not just because PFAS was added, but that PFAS was added to Pollutant Group 1, meaning that all industrial categories are subject to PFAS testing. So, wastewater discharges did NOT dodge the PFAS bullet.

- Module 1 of the Individual Wastewater Permit Application, which is used to obtain Industrial Stormwater coverage, now includes a question about whether aqueous film-forming foam (AFFF) containing PFAS are used at the facility. The inference here is that, if the applicant checks “Yes,” PFAS analysis is required for the stormwater sampling as well. So, applicants seeking industrial stormwater coverage via the Individual Wastewater permitting process also dodged the PFAS bullet, but only if PFAS-containing AFFF is not used.

Why should you care?

- Compliance is crucial: Missing the new PFAS testing requirements will certainly result in delays or even denial of your permit application.

- Other Industrial Stormwater Permit Applications: Industrial stormwater coverage can also be obtained via PADEP’s General Permit (PAG-03) or an individual industrial stormwater permit (or exemption via No Exposure). PADEP has not published and has not given any indications that PFAS testing will be added to any of these other NPDES Industrial Stormwater permit applications, so applicants seeking industrial stormwater coverage via these mechanisms have also dodged the PFAS bullet.

- Sampling: Specific methods, standards, and procedures for sampling PFAS are ever evolving. Keeping up with sampling guidelines such as this technical brief from U.S. EPA increases the integrity of your PFAS sample results.

Need Help?

ALL4 is continuing to monitor developments related to Individual NPDES permits and will be providing timely updates as they become available. For more information regarding this or other topics related to stormwater and wastewater, keep an eye out for any future ALL4 articles, or contact Kyle Costello of ALL4 at kcostello@all4inc.com or Evan Mia at emia@all4inc.com.

So – You Failed a RATA, Now What?

What’s a RATA?

A RATA is a Relative Accuracy Test Audit, and it’s typically performed as an annual audit on a continuous emissions monitoring system (CEMS). A third party brings an independently certified CEMS and hooks it up to your stack, and then you collect data at the same time and compare results between CEMS. They need to be within a certain threshold – a relative accuracy (RA) – to pass. If you don’t pass, then your CEMS is “out of control” and not gathering valid data from the hour that the RATA failed until the hour that you successfully pass a RATA.

You’ve scheduled your RATA, but it’s not going well.

The stack testers have mobilized and spent time setting up their equipment on the stack. They’ve spent hours collecting data, and it’s looking grim. Your relative accuracy has been outside the bounds of where it needs to be for a few runs, and It’s looking like your RATA is going to fail. It’s getting dark and late, troubleshooting efforts aren’t going well, and the stack testers can’t continue. What do you do?

Should I abort my RATA?

Well – maybe, but probably not. You may be considering aborting the RATA to avert a failure, but depending on your applicable Federal and State Regulations, aborting a RATA might not actually spare you from your data being considered out-of-control. 40 CFR Part 75, for example, considers an aborted RATA as if it were failed. If you have reasonable confidence that the system will get within the acceptable relative accuracy in more runs, then it makes sense to keep going. If not – well, then it might be time to abort and look to the next steps. Aborting a RATA can be seen as evasive by environmental agencies, especially if there are not explicit rules regarding how to handle an aborted RATA. Most states have guidance around the issue, and generally, if the data is suspect enough to consider aborting the RATA, then the data collected during the RATA should be invalidated and investigated. While not all applicable regulations address how data are to be handled during these times, most states require invalidation of tests results. The next sections will assume that the RATA failed, or it was aborted and your CEMS is now considered to be out-of-control.

So, I failed my RATA. What now?

The first thing you should do is notify your respective administrator or agency. If someone from the agency is on site observing, it’s still a good idea to send notification from the facility itself. Investigate the issue, schedule corrective maintenance, and reschedule your RATA. It is important to have a plan of action. Once you have a plan, it can be helpful to call your regulator, let them know the situation, and ask for guidance if you feel it’s necessary. A regulator is much more likely to work with you and your facility if they are informed and involved.

Next, consider your timeline. Do you know what caused the system to have issues? Do you know how long it will take to complete troubleshooting?

Most facilities that have CEMS that require a RATA have data availability requirements. Downtime from a RATA will quickly eat into your data availability if it’s not resolved quickly, and there are a lot of things that could prevent a successful RATA from being completed quickly – lead time on parts, stack tester availability, complex troubleshooting. If the system will be down for an extended period, consider the following:

How will the downtime affect my data availability?

Be aware of how much the out-of-control status will affect your data availability. Often, insufficient data availability can result in a notice of violation and/or fines from the agency. Understand your data availability thresholds, where your availability stands as of right now, and worst-case data availability based on your tentative timeline.

Do I have another way of getting indicator data?

Indicator data is data that isn’t gathered by a certified continuous monitoring system. Indicator data cannot be used to report compliance averages, but it can be used to show general stack conditions while the system is out-of-control. For example, if your facility is required to monitor NOX emissions and the monitor failed its RATA, process monitors or temporary replacements could potentially be used to collect data. If the intent is to convert a temporary CEMS into a permanent replacement, initial certification will have to be completed, which also ends with a RATA.

How well are we documenting our troubleshooting efforts?

For any event that might result in significant downtime – and a failed RATA is certainly one such event– it’s important to document every troubleshooting step that was taken to try to resolve the issue. In the event of a regulatory inquiry, having complete records can help paint a favorable picture for your facility.

Is my DAHS reflecting the situation correctly?

Most DAHS programs won’t invalidate data automatically following a failed RATA and sometimes may not even automatically recognize and flag a RATA. It is up to the facility’s personnel to identify the data that is affected by the failed RATA and invalidate appropriate time periods accordingly. We recommended you closely monitor the RATA results until the RATA is passed to ensure the data is flagged appropriately, as it will help show data availability correctly.

Conclusion

Understanding how to respond to monitoring issues can be overwhelming. Getting administrative tasks completed while your team is trying to troubleshoot, on top of all the other environmental health and safety tasks that need to be completed at the same time, can be difficult. If you have questions or would like guidance for navigating your RATA issues, please reach out to me at tcunningham@all4inc.com or 610-422-1106. ALL4 is here to answer your questions and assist your facility with any aspect of environmental regulatory compliance and our team of monitoring experts is ready to help you understand CEMS requirements.

Annual PM2.5 NAAQS Lowered!

On February 7, 2024, the United States Environmental Protection Agency (U.S. EPA) made the long-awaited announcement that the annual particulate matter less than 2.5 microns (PM2.5) National Ambient Air Quality Standard (NAAQS) will be lowered from 12 micrograms per cubic meter (µg/m3) to 9 µg/m3. A prepublication version of the rule was signed by U.S. EPA Administrator Michael Regan on February 5, 2024, and will be published in the Federal Register (FR) soon. The final rule and lowered annual PM2.5 NAAQS of 9 µg/m3 will become effective 60 days after the rule is published in the FR. Typically, it takes one to two weeks to publish a rule in the FR from when it is finalized. Based on that schedule the final rule is expected to be published by the week of February 19th with the 60-day effective date putting the final lowered annual PM2.5 NAAQS effective date around April 19, 2024. U.S. EPA also indicated in the preamble that they will develop, and release updated guidance on the appropriate PM2.5 annual Significant Impact Level (SIL) before the effective date of the new standard. This was unexpected, and a decrease from the already low 0.2 µg/m3 annual PM2.5 SIL will trigger more multi-source NAAQS modeling analyses, which will be difficult (if not impossible) in some areas of the country with the lowered annual PM2.5 NAAQS.

Despite requests by industry for a longer implementation period or to establish the annual NAAQS at the higher range proposed (10 µg/m3), air quality modeling demonstrations as a part of air permit applications will need to demonstrate compliance with the new lowered 9 µg/m3 annual PM2.5 NAAQS this spring. Only air permit applications that include an annual PM2.5 NAAQS modeling demonstration in the final stages of being approved and finalized have a chance of squeaking in before the estimated April 19, 2024, effective date. However, be aware that some agencies might not allow this.

Once the annual PM2.5 NAAQS takes effect, the 2-year clock starts for states to make and U.S. EPA to approve annual PM2.5 NAAQS attainment designations. Based on current ambient PM2.5 monitoring data summarized on ALL4’s PM2.5 NAAQS Resource Website there will a large amount of new PM2.5 nonattainment areas across the U.S. Areas designated nonattainment with the PM2.5 NAAQS around April of 2026 will trigger nonattainment new source review (NNSR) air permitting requirements instead of Prevention of Significant Deterioration (PSD) air permitting requirements. NNSR air permitting requirements include more stringent implementation of Lowest Achievable Emissions Rates (LAER), purchasing Emission Reduction Credits (ERCs) to offset PM2.5 emissions increases, and development of alternative siting analyses for proposed projects. NNSR permitting can be triggered by increases in direct PM2.5 emissions as well as PM2.5 precursors, nitrogen oxide (NOX) and sulfur dioxide (SO2) and in some locations ammonia (NH3) and volatile organic compounds (VOC). Unlike PM2.5 modeling requirements that become effective immediately, there are still 2 years to obtain an air permit before NNSR requirements (e.g., implementing LAER and purchasing ERCs) become effective. However, it may be easier to implement LAER and purchase ERCs under NNSR than it will be to complete a PM2.5 NAAQS modeling analysis under PSD.

For areas that are currently exceeding the new annual PM2.5 NAAQS that trigger PSD PM2.5 permitting requirements during the 2-year attainment determination period the only modeling option will be to model below the PM2.5 SIL. This will also likely be the only option for states that have minor source NAAQS air quality modeling requirements. Keep in mind that triggering PSD for SO2 or NOX, PM2.5 precursors also triggers the requirement to conduct a direct PM2.5 NAAQS air quality modeling demonstration.

In related news, U.S. EPA also sent a proposal to lower the secondary NOX, SO2, and PM NAAQS to the White House Office of Management and Budget (OMB) on February 6, 2024. A proposed rule is mandated by a consent decree to be signed by April 9, 2024, with a final rule by December 10, 2024. The Secondary NAAQS are designed to protect public welfare as opposed to public health and have historically been set to levels above the primary NAAQS. If the secondary NAAQS were to be set lower than the primary NAAQS there is no precedent for how air permitting would be impacted.

ALL4 has substantial experience in PM2.5 air quality modeling demonstrations and NNSR PM2.5 permitting. For more information about how a lowered PM2.5 NAAQS will affect your facility and how ALL4 can help check out ALL4’s PM2.5 NAAQS Resource webpage or contact Dan Dix at ddix@all4inc.com or (610) 422-1118.

Company-Specific Emission Reduction Plan (cERP), What’s Next?

Introduction

In January 2021 Colorado’s Department of Public Health and Environment (CDPHE) published a Greenhouse Gas (GHG) Pollution Reduction Roadmap meant to greatly reduce statewide GHG emissions. The roadmap was published in response to House Bill 19-1261, the Climate Action Plan to Reduce Pollution, which established GHG emissions reduction targets of 25% by 2025, 50% by 2030, and 90% by 2050 from 2005 levels. It establishes action items to be carried out in the near-term to make progress towards the 2025 and 2030 goals. Specifically, it indicates that significant emissions reductions from the oil and gas industry will be required. Additionally, in October 2020, the Air Quality Control Commission (AQCC) established a target of a 36% reduction from the 2005 baseline emissions by 2025 and a 60% reduction by 2030. These goals were mandated by law when they were included in House Bill 21-1266.

What Does This Mean For Me ?

Colorado has lived up to its word of their Pollution Reduction Roadmap and has published several related regulations. One of the prominent regulations being codified as a part of the Roadmap is the “Reduction of Emissions from Oil and Natural Gas Midstream Segment Fuel Combustion Equipment” which is codified in CDPHE Air Quality Control Commission Regulation No. 7, Part B, Section VII. This regulation created a Midstream Steering Committee and requires midstream owners and operators to develop and submit a company-specific emissions reduction plan (cERP) to then be used by CDPHE to create a data-based regulatory midstream segment emissions reduction plan (ERP). The cERPs were to be submitted to the Colorado Midstream Steering Committee by September 30, 2023. DHPE has released a guidance document entitled “Guidance Document for Company Emission Reduction Plans to be developed by Colorado Midstream Segment Owners or Operators” which outlined the cERP requirements including the following main items:

- Emissions calculation and inventory of GHG pollutants (CO2, CH4, N2O, and CO2 equivalent);

- Emissions calculation for a nonbinding emissions target;

- Identify and evaluate impact on disproportionately impacted communities;

- Identify and evaluate options to achieve GHG emissions reductions;

- Estimate NOX and VOC impacts for each emissions reduction option;

- Estimate the cost of each emission reduction option; and

- Create a non binding list of potential emissions reduction options.

While the initial due date of the cERP submittal has passed, the action of CDPHE has not, CDPHE will do the following in the creation a midstream segment ERP:

- By March 31, 2024, the Midstream Steering Committee will develop a midstream segment ERP, and provide the proposed midstream segment ERP to the Division for review

- The midstream segment ERP will do the following:

- Identify the total tons of CO2e emissions reduction from midstream segment fuel combustion equipment by the ERP and for each individual owner and operator;

- Identify specific facilities and equipment affected by the ERP;

- Prescribe the timing and process for emissions reductions (including, but not limited to, electrification, retrofit, shut-down, or replacement);

- Identify the environmental justice impacts to disproportionately impacted communities;

- Prescribe an emissions reduction plan for equipment modified, constructed, or relocated to Colorado on or after September 30, 2023;

- Prescribe record keeping and reporting requirements;

- Report the total estimated cost to midstream segment owners and operators to achieve the CO2e reductions;

- The Midstream Steering Committee is required to submit a regulatory proposal by August 31, 2024, with final rulemaking by December 31, 2024.

Does This Affect Me?

This regulation is applicable to midstream segment owners or operators, and midstream fuel combustion equipment. Midstream segments are defined as “the oil and natural gas compression segment and the natural gas processing segment that are physically located in Colorado and that are upstream of the natural gas transmission and storage segment” Meaning facilities which store, transport, and wholesale sell petroleum in Colorado are subject to this regulation and will be affected by the final ruling on December 31, 2024.

What Can I Do?

With the completion data of the ERP approaching, you should be keeping an eye on any CDPHE correspondence or ALL4 articles regarding the details of the final plan. ALL4 is always ready to assist, so if you have questions about Colorado’s ERP or compliance strategies do not hesitate to reach out to Evan Mia at emia@all4inc.com or 610-422-1162.

Legal Challenges Threaten United States Environmental Protection Agency (U.S. EPA) Environmental Justice Agenda

The U.S. EPA has been facing increasing pushback in the courts, threatening to derail their environmental justice (EJ) wins, and putting the administration’s ability to enforce its EJ agenda at risk.

First, on January 19th, the Louisiana Court of Appeal First Circuit reversed a September 2022 decision of the 19th Judicial District Court Parish of East Baton Rouge and reinstated 15 Louisiana Department of Environmental Quality (LDEQ) air permits for Formosa Plastics that had been blocked by that court, opening the door for the construction of the controversial petrochemical complex to be built in St. James Parish. The ruling found that “LDEQ’s decision to grant Formosa the 15 permits was not in violation of any constitutional or statutory law, was not arbitrary or capricious, or characterized by abuse of discretion or unwarranted exercise of discretion. In granting the permits, DEQ complied with the Clean Air Act.”

The decision in this matter, which is also related to the Title VI investigations that have been ongoing in the state until recently, immediately drew backlash from environmentalists, including Earthjustice and RISE St. James, organizations that raised the initial challenges to the issuance of the permits for Formosa. According to Earthjustice, the permits “add an extraordinary burden to the predominantly Black communities in the area who already suffer from exposure to some of the worst toxic air from industrial sources in the nation — exacerbating environmental racism in this region known as ‘Cancer Alley.’”

Should this decision hold, it is another major blow to U.S. EPA’s EJ agenda, as the decision to block those permits had been hailed as a major win for EJ advocacy across the United States.

In even bigger news, in a major ruling on January 23rd, Judge James Cain of the U.S. District Court for the Western District of Louisiana ruled in favor of the state of Louisiana in the ongoing court case between Louisiana and U.S. EPA regarding U.S. EPA’s authority to use Title VI of the Civil Rights Act to enforce its EJ agenda. This ruling blocks U.S. EPA and the Department of Justice (DOJ) from using Title VI of the Civil Rights Act, which bars states and other government agencies from actions that cause “disparate impacts,” to advance EJ, at least temporarily.

Judge Cain had been deliberating on whether to let the lawsuit continue given U.S. EPA’s withdrawal from two Title VI investigations it had launched against the state after it had filed a lawsuit claiming the agency was overstepping its authority. U.S EPA’s position is that the case is now moot and should be dropped since the investigations are over, while the state wants to continue the case, arguing that the state “suffered injury from the civil rights policies regardless of any active enforcement” and called EPA’s withdrawals “gamesmanship” designed to avoid an adverse court ruling.

Ultimately the judge’s ruling went further than just allowing the case to continue but also agreed with the state’s request for the injunction “against the U.S. EPA and DOJ to enjoin these federal governmental agencies from imposing or enforcing any disparate impact-based requirements against the State or any State agency under Title VI.”

As part of Cain’s ruling to allow the case to continue, he seems to suggest that he already supports most of the state’s arguments, including its claim that U.S. EPA and DOJ’s investigations violate the major questions doctrine because they impose “disparate impact” mandates when Congress did not explicitly provide them. “The Court agrees with the State that the major questions doctrine is applicable here as to the imposition of disparate impact mandates under Title VI and as such, demands clear congressional authorization,” he wrote. “Defendants have constructed Title VI to allow it to regulate beyond the Statute’s plain text and by doing so, invade the purview of the State’s domain.”

Judge Cain’s ruling immediately drew fire from environmentalists, who have repeatedly petitioned U.S. EPA to undertake Title VI investigations against the permitting programs and other elements of several state agencies. Sam Sankar, Earthjustice senior vice president of programs, said in a statement: “The court’s decision to issue this injunction is bad enough, but what’s worse is that instead of fixing the discriminatory permitting programs that have created sacrifice zones like Cancer Alley, Louisiana is fighting tooth and nail to keep them in place,” and “The public health crisis in St. John the Baptist Parish shows us why we need Title VI: EPA needs to be able to use our civil rights laws to stop states from running permitting programs that perpetuate environmental injustice.”

Regardless of Judge Cain’s decision, the case is expected to be appealed and may go all the way to the Supreme Court. Meanwhile, the decision seems likely to embolden other states to oppose U.S. EPA, which should make it increasingly difficult for U.S. EPA to advance EJ via Title VI in those states not actively pursuing an EJ agenda on their own.

What Do these Challenges Mean?

These are just the latest setbacks U.S. EPA has faced in enforcing their EJ agenda. It remains to be seen if U.S. EPA will accept these decisions, especially the Title VI case, or appeal and risk a more permanent negative decision. With the head EJ position in U.S. EPA still vacant since the departure of former deputy assistant administrator of the U.S. EPA Office of Environmental Justice & External Civil Rights Matt Tejada, and the presidential election coming up in November, the future of the U.S. EPA agenda around enforcing EJ is a bit cloudy. However, the funneling of money by U.S. EPA into EJ projects, the ramping up of EJ Technical Assistance Centers to aid organizations in navigating the grant process, and the funding of community-level monitoring programs continues.

Regardless of events at the federal level, many states are continuing full speed ahead in developing their EJ rules and policies, with no reason to believe that will change. New Jersey, Illinois, Colorado, California, Pennsylvania, Massachusetts, Texas, and several other states are now adding additional requirements, primarily in the form of additional analysis and public outreach requirements, to their permitting process, whether it is formally part of their permitting rules or not.

If you have concerns about the potential implications of these developments or need help parsing through them, feel free to contact your ALL4 Project Manager or Rich Hamel. ALL4 will continue to monitor EJ guidance from the administration and states and the tools available to evaluate EJ concerns as they develop. We can also help you evaluate permitting risks, from EJ concerns to regulatory issues, and assist in developing a strategy to make the permitting of your project as efficient as possible, including how to communicate project information to the public and what you might include in a cumulative impacts analysis.