From Compliance to Competitive Advantage: Embracing Double Materiality in ESG Reporting

Posted: September 6th, 2023

Authors: James G.

Sustainability has emerged as a paramount concern for businesses worldwide. With growing environmental, social, and governance (ESG) pressures, companies are facing increasing scrutiny to align their operations with sustainable practices. One essential concept gaining prominence in this area is double materiality. In the world of investing, the term double materiality is garnering significant attention from businesses and investors alike. This concept carries profound implications for major legislative changes that will reshape how companies disclose ESG data in both the European Union (EU) and the United States. Understanding what double materiality entails and why it matters has become critical for businesses seeking to navigate the evolving landscape of sustainable investing and corporate accountability.

Traditionally, materiality in the corporate context refers to the significance of information to a company’s investors and is based off financial information. If a piece of financial information is deemed material, it can significantly impact investors’ decisions and therefore must be disclosed in financial reports. According to the United States Supreme Court, information is material if there is “a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.”1 However, as ESG issues increasingly influence businesses’ performance, double materiality expands this concept by considering two dimensions:

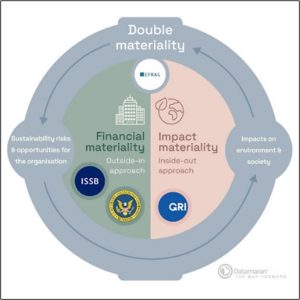

- Financial Materiality: This dimension remains consistent with the conventional definition. It assesses the financial impacts of ESG factors on a company’s operations and financial results. An ESG issue is material if it does, or has the potential to, impact cash flow and value creation for a company. This might be considered an “outside-in” perspective on the company’s operations.

- Impact Materiality: This aspect delves into the non-financial impacts of a company’s operations on society, the environment, and stakeholders. This is an “inside-out” perspective in that an ESG issue is material based on the impact of a company and its value chain operations on the outside world. These non-financial impacts are increasingly gaining importance in the decision-making processes of investors, consumers, employees, and other stakeholders.

The double-materiality approach encompasses both a company’s financial and impact viewpoints, offering a comprehensive understanding of that organization’s significant sustainability effects, risks, and opportunities. The European Financial Reporting Advisory Group (EFRAG), has combined the financial materiality definitions from the U.S. Securities and Exchange Commission (SEC) and the International Sustainability Standards Board (ISSB) with the impact materiality definitions from the Global Reporting Initiative (GRI) to create the European Sustainability Reporting Standards which requires the double materiality viewpoints. As shown in Figure 1 below, this approach recognizes that a company both influences and is influenced by ESG issues. It provides a holistic view by considering both internal and external perspectives, vital for shaping strategy, bolstering governance, and improving transparency in reporting. By capturing these dimensions, it facilitates a top-tier assessment and response to ESG and sustainability challenges.

https://www.datamaran.com/materiality-definition

The significance of double materiality becomes evident through its integration into crucial EU legislation. Approximately ten years ago, the EU began mandating non-financial reporting to enhance accountability for ESG issues. During this period, the concept of double materiality was introduced and recommended to elevate the quality and quantity of these disclosures. The EU has since revised its regulations, leading to the establishment of the Corporate Sustainability Reporting Directive (CSRD), set to roll out across the 27 EU countries starting in 2024, which demands double materiality assessments. The CSRD notably broadens the scope of sustainability reporting, encompassing social, governance, environmental, and climate change aspects. Companies will need to disclose sustainability risks, opportunities, targets, due diligence processes, and impacts across their operations and value chain. Moreover, the CSRD mandates sustainability information audits and advocates for digitalized reporting. This rule pertains to both EU-registered companies and non-EU entities with substantial financial involvement within the EU.

Interestingly, the influence of double materiality is not limited to the EU. The US is also embracing this concept through the Securities and Exchange Commission’s (SEC) proposed rule known as “The Enhancement and Standardization of Climate-Related Disclosures for Investors.” This proposal would mandate domestic and foreign registrants to disclose certain climate-related information, including greenhouse gas (GHG) emissions, both direct and indirect (Scope 1 and Scope 2), and emissions from their value chain (Scope 3). With both the EU and the US moving towards making ESG reporting mandatory, businesses must take double materiality seriously. Embracing this concept and complying with the evolving disclosure requirements will not only ensure legal adherence but also allow companies to demonstrate their commitment to sustainability and corporate responsibility in a world where investors increasingly prioritize ESG considerations.

Embracing double materiality yields a host of benefits, from meeting sustainability-conscious consumer demands and attracting responsible investments to spurring innovation, ensuring compliance, and fortifying supply chains. It’s more than a choice; it is imperative for businesses seeking long-term success in an increasingly sustainability-focused world. Here’s a breakdown of how double materiality shapes businesses’ future:

- Holistic Risk Management: Companies contend with multifaceted risks, extending beyond financial realms. Adopting double materiality equips them to proactively address environmental and social risks, enhancing overall resilience.

- Elevated Sustainability Significance: Sustainability’s importance has surged. Embracing double materiality showcases commitment to sustainable practices, cultivating trust and loyalty among stakeholders, from customers to investors.

- Stringent Regulation Compliance: Stringent global regulations tied to environmental and social obligations necessitate proactive compliance. Double materiality integration keeps companies ahead by weaving these factors into risk management and decisions.

- Catalyzing Innovation and Relevance: Double materiality spurs eco-friendly innovation, aligning products and processes with environmental and social impact. This innovation resonates with conscious consumers and maintains market relevance.

- Resilient Supply Chains: Global supply chains face diverse sustainability challenges. Double materiality assessments empower businesses to evaluate suppliers, forging robust, responsible, and efficient supply chains.

In the ever-evolving business landscape, where sustainability is paramount for achieving success, embracing double materiality has transcended mere catchphrase status to become an indispensable strategic imperative. Companies that integrate both financial materiality and non-financial or impact materiality aspects into their decision-making processes can effectively manage risks, build trust among stakeholders, and pave the way for sustainable growth. Embracing double materiality is not only ethically crucial but also a prudent approach to thrive in an ever-evolving world that demands sustainable practices.

If your company aims to improve its grasp of double materiality, engage in an ESG journey covering strategy, GHG portfolios, targets, and climate efforts, ALL4 is ready to support you. To learn more about how ALL4 can support your specific needs or to discuss any ESG-related queries, please reach out to James Giannantonio, Managing Consultant of ESG & Sustainability, at jgiannantonio@all4inc.com.

1 https://www.sec.gov/news/statement/munter-statement-assessing-materiality-030922#_edn4