Forest Products Industry Lookahead

Posted: January 29th, 2026

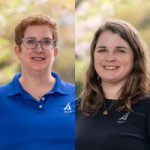

Authors: Amy M. Lizzie S.

The last few years have brought a lot of change to the forest products industry. Companies have bought, sold, and closed facilities and a new company, Global Cellulose Fibers, was formed as International Paper made strategic shifts. Several states are focused on extended producer responsibility (EPR) laws for packaging, which could favor paper-based packaging over plastic, but also creates a regulatory patchwork when different states have different requirements. While companies have sustainability goals, we haven’t really seen a large carbon reduction project in the pulp and paper industry yet, and this is certainly not a priority for the current administration. In the wood building products space, we hope for lower mortgage rates in 2026 to spur the demand for new homes. With the current deregulatory atmosphere and push for permit streamlining, 2026 could be the year to plan and permit capital improvements to optimize production and energy efficiency and reduce operating costs.

The forest products industry is fairly heavily regulated from an environmental standpoint. Although the general trend at the United States Environmental Protection Agency (U.S. EPA) is deregulation, there are some things to watch for in air quality regulations. We will see a revision to the National Emission Standards for Hazardous Air Pollutants (NESHAP) for Plywood and Composite Wood Products (PCWP MACT) this summer. The revised rule will fill gaps and address hazardous air pollutant (HAP) emissions from all sources at lumber, plywood, and composite wood products mills. Facilities will have first-time work practice requirements for lumber kilns and resinated material handling operations and additional emissions limits on dryers and presses. Look for an industry workshop hosted by the American Wood Council (AWC) and the National Council for Air and Stream Improvement (NCASI) for a deep dive into the new requirements and how to comply. The pulp and paper industry was originally expecting to be working on completing an information collection request from U.S. EPA this year to inform its technology review and gap filling for 40 CFR Part 63, Subparts S and MM, and 40 CFR Part 60, Subpart BBa, but the current administration will not issue an information collection request (ICR). Instead, some companies have volunteered to collect information that would inform the regulatory review and allow the current administration to develop proposed rules.

U.S. EPA also needs to make revisions to the Industrial Boiler NESHAP based on a court ruling related to the new source standards, so forest products facilities should also be tracking that closely. Reopening the rule is also an opportunity to make clarifications around compliance procedures for multi-fuel boilers that are common in the pulp and paper industry. Speaking of pulp and paper mill boilers, U.S. EPA is also expected to propose changes to the Good Neighbor Plan (GNP) that established first-time nitrogen oxides (NOX) emissions limits for fossil fuel boilers at paper mills in certain states. That rule is currently stayed, and we hope that U.S. EPA’s upcoming actions to approve ozone transport state implementation plans (SIP) that were previously rejected and resulted in the need for the GNP means that an updated analysis will show that NOX emissions reductions from paper mill boilers are not needed to achieve attainment with the 2015 ozone standard in downwind states. We are also hoping to evaluate less forest products mill sources for emissions reductions under the Regional Haze Rule with the expected changes that should be proposed in 2026 ahead of the next planning period, at least in areas that have already made significant improvements in visibility. Our air quality lookahead article details other cross-cutting air-related issues to watch for in 2026.

On the Toxics Substances Control Act (TSCA) front, the industry is watching the recent proposal related to U.S. EPA’s risk evaluation for formaldehyde. U.S. EPA’s revised approach would mean the removal of the unreasonable risk determination for inhalation exposure to formaldehyde by wood products manufacturing facility workers. See our recent article for more information. If U.S. EPA finalizes the revisions as proposed, wood products mills would not be subject to additional formaldehyde inhalation risk management rules.

In the world of water, we expect potential changes to the Clean Water Act (CWA) Hazardous Substances Facility Response Plan (FRP) rule to be impactful to the forest products industry. As discussed in our water lookahead article, measures to delay compliance dates and make changes to the rule have completed White House Office of Management and Budget (OMB) inter-agency review. We are expecting the delay to be up to five years and are hearing that U.S. EPA may consider increasing threshold quantities by 10 times, which could impact what facilities are subject to the rule and how many chemicals subjected facilities must consider.

For forest products facilities that provide drinking water to their employees and/or the outside community, ALL4 is tracking the American Waterworks Association’s (AWW) case against the October 2024 Lead and Copper Rule Improvements (LCRI). LCRI currently has compliance dates beginning in 2027 with later dates for lead service line (LSL) replacement. U.S. EPA has also proposed perchlorate drinking water standards, and on January 22 released a plan to develop a revised toxicity assessment for fluoride in drinking water. A D.C. circuit court has also blocked, for the time being, U.S. EPA’s attempt to roll back four of the six per- and polyfluoroalkyl substances (PFAS) maximum contaminant levels (MCLs) that were promulgated in 2024. We have a separate lookahead article dedicated to PFAS, which discusses a few other items with potential impact to the forest products industry including biosolids, Toxics Release Inventory (TRI) reporting, Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), one-time reporting under TSCA, and state-specific consumer product restrictions.

Many forest products facilities have stormwater discharges that are permitted under general stormwater permits – U.S. EPA’s Multisector General Permit (MSGP) is set to expire at the end of February 2026; we saw a draft permit in late 2024 (see our previous article) with extended public comment period until May 2025 but no movement since then. Though U.S. EPA’s MSGP only directly applies to facilities in a few states and other areas under U.S. EPA’s authority, many states adopt updates in U.S. EPA’s MSGP as they renew their own state permits. We are currently tracking state MSGP renewals in several states including Alaska, Wisconsin, Mississippi, Oregon, Texas, Kansas, and Louisiana.

On the energy and modernization side of things, aside from the air permitting and modeling regulatory and policy improvements we are hoping for, it will be interesting to see if there is an uptick in utilization of U.S. Forest Service grant programs like the Community Wood Grant Program. This program provides funding for grants to install thermal wood energy systems or build innovative wood product manufacturing facilities. The various programs support innovation, expand wood energy markets, and promote wood as a sustainable building material. Could we see a data center get energy from wood residuals under this program? At a minimum, these grants could help wood products facilities modernize their systems and optimize production.

The forest products sector is a core part of ALL4’s business and we have experts who have not only completed projects for mills as consultants but have also worked at mills and for regulatory agencies. Through staff shortages over the past several years, we’ve also provided extension services at a number of paper mills to bridge the gap until replacement staff can be hired and/or existing staff can be trained. When facilities have made the unfortunate decision to close, we have supported facilities in navigating permitting obligations through shutdown and/or transitional operations. Our staff brings a deep expertise to environmental, safety, and digital solutions projects for forest products clients. We are committed to helping forest products companies navigate environmental and health and safety policies and regulations, develop project strategies, and stay ahead of regulatory changes. If you have questions on how to navigate what’s ahead in 2026, please reach out to Lizzie Smith or Amy Marshall.